Bitrace Co-Founder: Supporting Stablecoin and RWA Compliance under Hong Kong’s New Regulatory Framework

On July 22, 2025, Hugo HU, Co-Founder of Bitrace, was invited to attend the “Focus on Hong Kong’s New Policy: From Regulatory Framework to Mainland Innovation” seminar held in Hangzhou. He joined experts from regulatory bodies, industry associations, and Web3 enterprises to explore the development trends and compliance challenges of stablecoins and real-world assets (RWA).

During the roundtable discussion, Hugo HU shared insights on Hong Kong’s latest stablecoin regulatory proposals and emphasized the importance of compliance and transparency in driving the adoption of stablecoins and asset tokenization. He noted that with Hong Kong formally introducing a licensing regime for stablecoin issuers along with clear AML/CFT requirements, a new window of opportunity is opening for industry players to participate in a compliant stablecoin ecosystem. Meanwhile, as a bridge between traditional finance and blockchain, RWA calls for more robust on-chain regulatory tools and risk management capabilities.

To address this, Bitrace has launched a customized, all-in-one compliance solution for stablecoins and RWA, offering purpose-built on-chain monitoring platforms for issuers, underwriters, and regulators. These solutions are designed to support comprehensive risk management and compliance oversight throughout the full lifecycle of stablecoin and RWA issuance, circulation, and redemption.

Key Features of the Bitrace Stablecoin/RWA Customized Compliance Solution

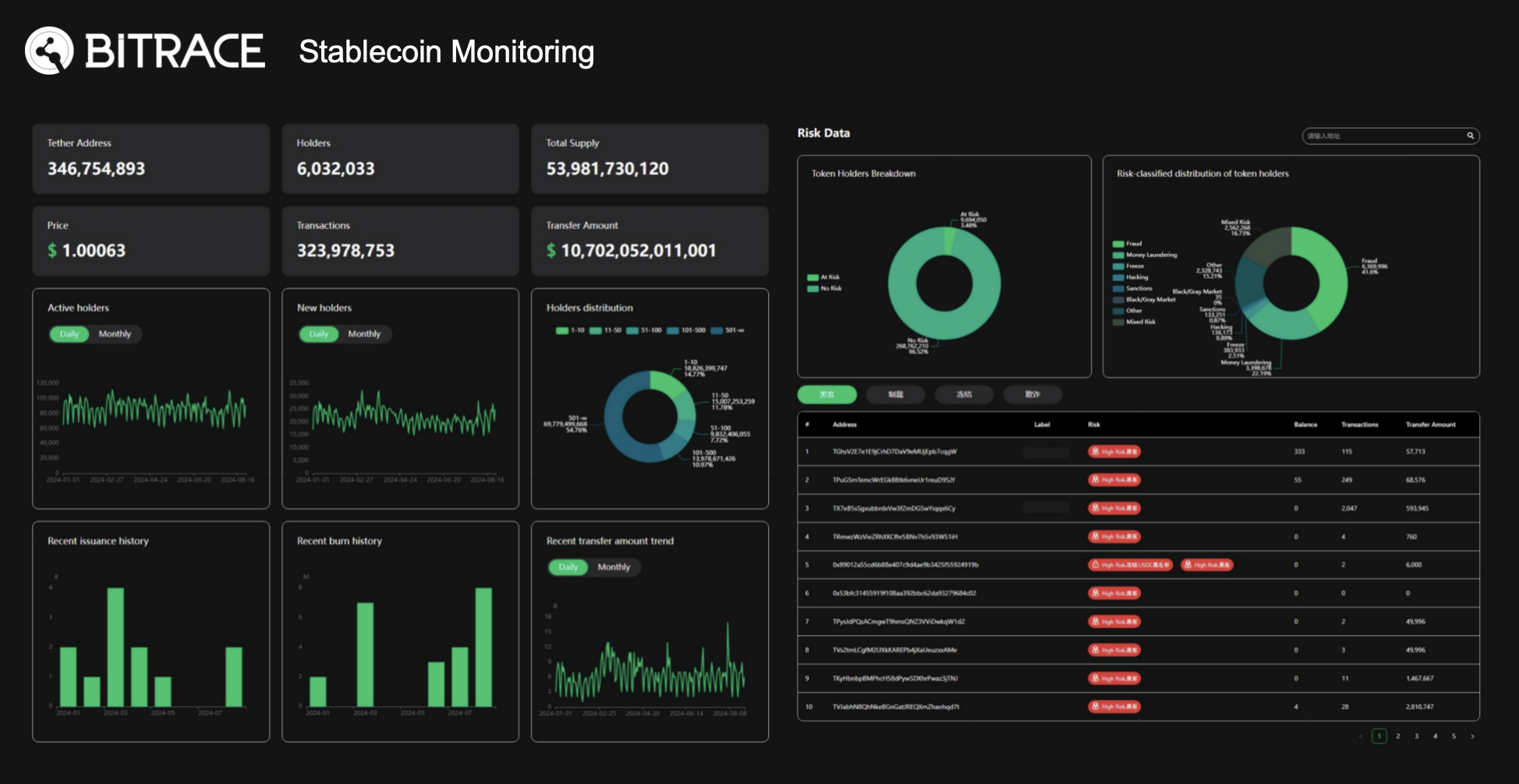

- Comprehensive Statistics and Real-Time Monitoring

- Track the total issuance, redemption, and circulation of stablecoins over time;

- Analyze fund flows and usage scenarios across multiple dimensions;

- Real-time updates on large transactions, abnormal volatility, and active address behavior.

- Suspicious Transaction Detection and Reporting

- Automatically identify transactions involving high-risk addresses (e.g., fraud rings, illicit marketplaces, gambling platforms);

- Visualize transaction paths and perform aggregated risk analysis;

- Customizable risk rules and thresholds with real-time alerting capabilities.

- Address Analysis and Risk Assessment

- Multi-dimensional insights into stablecoin/RWA holder structure;

- Identify potentially risky address clusters or unusual distribution patterns;

- Automated risk scoring of holder addresses, with drill-down views for deeper investigation.

The Bitrace Stablecoin/RWA Customized Compliance Solution enables key stakeholders to meet growing demands in asset transparency, holding compliance, and on-chain activity monitoring:

- Issuers: Facilitate daily compliance reporting and risk disclosures; monitor the security and integrity of the on-chain stablecoin/RWA ecosystem;

- Underwriters/Platforms: Understand user behavior and asset utilization patterns to mitigate systemic risks;

- Regulators: Achieve full visibility into the circulation of stablecoins/RWA and strengthen AML/CFT enforcement through on-chain transparency.

Bitrace Product Suite: Scalable Tools for Risk Monitoring and On-Chain Compliance

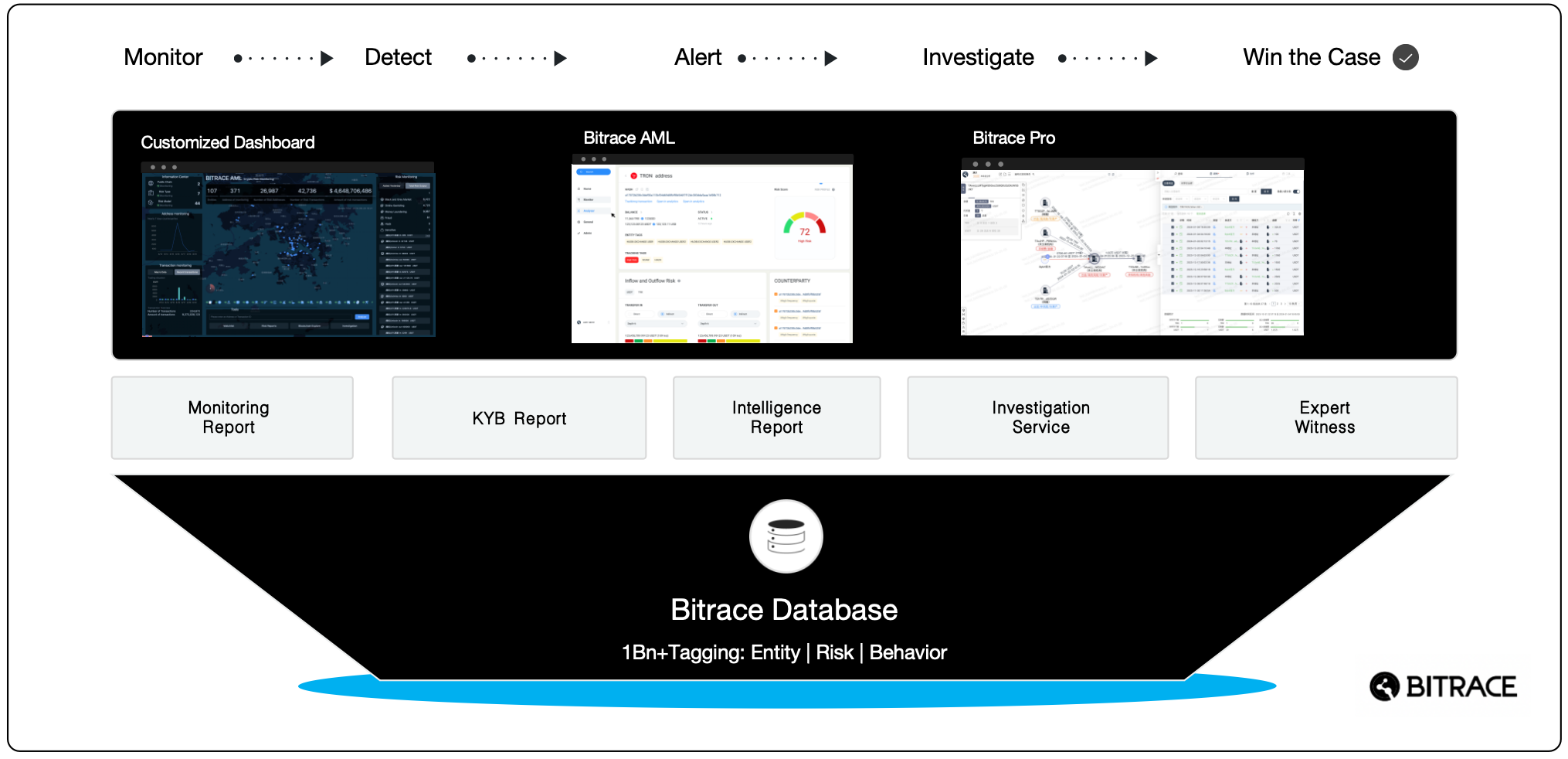

As a regulatory technology company specializing in digital asset risk monitoring and blockchain compliance, Bitrace offers a mature product suite across multiple compliance scenarios, including address risk scoring, transaction tracing, and fund flow analysis:

- Bitrace Blacklist: A lightweight, efficient risk address query tool designed for small and medium OTC providers and individual traders. It offers rapid and simple blockchain address risk checks.

- Bitrace AML: An enterprise-grade AML and compliance platform built for medium to large VASPs and financial institutions. It supports multi-chain address and transaction inquiries, enriched with over a billion entity and risk labels. It also provides a powerful, flexible, and easy-to-use API for customers to implement tailored KYA/KYT rules by business line or geography, enabling granular risk control.

- Bitrace Pro: A collaborative crypto investigation and analysis platform tailored for compliance teams with investigation needs. It offers comprehensive tools for fund tracing, address analysis, case management, and team collaboration—delivering the next-generation solution for blockchain intelligence and investigation.

Building a Global Compliance Ecosystem from Hong Kong

As Hong Kong regulators actively advance the licensing regime for stablecoin issuers and pilot regulatory frameworks for real-world assets (RWA), a compliant digital asset ecosystem—anchored in Hong Kong and connected to the global market—is steadily taking shape. Upholding its core philosophy of “technology-powered compliance, data-driven security,” Bitrace will continue to deepen collaboration with regulatory authorities, industry bodies, and financial institutions, driving coordinated innovation across the Web3 compliance landscape.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech