Bitrace Launches Upgraded Product Matrix to Power One-Stop Compliance for the Web3 Era

As the crypto industry matures and regulatory frameworks become increasingly rigorous, the widespread adoption of stablecoins—coupled with tightening oversight—has made regulatory compliance a core imperative for enterprises and institutions engaged in the blockchain ecosystem.

Bitrace, a technology firm focused on blockchain risk monitoring and compliance solutions, has recently completed a full upgrade of its product portfolio. The company has launched three standardized platform solutions: Bitrace Blacklist, Bitrace AML, and Bitrace Pro—each designed to address the diverse needs of users ranging from small and mid-sized entities to financial institutions and law enforcement. The suite forms a truly customizable, scalable, and unified compliance infrastructure.

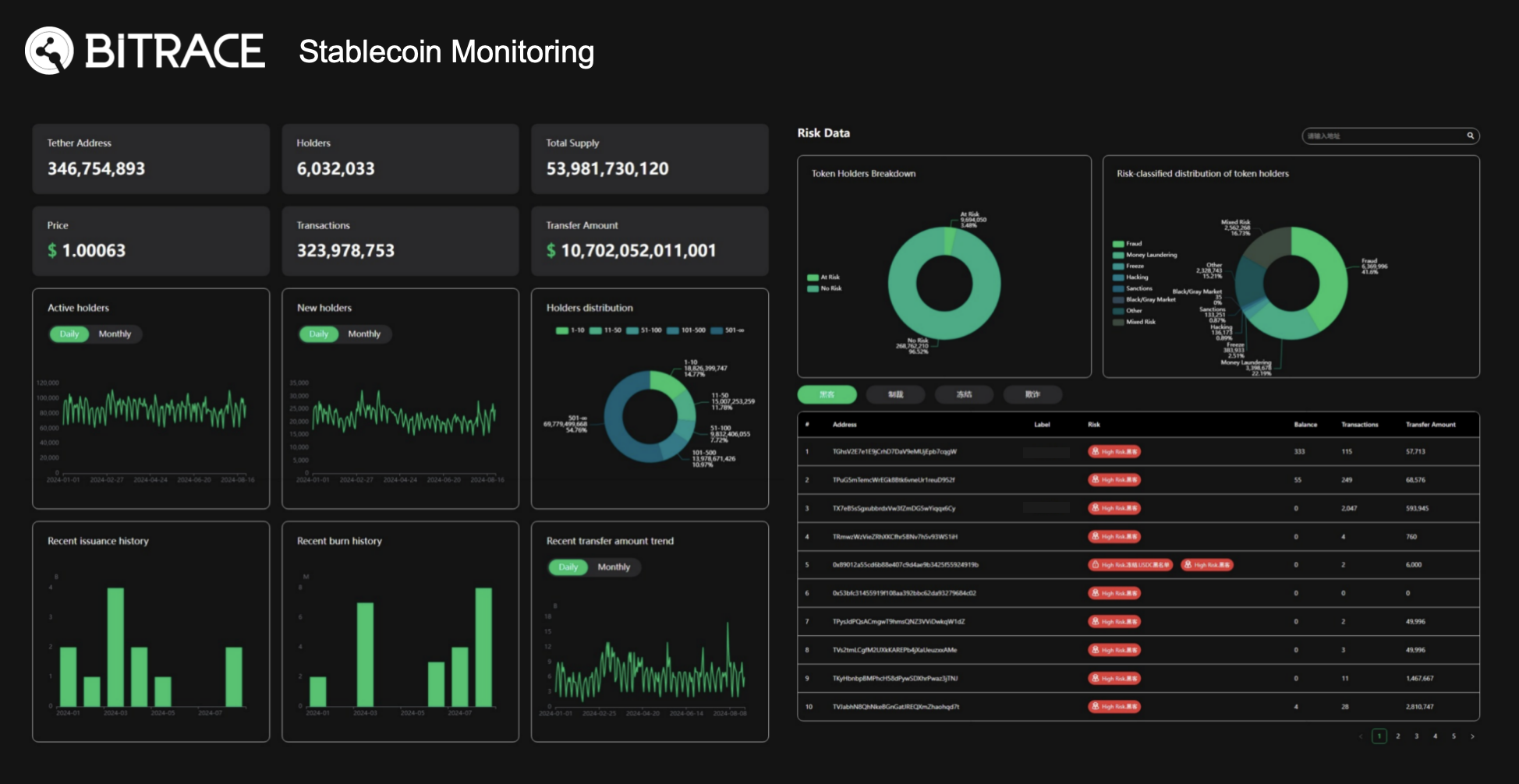

In parallel, Bitrace has also developed and rolled out a dedicated stablecoin monitoring and risk management module, in alignment with emerging regulatory trends in markets such as Hong Kong. This solution is purpose-built to support stablecoin issuers by providing end-to-end compliance monitoring—helping institutions navigate the shifting regulatory landscape with confidence and operational integrity.

Three Core Products, Precisely Aligned with User Needs

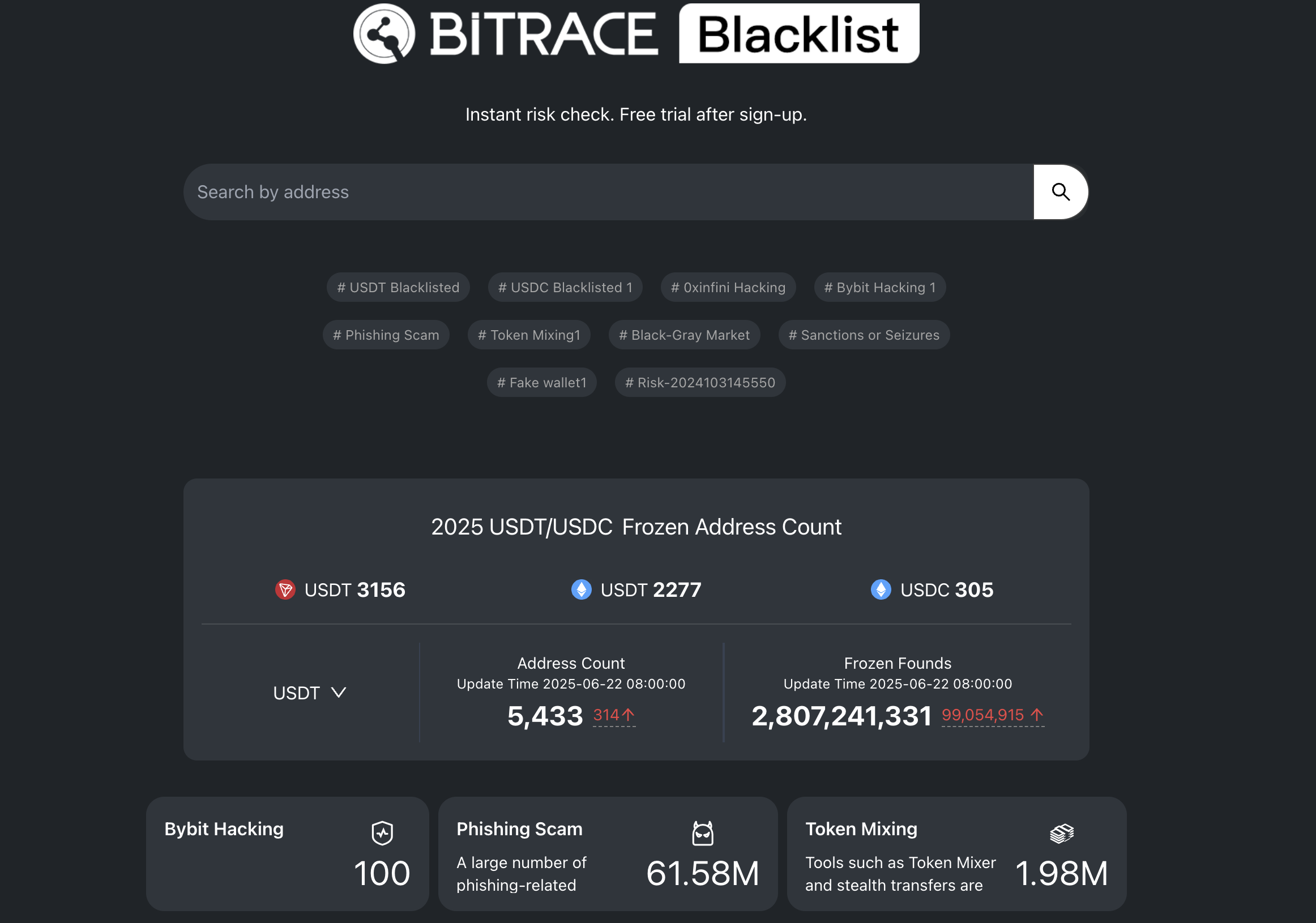

🔍 Bitrace Blacklist: A Lightweight and Efficient Risk Address Lookup Tool

Tailored for small to mid-sized OTC providers and individual traders, Bitrace Blacklist delivers a fast, lightweight blockchain address risk screening service. Without any complex setup, users can quickly identify high-risk addresses via a simple web interface—fulfilling essential day-to-day risk control needs and safeguarding transaction security.

- Intuitive and easy to use—no training required

- Supports USDT/USDC risk queries, covering a wide range of threats including fraud, gambling, illicit industries, money laundering, hacking, sanctions, and frozen assets

- Provides risk scores and counterparty intelligence to support informed and secure trading decisions

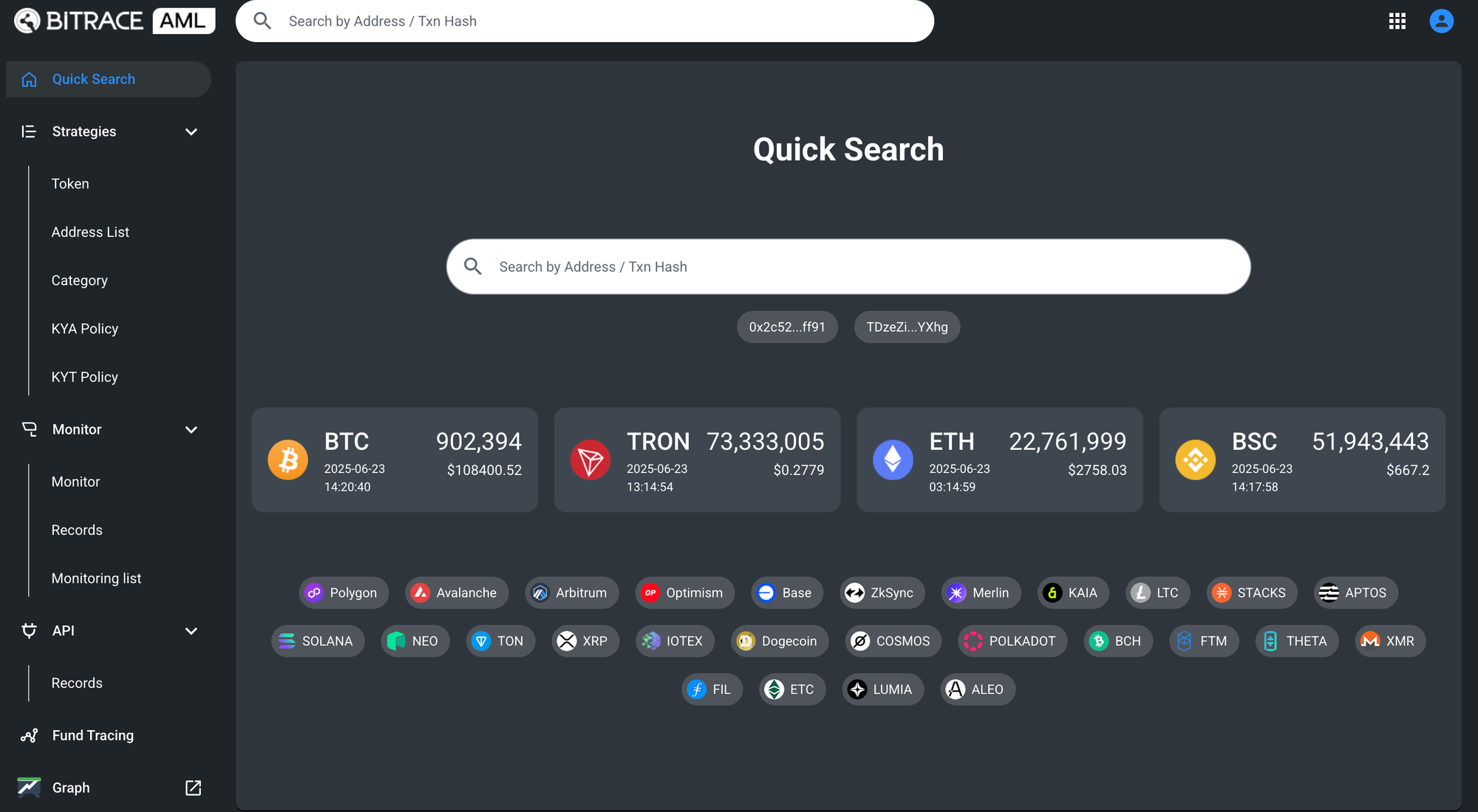

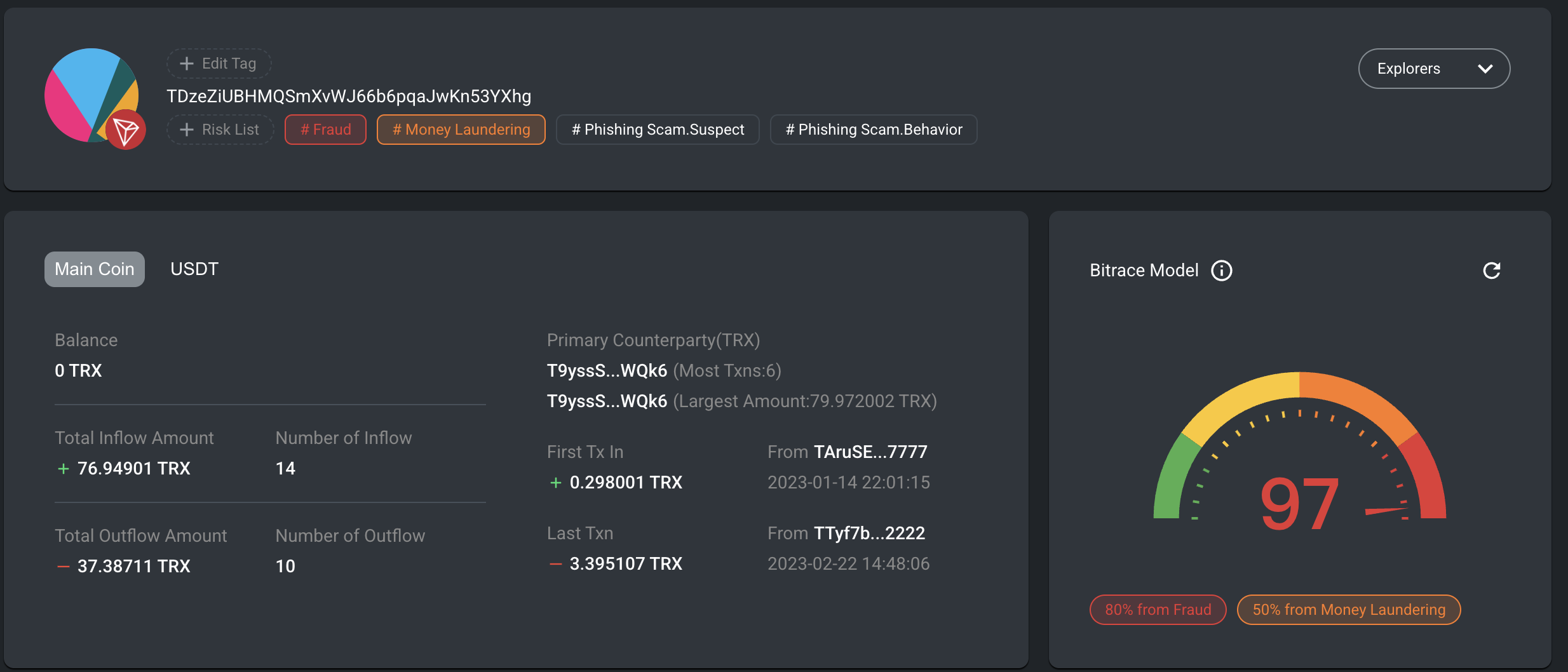

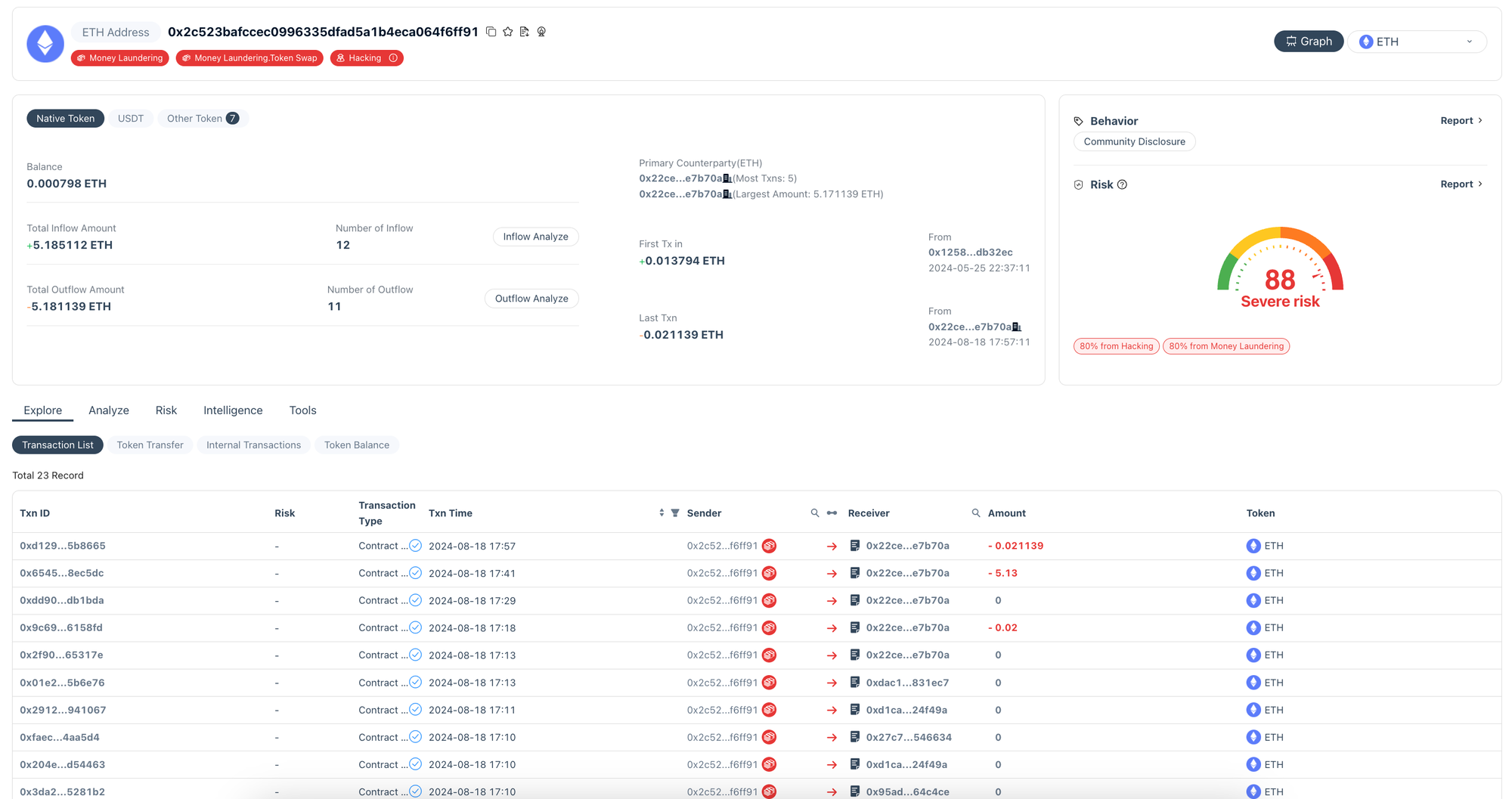

🛡️ Bitrace AML: On-Chain Anti-Money Laundering and Compliance Platform

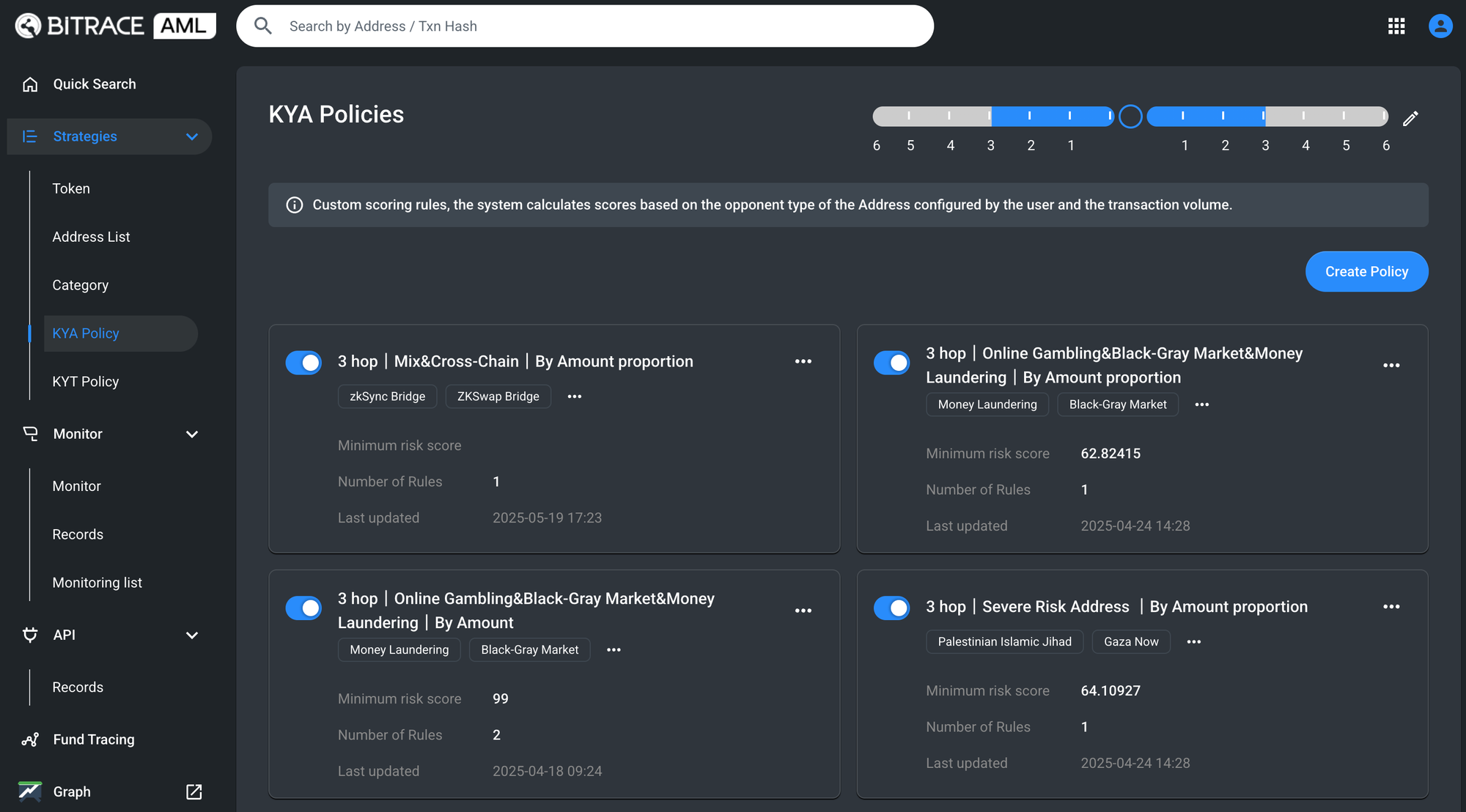

Designed for mid-to-large Virtual Asset Service Providers (VASPs) and financial institutions, Bitrace AML is a professional and comprehensive platform for on-chain fund compliance analysis. It enables clients to implement standardized KYA (Know Your Address) and KYT (Know Your Transaction) strategies for granular, risk-based fund flow management.

- Supports multi-chain address and transaction screening with access to over a billion entity and risk labels

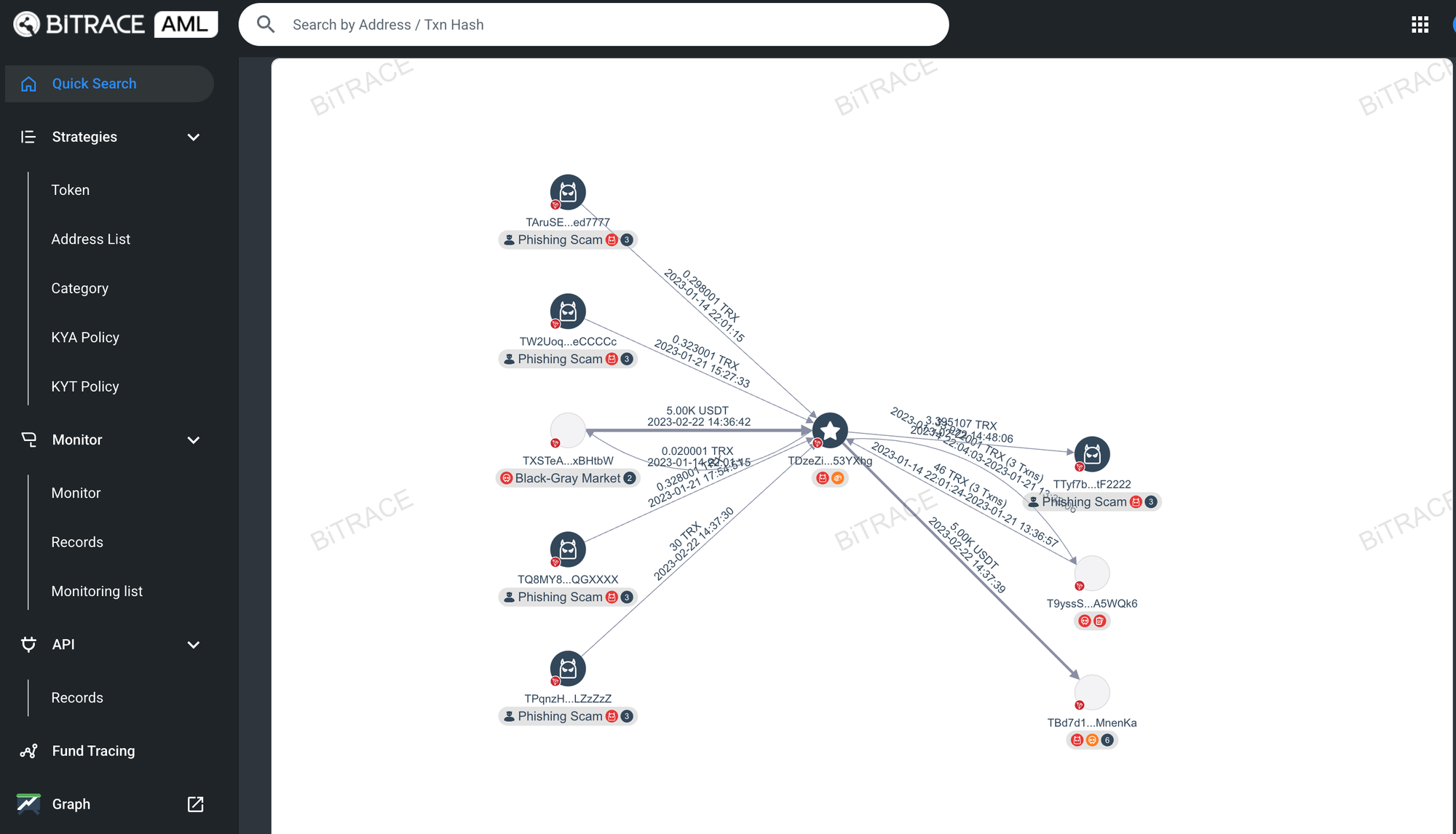

Visualized transaction flows and aggregated risk analysis for enhanced traceability and strategic decision-making.

- Flexible policy configuration: KYA/KYT rules can be customized based on business models or regional compliance requirements.

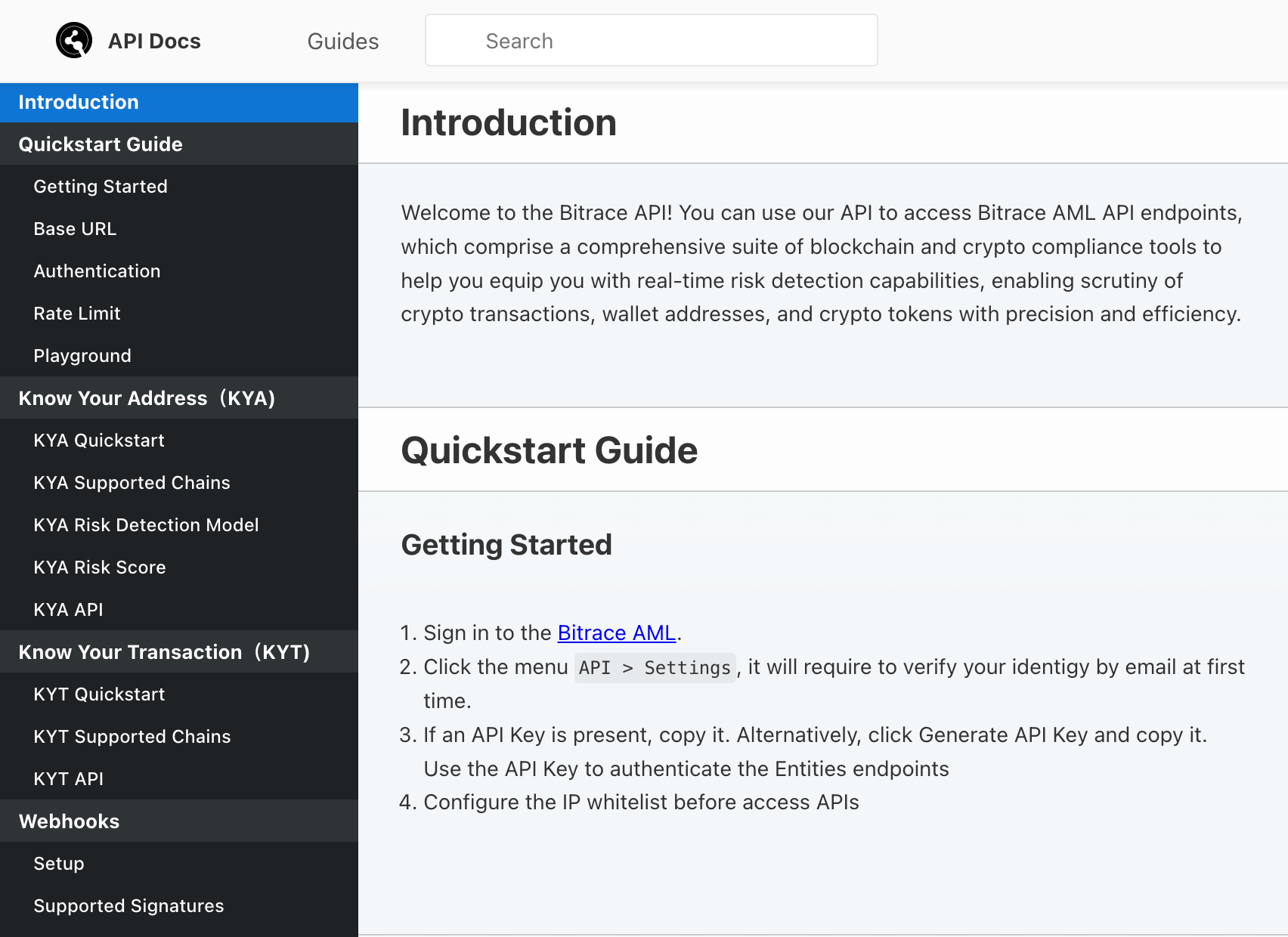

- Powerful, flexible, and developer-friendly API integration: Clients can seamlessly embed Bitrace AML’s risk intelligence engine into their internal systems and receive real-time threat alerts as part of their compliance workflows.

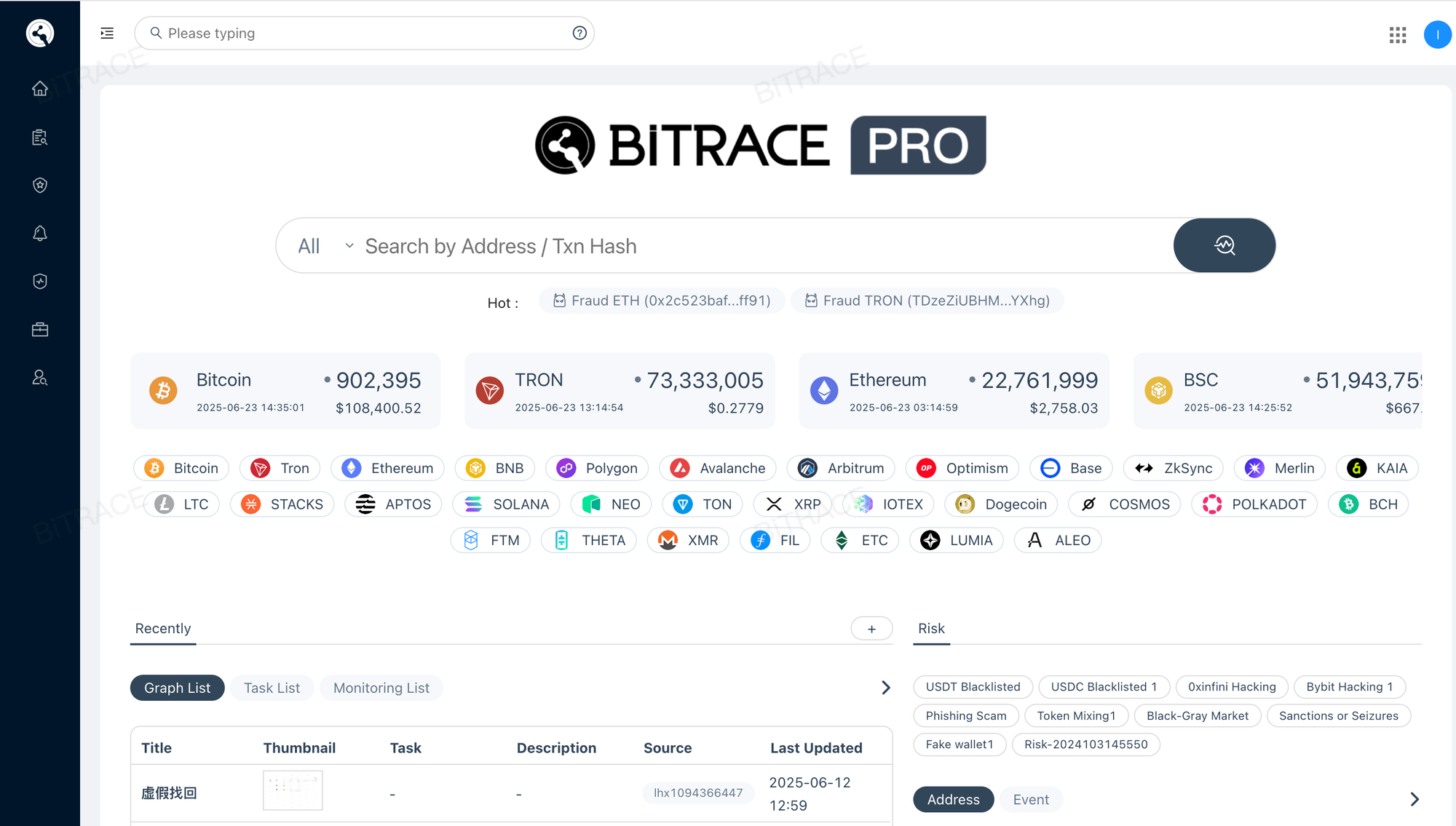

🕵️ Bitrace Pro: Collaborative Crypto Investigation & Intelligence Platform

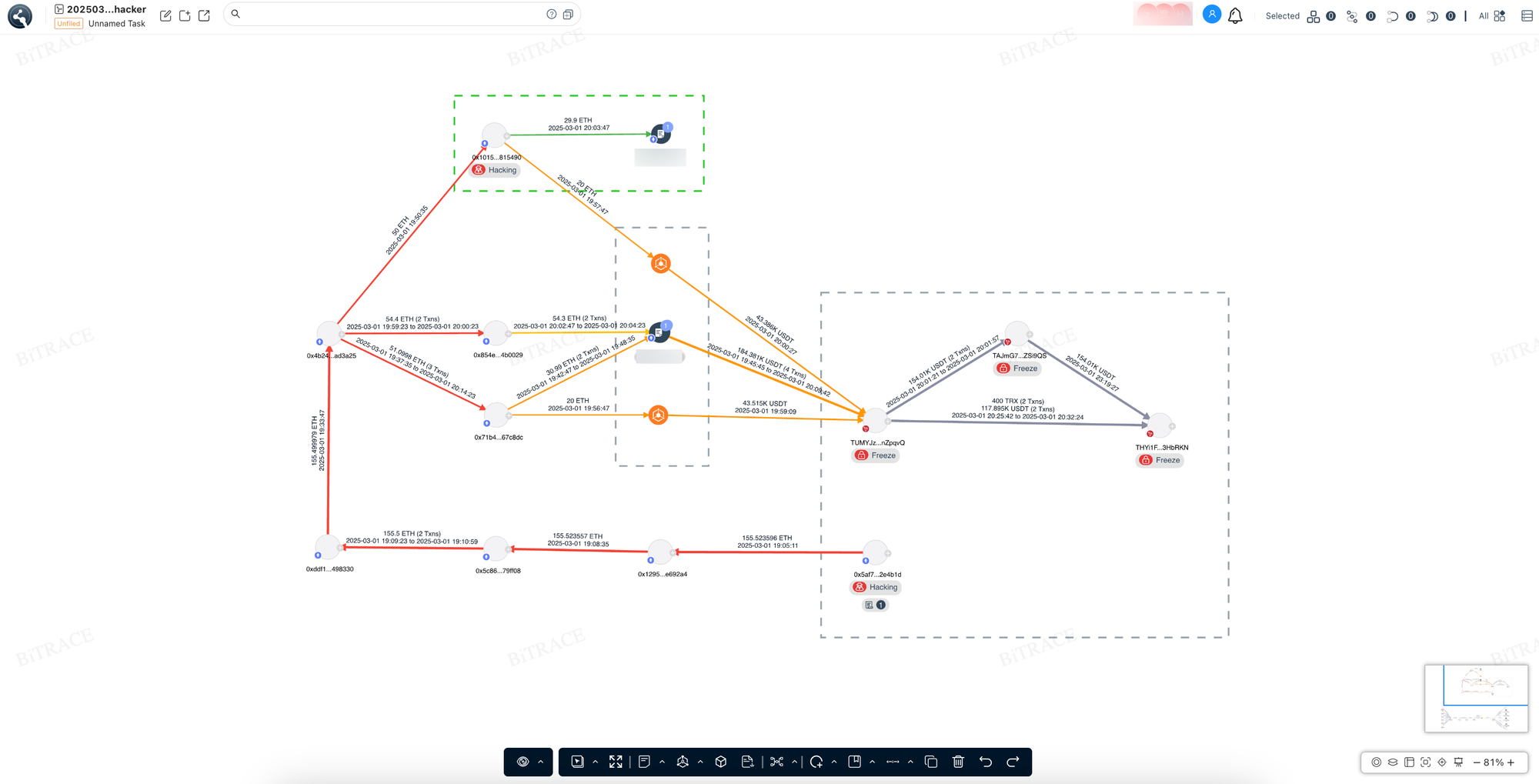

Purpose-built for compliance teams with investigative needs, Bitrace Pro delivers a comprehensive suite for on-chain fund tracing, address profiling, case management, and team-based collaboration. It's a next-generation investigation tool and crypto intelligence platform designed for high-stakes, cross-functional workflows.

- Supports multi-user case collaboration with shared intelligence and seamless team coordination

- Visualized fund flow analysis, entity identification, and address clustering

- 20+ smart crime pattern models built-in

- Intelligent alert monitoring for real-time threat detection

To better serve individual users and small to mid-sized clients, Bitrace has decoupled several previously embedded features—such as Bitrace Explorer and Bitrace Graph—into standalone tool-based services. These modular tools focus on core capabilities such as address and transaction analysis, fund flow visualization, and relationship graphing. Users can choose exactly what they need and enjoy customized solutions with lightweight integration and maximum cost-efficiency in crypto risk management.

Localized Compliance Services for Stablecoin Issuers in Hong Kong

In response to the 2024 consultation paper on stablecoin regulation released by the Hong Kong Monetary Authority (HKMA), all fiat-backed stablecoins intended for issuance and circulation in Hong Kong will be subject to a future licensing regime. This framework will require compliance with multiple regulatory obligations, including transparency of reserve assets, transaction monitoring, and robust anti-money laundering (AML) mechanisms.

Actively aligning with Hong Kong’s regulatory direction, Bitrace has completed the development of a localized compliance and risk monitoring solution tailored to these requirements. The product focuses on end-to-end oversight of stablecoin issuance, on-chain circulation, and usage scenarios—offering customized compliance support for stablecoin issuers, custodians, and Virtual Asset Service Providers (VASPs) operating in or targeting the Hong Kong market.

Enabling Compliance Through Deep-Tech Foundations

Bitrace is committed to a core philosophy of standardized deployment with flexible configurability—ensuring adherence to universal regulatory requirements while empowering clients to tailor compliance strategies based on their specific business models or regional legal frameworks.

At the technical core, Bitrace has maintained long-standing collaboration with enforcement and regulatory bodies across Asia, contributing to the investigation and analysis of over a thousand virtual asset–related cases. Through this extensive involvement, the company has built a rich repository of operational expertise and high-value risk intelligence. Leveraging this foundation, Bitrace has developed a high-quality risk address database covering 20+ mainstream and emerging public chains. Powered by proprietary AI and large language model technologies, it continuously enhances its capabilities in risk labeling, fund flow identification, and address clustering, enabling swift and intelligent detection of complex on-chain money laundering and illicit activity.

With the comprehensive upgrade of its product ecosystem, Bitrace is accelerating its presence in key markets such as Hong Kong, Singapore, Japan, and the Middle East, working alongside global partners to advance the accessibility and implementation of scalable compliance infrastructure.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech