Bitrace Releases the 2025 Crypto Crime Report

The year 2024 marked a milestone for the Web3 industry. The market capitalization of crypto assets and the adoption of industry infrastructure both reached unprecedented heights. At the same time, criminal enterprises increasingly leveraged crypto infrastructure to optimize operations or create new crime paradigms. This report provides statistics and disclosures on major types of crypto crimes, and explains the impact of compliance measures on the scale of criminal activities, aiming to raise awareness among the industry and government sectors about the harms caused by crypto-related crimes.

Due to space constraints, this article only presents selected findings and data from the report. The full version is available for download on Bitrace’s official website.

Crypto Crime Remains Severe

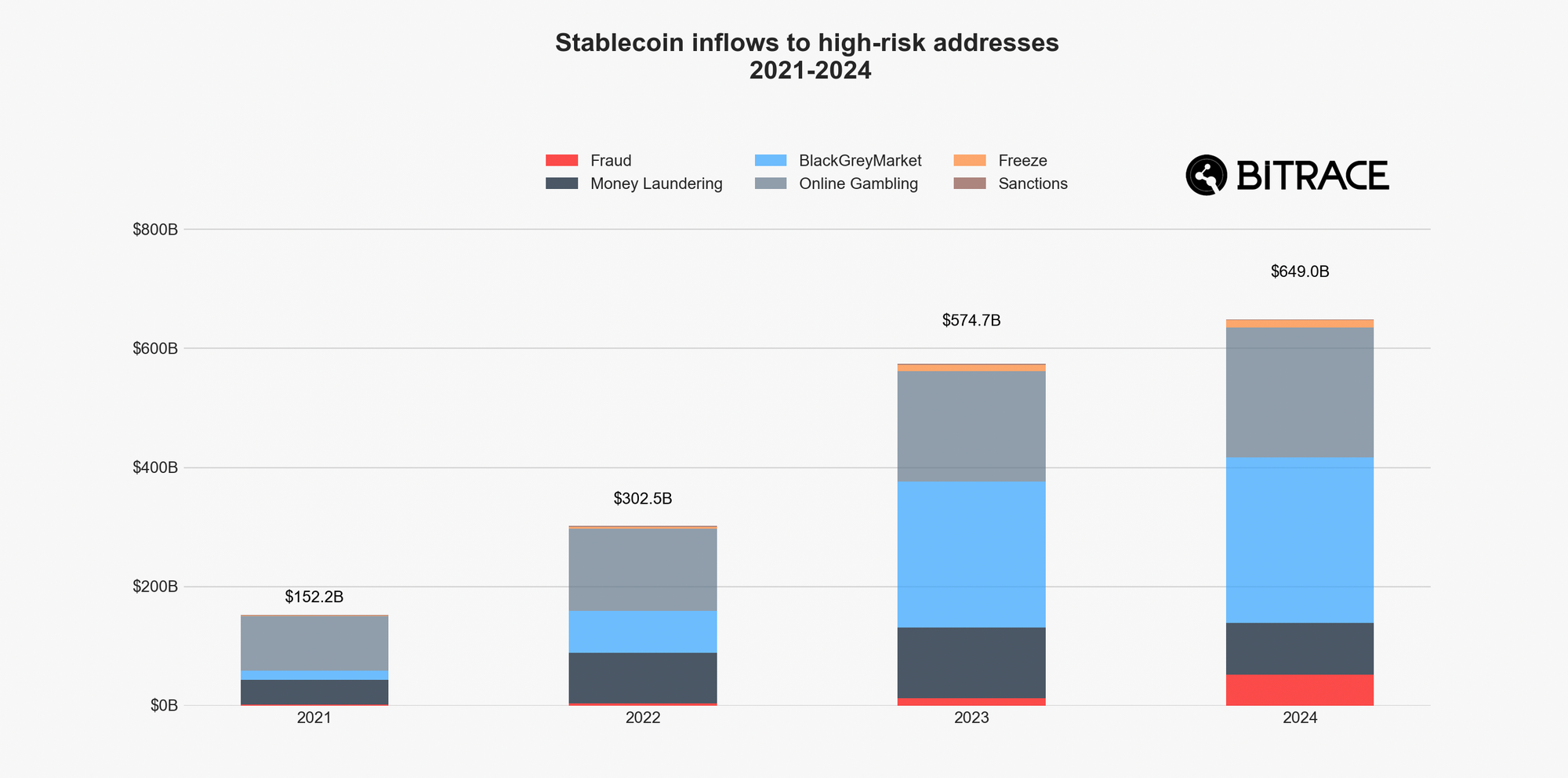

Given that most illicit activities occur on Ethereum and TRON networks, Bitrace defines blockchain addresses used by illegal entities for receiving, transferring, and storing stablecoins (ERC20_USDT, ERC20_USDC, TRC20_USDT, TRC20_USDC) as high-risk addresses. In 2024, these addresses collectively received approximately USD 649 billion, slightly higher than the previous year.

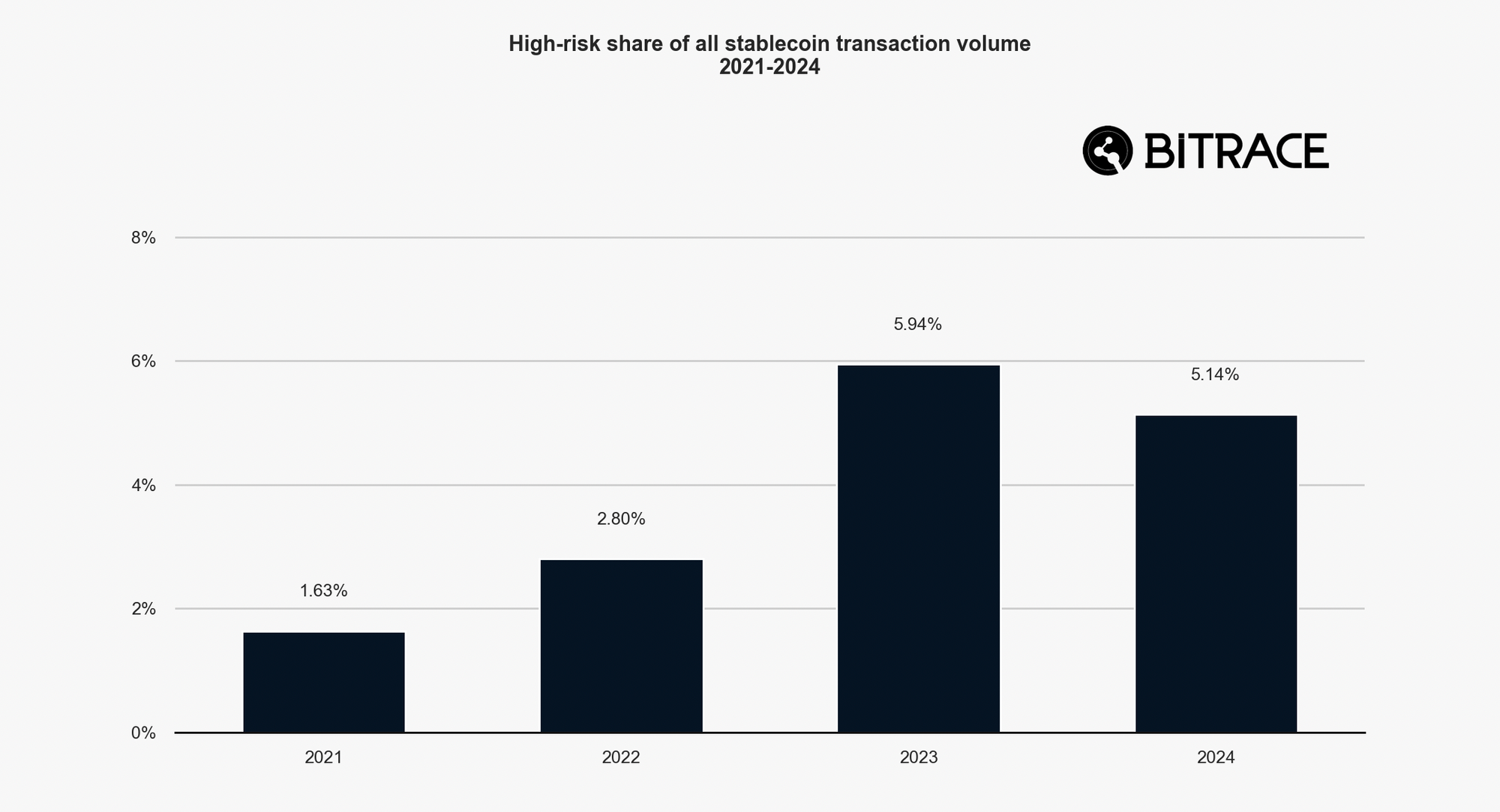

Measured by transaction volume, these high-risk activities accounted for 5.14% of total stablecoin transactions in 2024, a decrease of 0.80% compared to 2023, yet still significantly higher than in 2021 and 2022.

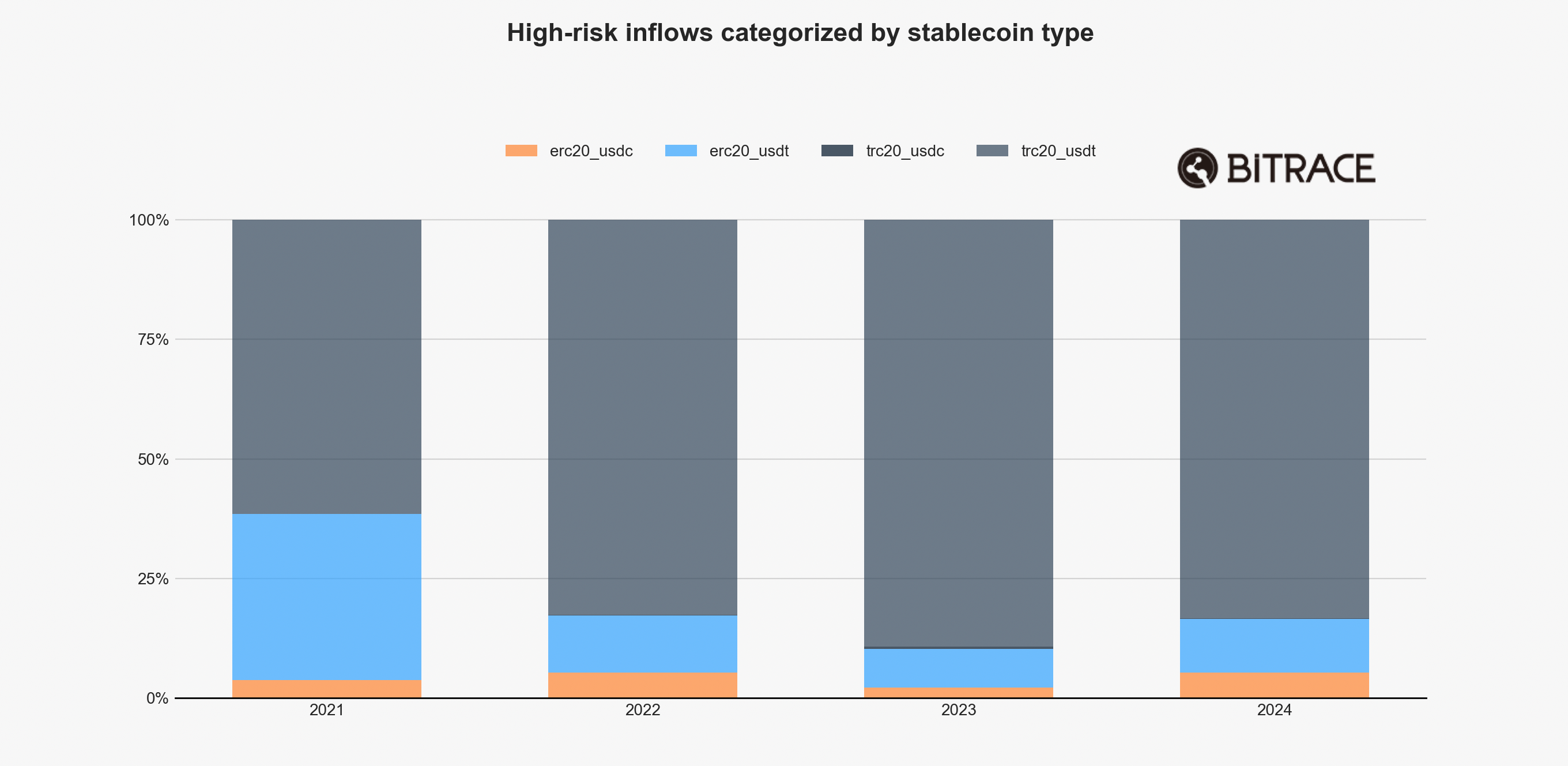

By stablecoin type, TRON-based USDT dominated from 2021 to 2024. However, in 2024, the share of USDT and USDC on Ethereum increased.

Online Gambling Scale Continues to Grow

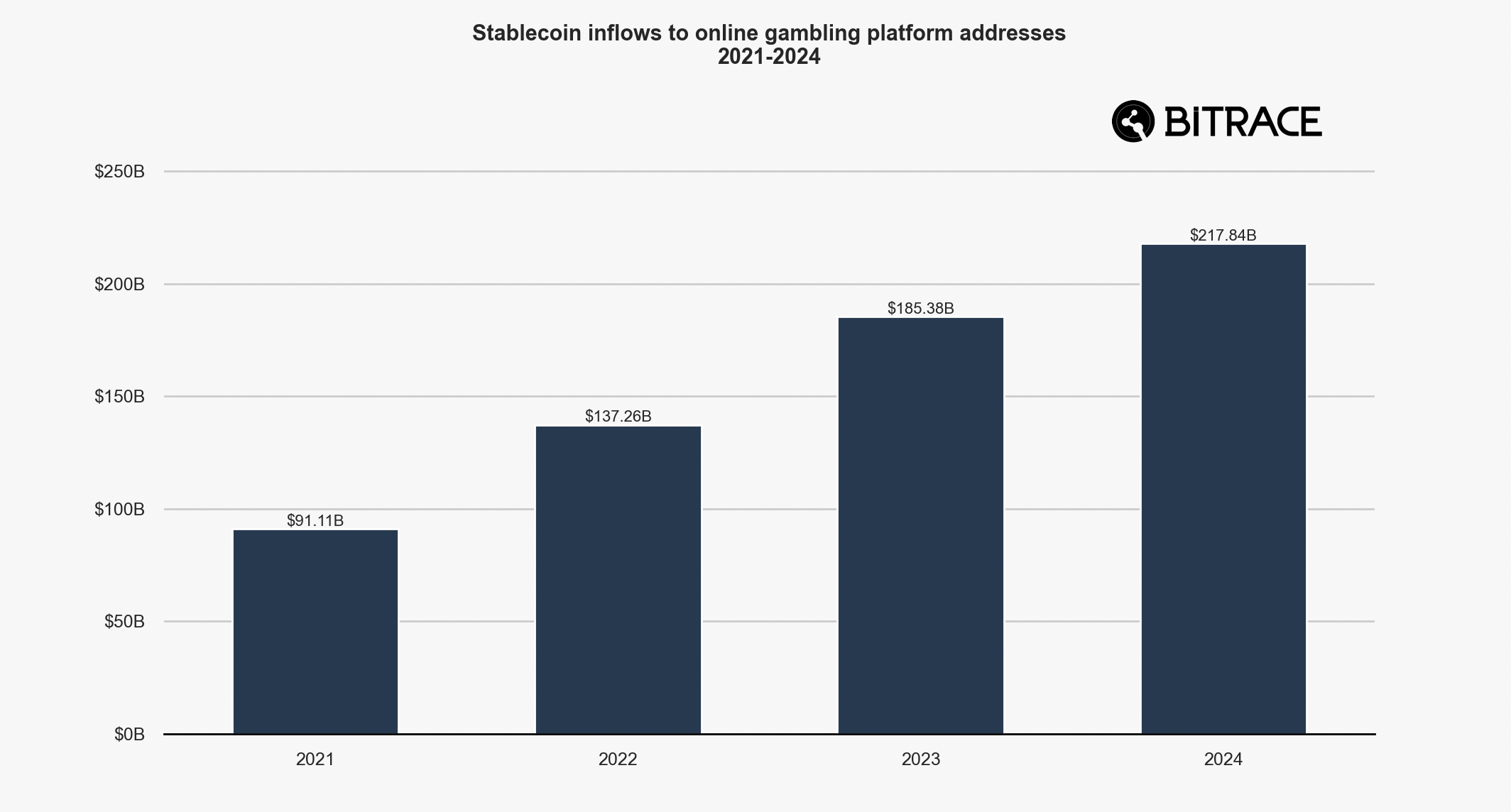

In 2024, online gambling platforms and associated payment processors handled USD 217.8 billion, over 17.5% higher than in 2023.

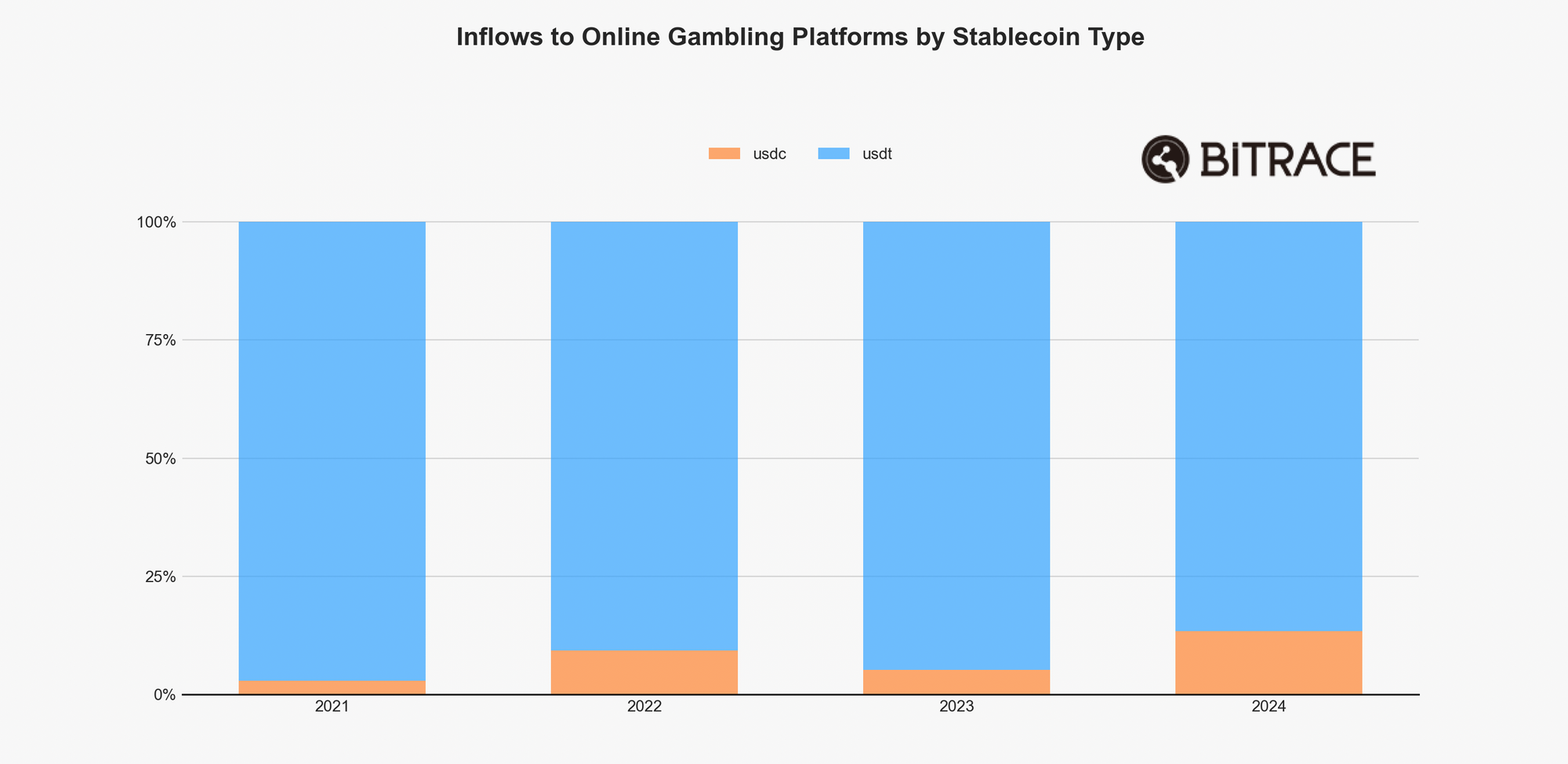

Breaking down by stablecoin type, USDC’s share rose significantly to 13.36% in 2024, up from 5.22% in 2023. This shows that as USDC’s market presence expanded, so did its adoption in the online gambling sector, despite being issued and regulated by compliant entities.

Black/Gray Market Activity Remains High

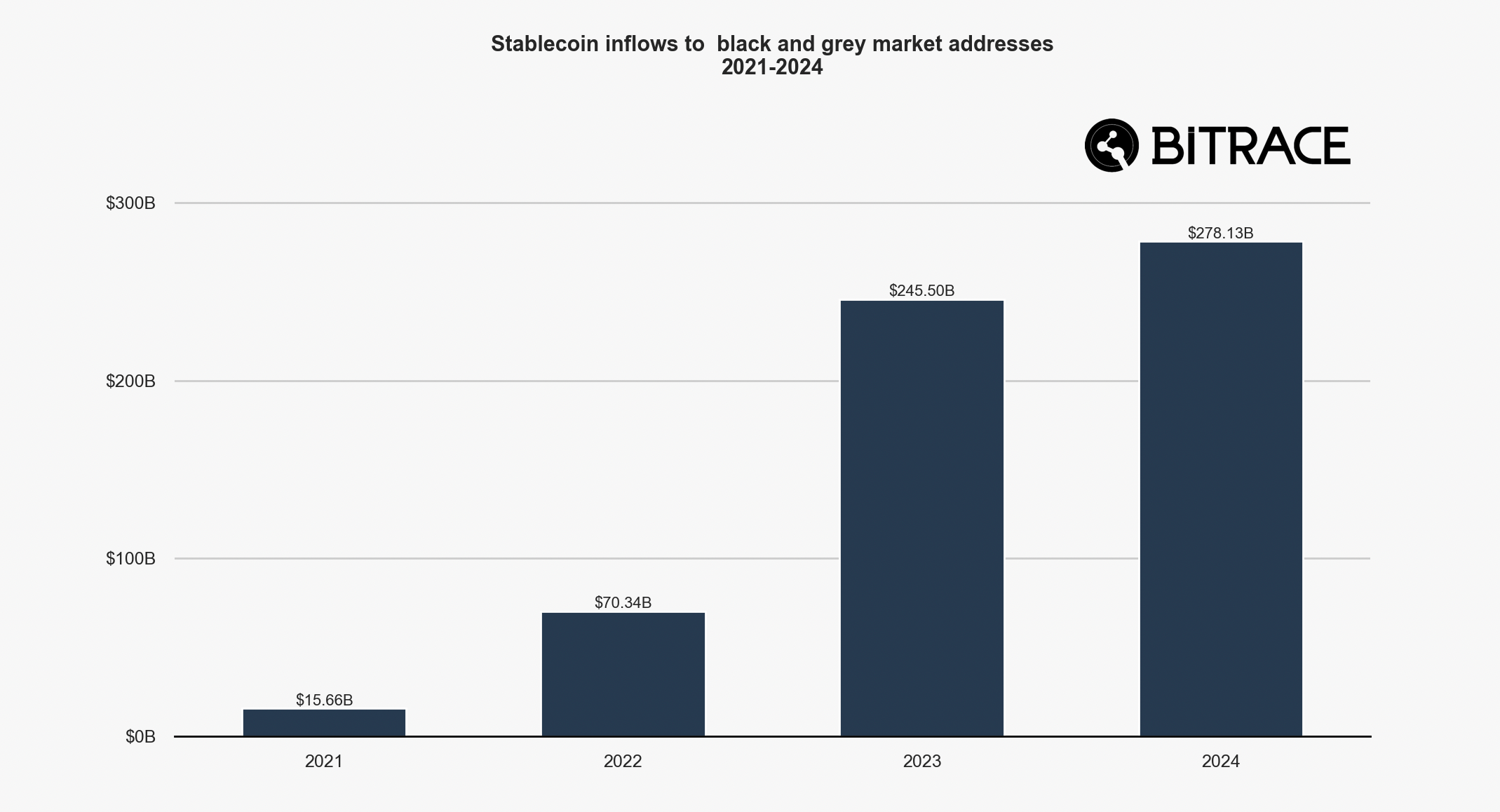

In 2024, blockchain addresses associated with illicit trade on Ethereum and TRON networks received over USD 278.1 billion, slightly higher than in 2023, and far exceeding the levels seen in 2021 and 2022.

An inseparable part of illicit trade is crypto escrow services, which facilitate transactions across all stages of the illicit supply chain, building trust among criminals.

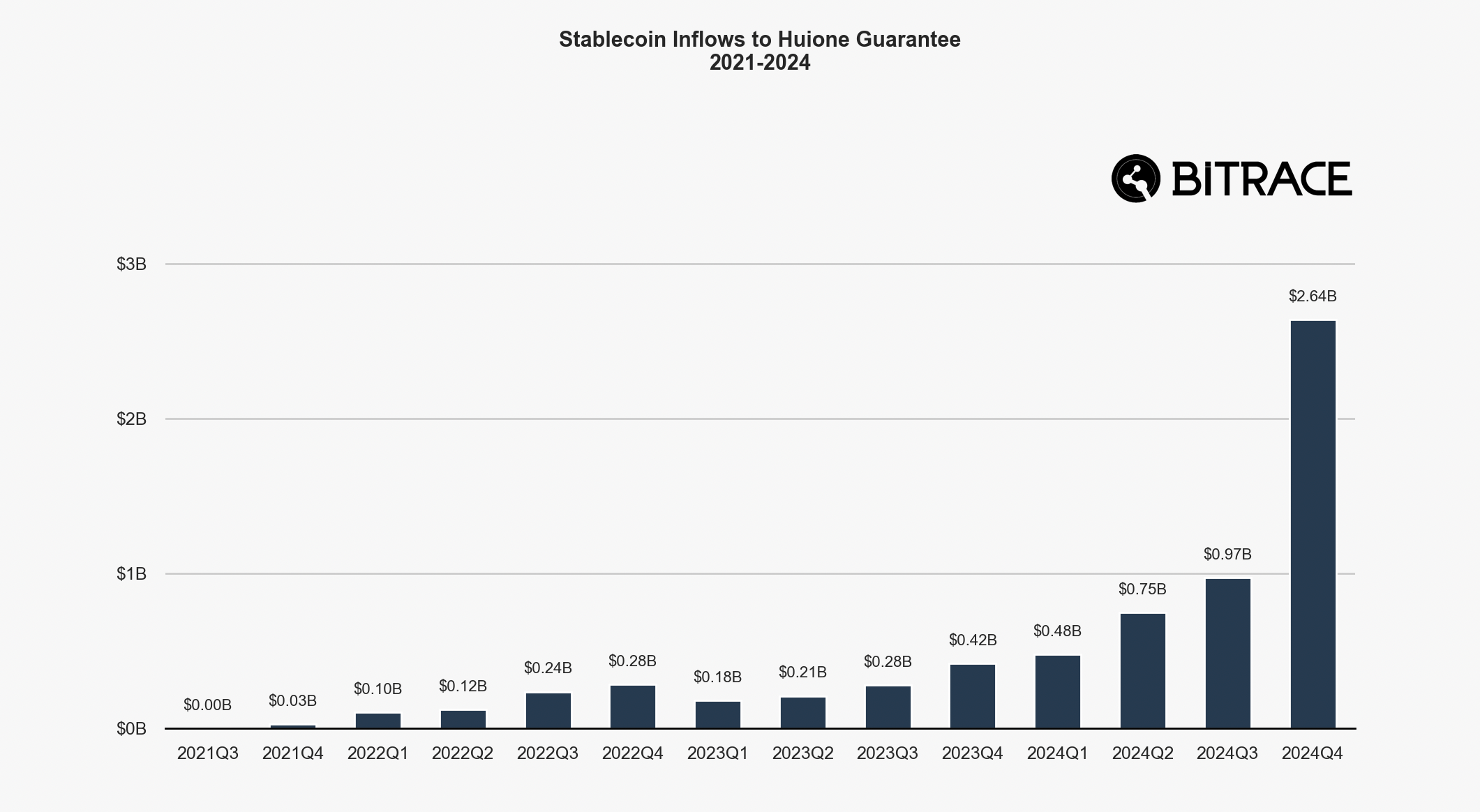

The rise of escrow platforms like Huione Guarantee and their Southeast Asian competitors paralleled the growing use of stablecoins in real-world economies, a trend especially prominent in 2024. By Q4 2024, their transaction volume had expanded to USD 2.64 billion.

Crypto Fraud Surges

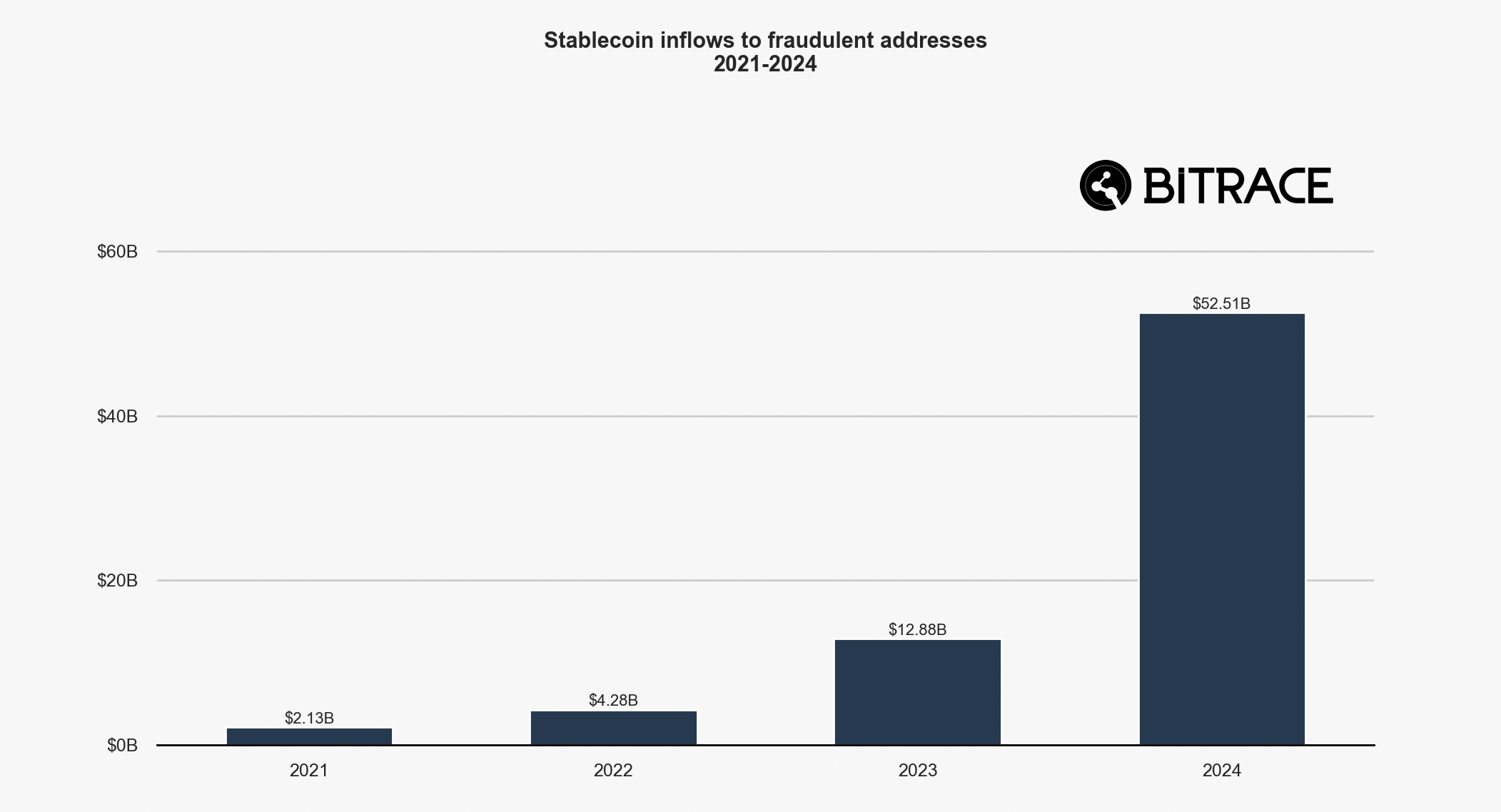

In 2024, blockchain addresses linked to fraud activities experienced an explosive growth in stablecoin inflows, reaching USD 52.5 billion — exceeding the total of previous years combined.

However, this sharp increase may not fully reflect reality, as statistics are influenced by the detection capabilities of security firms and the evolving sophistication of fraud tactics. As more blockchains are monitored and more cases are reported, previously undetected crimes are increasingly included in statistics.

Future reports are expected to show even higher figures as data collection methods improve and case disclosures rise.

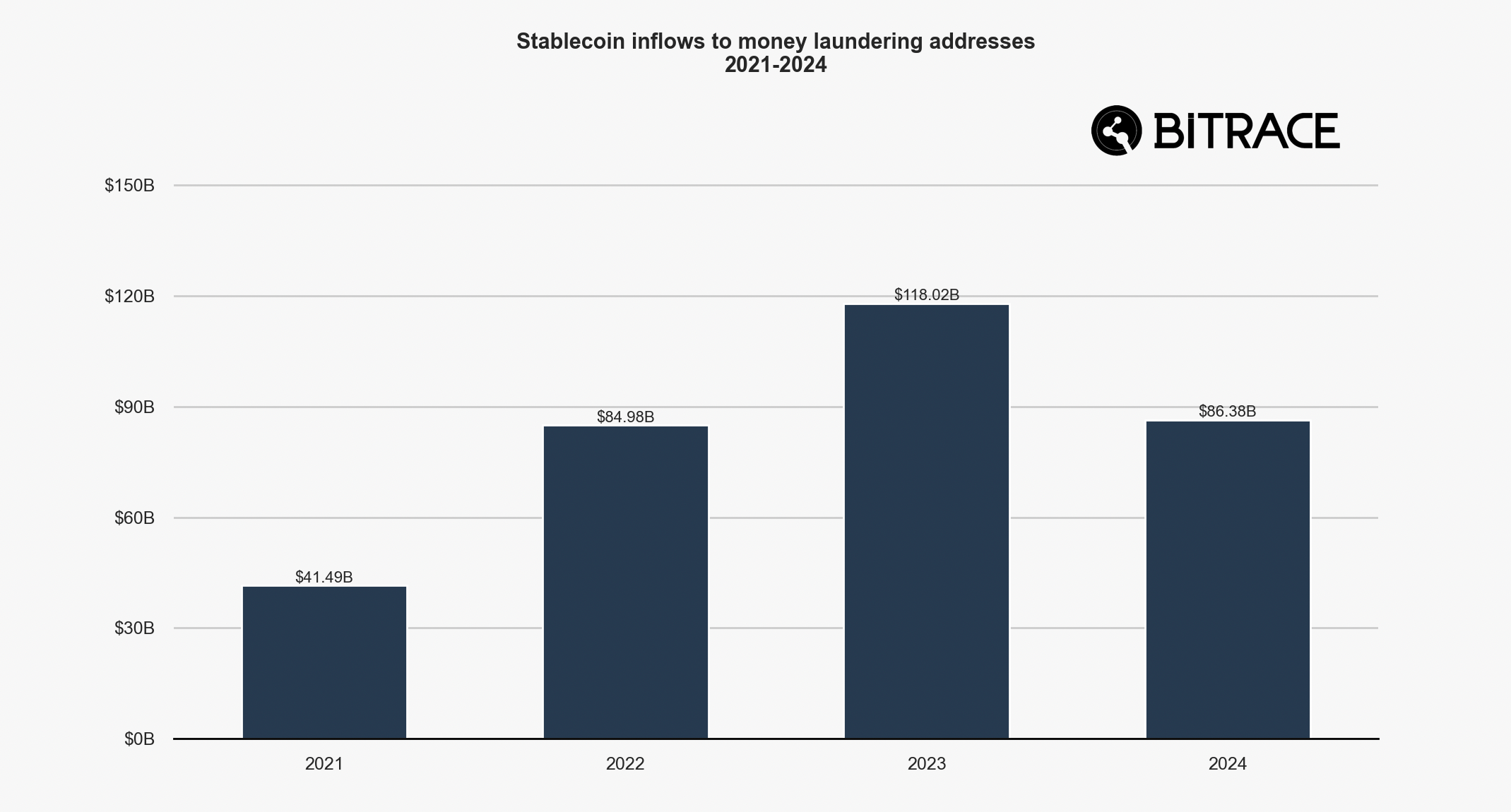

Money Laundering Scale Contracts

Addresses linked to money laundering activities received a total of USD 86.3 billion in stablecoins in 2024, slightly lower than 2023 and on par with 2022. This suggests that major enforcement actions and regulatory initiatives over the past two years have effectively curbed money laundering activities in the crypto sector.

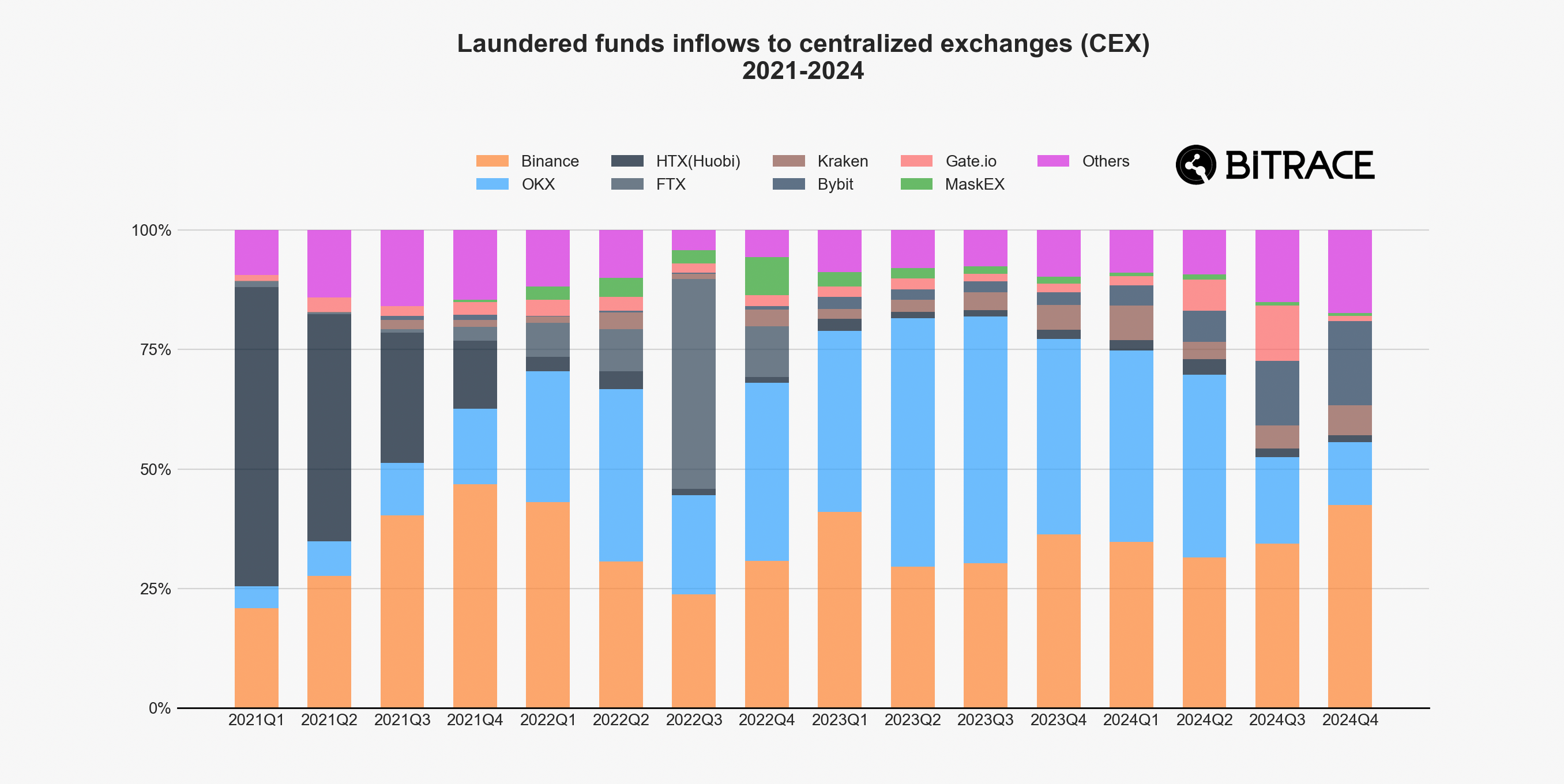

Given centralized exchanges’ advantages in liquidating assets, Bitrace audited the hot wallets of major exchanges. As with fraud-related activities, the amount of laundering funds received generally correlated with each platform’s size. Notably, OKX saw a significant drop in its share in recent quarters, possibly due to improved compliance practices.

Stablecoin Freezes

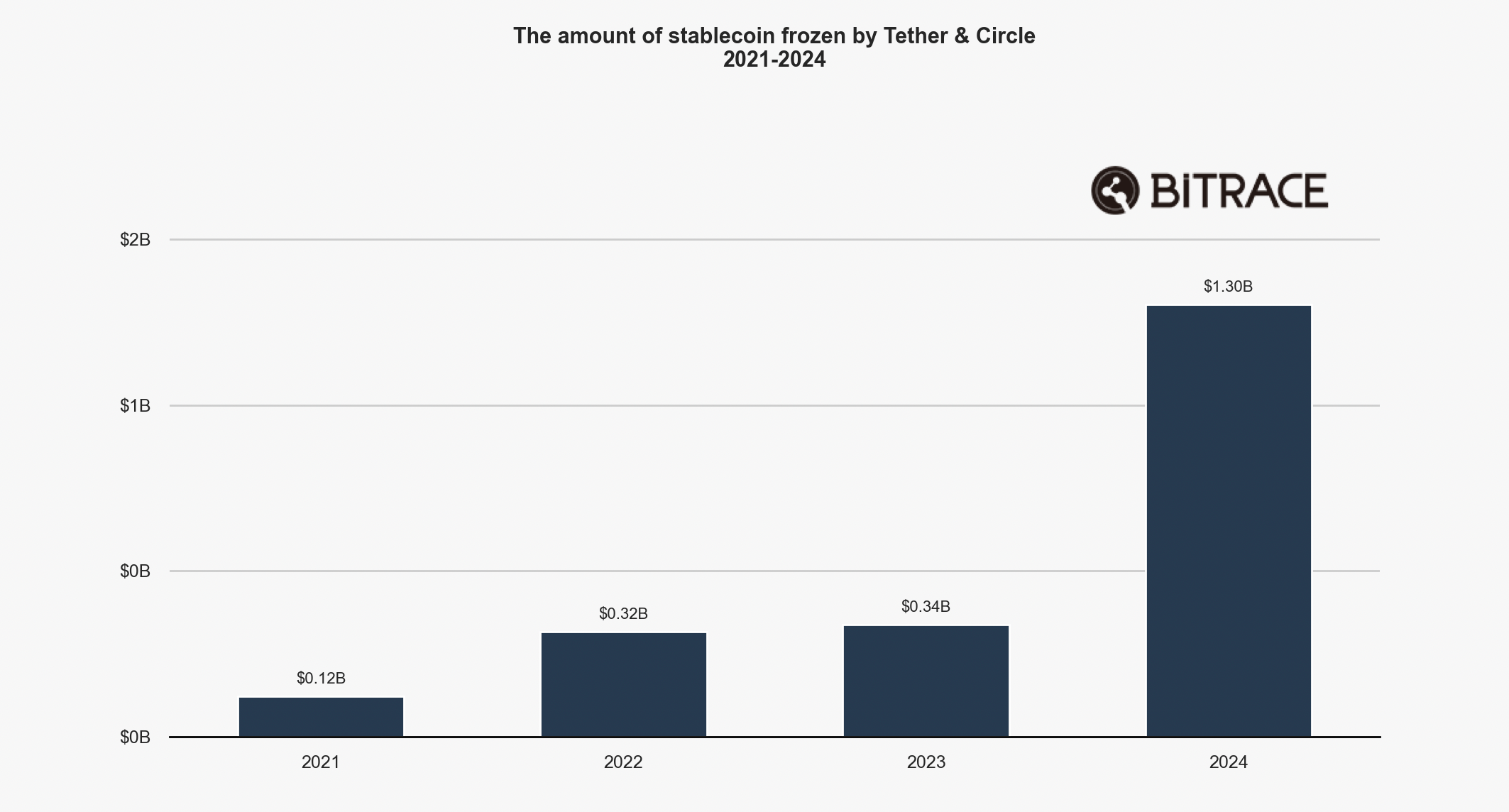

In 2024, stablecoin issuers actively cooperated with law enforcement. Tether and Circle froze over USD 1.3 billion worth of stablecoins on Ethereum and TRON, double the amount frozen over the past three years combined.

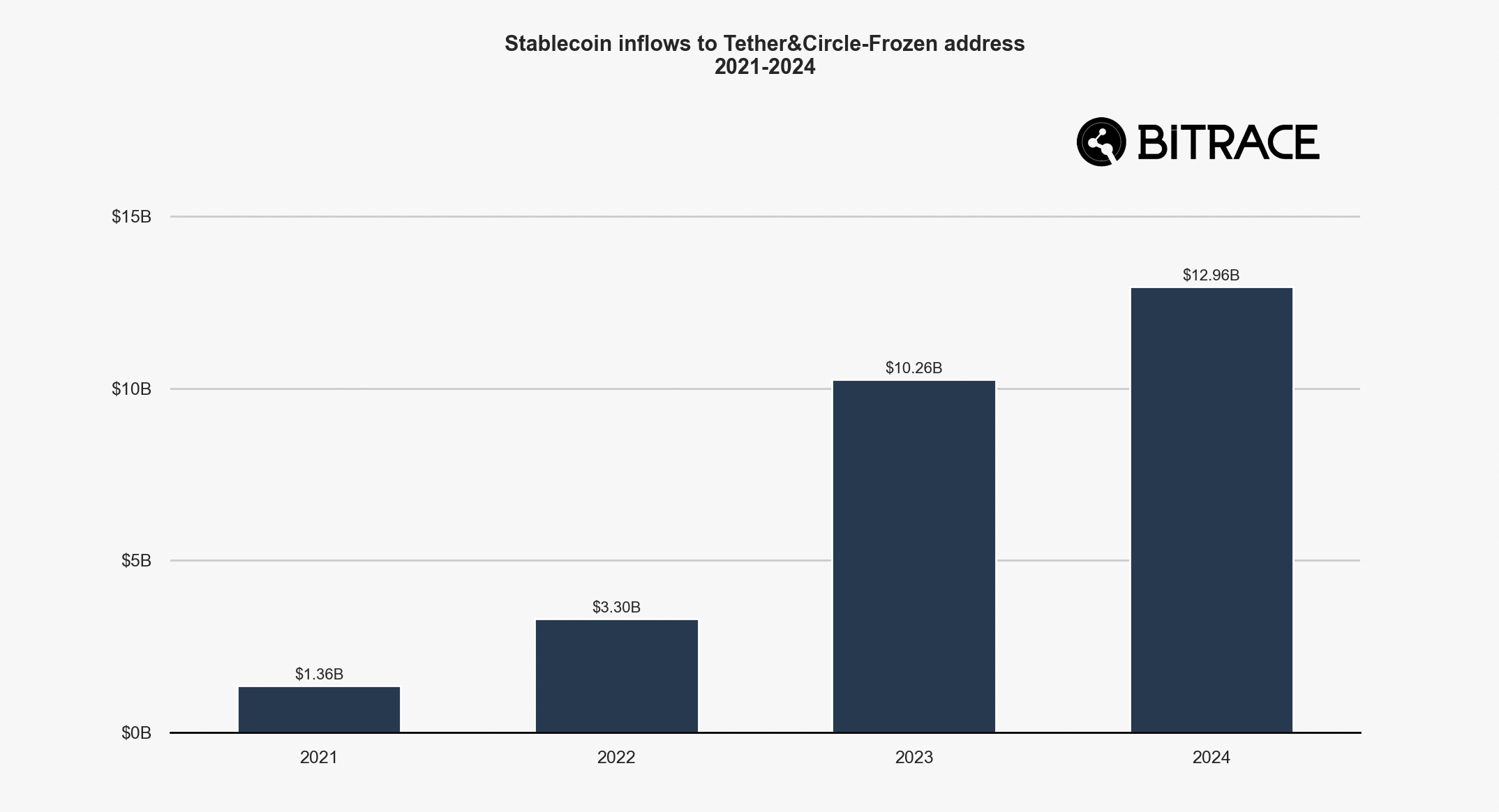

The total transaction volume involving these frozen addresses reached USD 12.9 billion in 2024, consistent with 2023 levels. This indicates that illicit crypto activities had already become active years ago but only began facing effective crackdowns recently.

*It is important to note that not all frozen addresses were necessarily tied to criminal cases. Bitrace did not exclude such addresses in this analysis, so the actual scale might be slightly smaller.

Sanction Trends by OFAC and NBCTF

The U.S. Office of Foreign Assets Control (OFAC) and Israel’s National Bureau for Counter-Terror Financing (NBCTF) are two key agencies tackling terrorist financing. Together, they collaborate extensively on disrupting financial networks linked to terrorist organizations like Hamas.

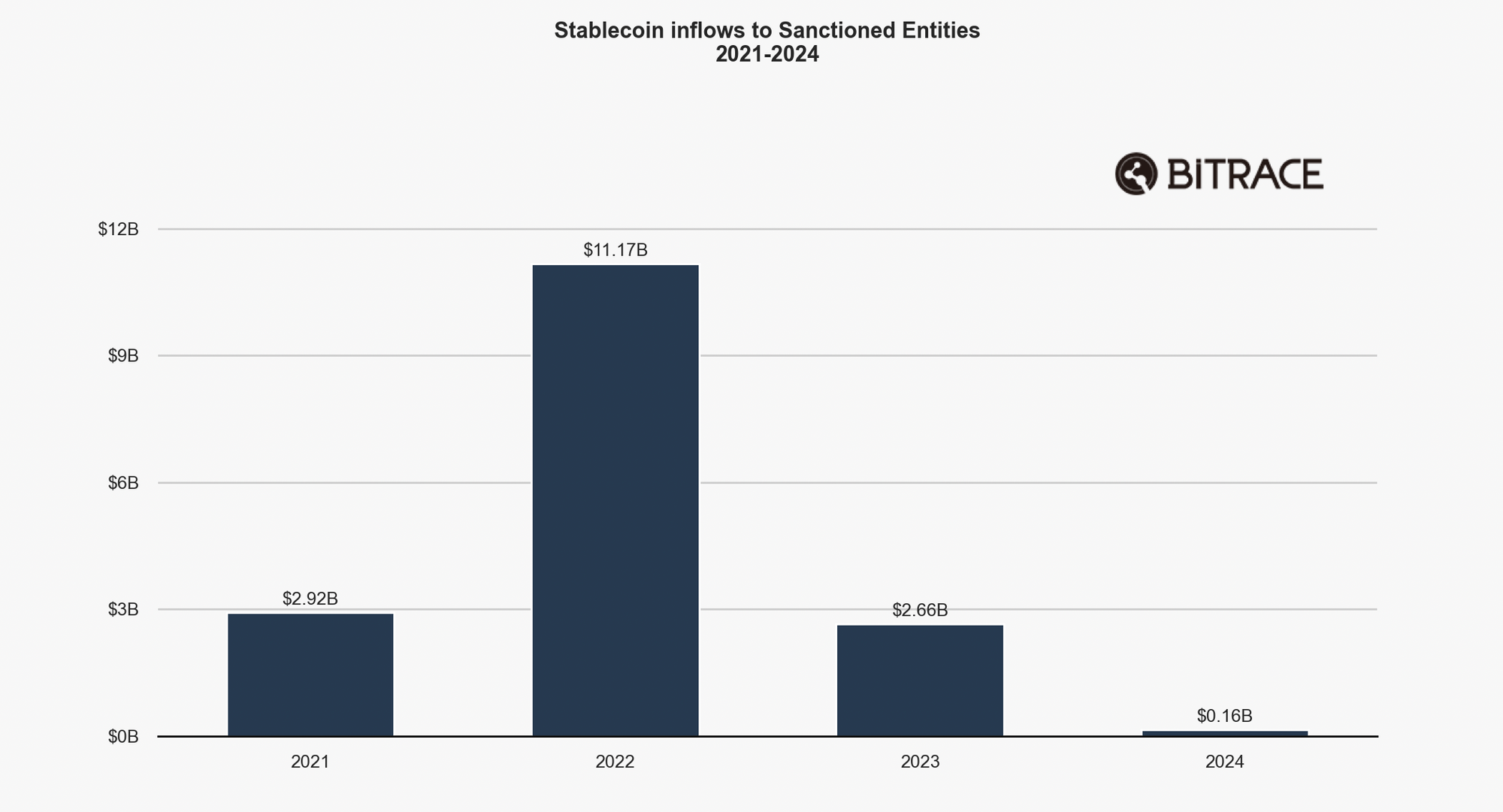

According to data, blockchain addresses linked to sanctioned entities peaked in funding activity in 2022 and have declined annually since.

While sanctions severely impact targeted entities, criminal groups using decentralized technologies experience minimal disruption due to crypto’s inherent anonymity and resilience. Regulatory authorities must intensify investigations and enforcement actions against crypto crimes.

Regulation Brings Positive Impact to Hong Kong

2024 was a year of accelerated crypto compliance globally. Regulatory authorities shifted from cautious observation to proactive engagement, pushing the industry toward greater standardization and transparency. Hong Kong serves as a prime example:

Through clear legal frameworks, customer fund protections, crackdowns on illegal activities, attraction of institutional capital, and alignment with international standards, Hong Kong has built a safer, more controllable crypto ecosystem.

This not only reduced direct financial losses from hacking, exchange collapses, and legal penalties but also enhanced market stability and trust. While compliance increased operational costs in the short term, it significantly reduced long-term risks for crypto businesses.

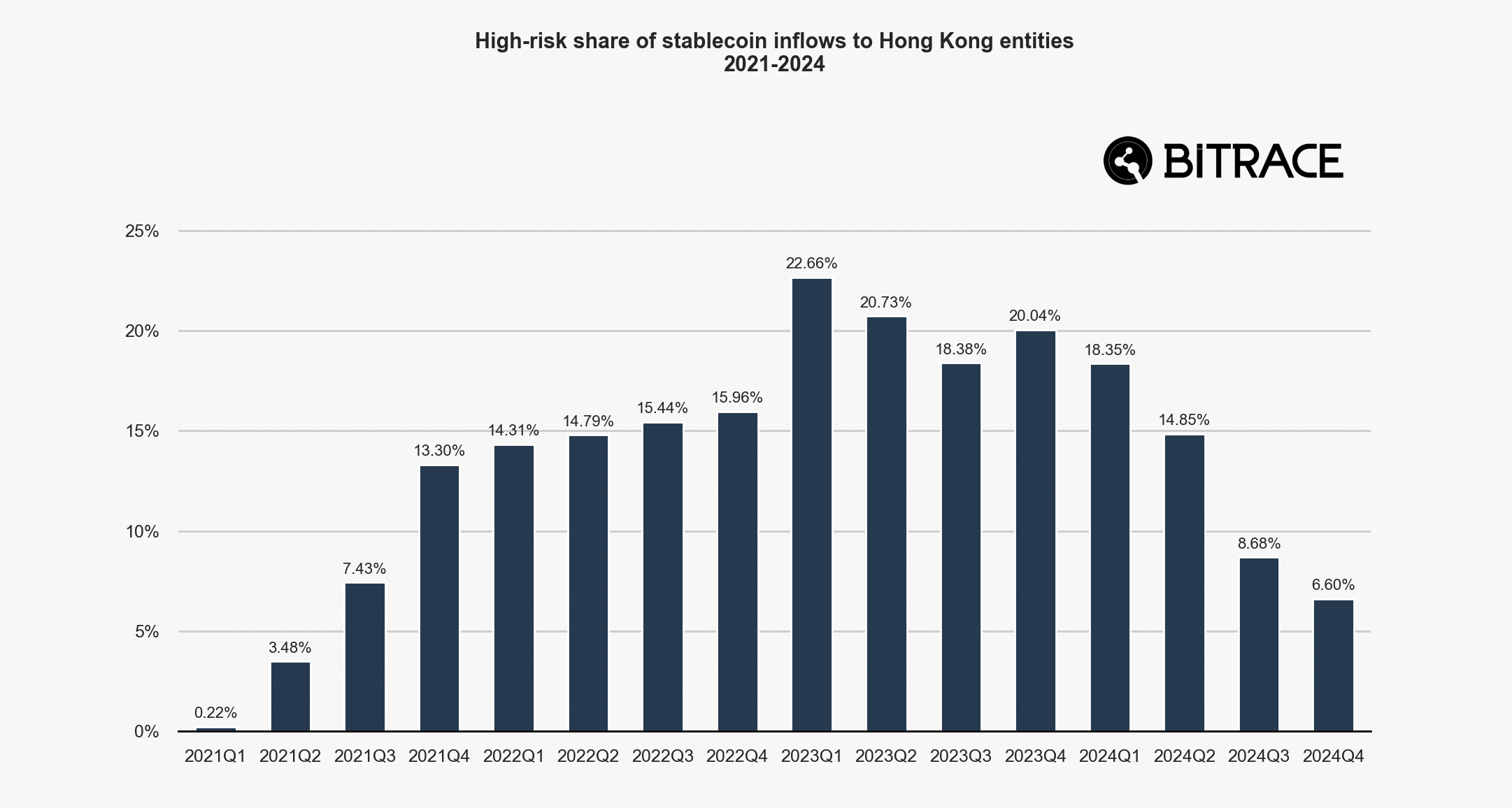

Analysis of addresses serving Hong Kong customers shows that after Q3 2023, the proportion of risky stablecoin inflows dropped sharply — a clear sign that compliance policies and enforcement actions have effectively suppressed illicit stablecoin activities.

Conclusion

2024 was a year of comprehensive industry revival, and one where major economies began recognizing the importance of crypto.

Although crypto crime remains prevalent, top-down regulatory measures and bottom-up industry self-discipline have already brought positive changes to crypto sectors in certain regions.

The future promises a safer and more trusted crypto environment — a conclusion we believe is self-evident.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech