Bitrace Reminder: Recent Surge in Fraudulent USDT Transactions Using Bad Checks

Recently, criminals have been exploiting the business characteristics of VAOTC merchants and forex traders to carry out financial fraud. They use bad checks as bait to deceive victims into handing over their virtual currencies or RMB. Bitrace has received reports from victims about a gang that successfully committed two frauds in just three days, illegally profiting up to $700,000. This article will delve into this scam, uncovering its operating mechanism, with the aim of raising public awareness and preventing similar fraudulent activities.

Background

On July 18, 2024, a victim reported a fraud case to Bitrace. An overseas fraud gang contacted the victim through an intermediary, claiming that their child was studying abroad and needed to exchange a large amount of USD for USDT. Both parties agreed to use an overseas bank check for payment.

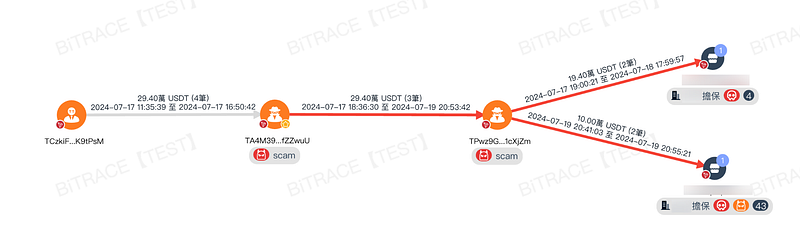

The transaction process was not complicated. After receiving a bank “funds received” notification, the victim transferred the agreed amount of approximately 300,000 USDT in four installments to a specified blockchain address. However, after the transaction was completed, the funds in the bank account were withdrawn, and the victim realized they had been scammed.

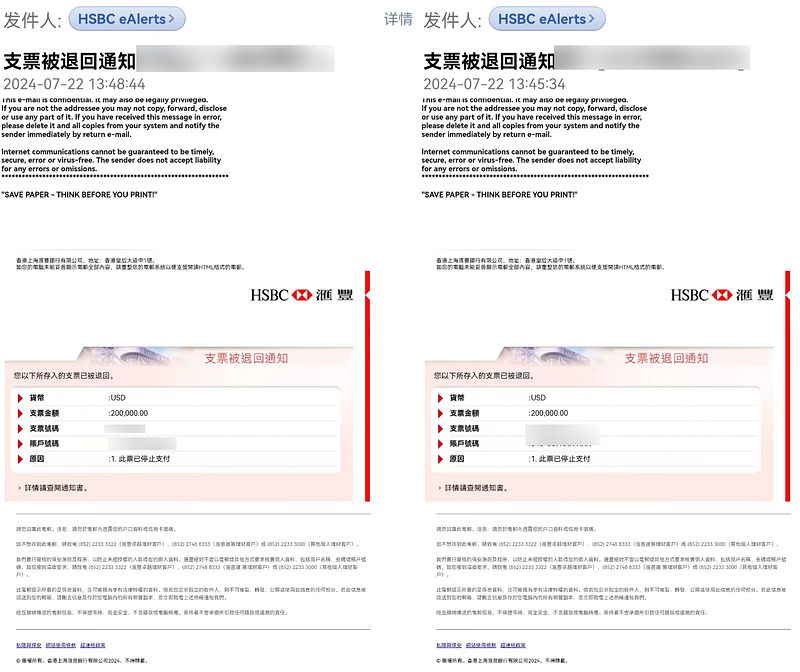

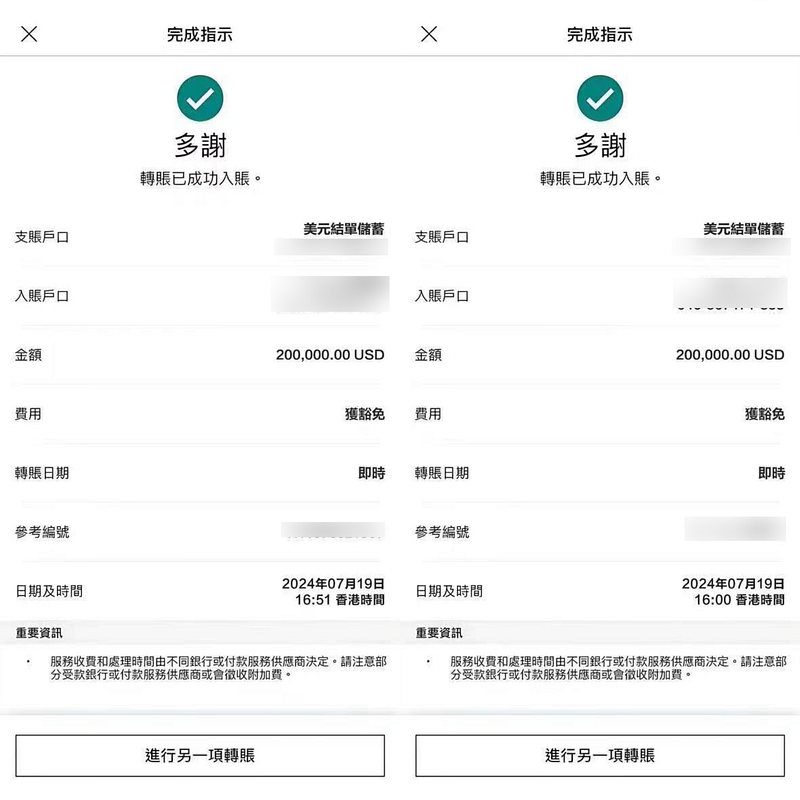

Coincidentally, two days later, on July 19, another victim reported the same fraud method to Bitrace, with even greater financial losses. The victim was scammed out of RMB worth $400,000.

Upon comparing the materials submitted by the two victims, Bitrace discovered that the scam gang used the same set of identity information for KYC or to receive funds in both fraud cases. Evidently, this gang committed at least two frauds within three days, illegally obtaining $700,000 worth of cryptocurrency or cash assets.

Disclosure of Fraud Techniques

Bad check fraud is a classic traditional scam. According to the bank check rules of some countries, the transferor can revoke the check within 24 hours. Even if the transferor does not revoke the check, the check may not clear due to insufficient funds, signature mismatches, or other factors. However, the recipient will still receive a “funds received” notification from the bank.

Users unfamiliar with these rules often mistakenly believe that “funds received” means “funds cleared,” leading to a completed transaction that is later revoked. For example, the second victim in the above case had two transfers of $200,000 each maliciously revoked.

In the first fraud case involving USDT, the scam method is a variant of this traditional fraud targeting ordinary investors, especially cryptocurrency traders, in the secondary market. Its tricky aspect lies in the anonymity of blockchain transactions, making it difficult to trace cryptocurrency transfers. Additionally, in some countries or regions where cryptocurrencies are not recognized, victims may find it hard to file a case and recover their funds through legal procedures.

According to Bitrace’s on-chain investigation, the stolen funds in the first case have already been transferred to multiple escrow platforms in Southeast Asia for laundering, making fund recovery extremely challenging.

Preventive Measures

- Verify Information: Be highly vigilant of any investment opportunities promising abnormally high returns. Do not easily trade with parties offering favorable USDT exchange rates.

- Understand Payment Processes: Familiarize yourself with and verify the source of funds and payment methods of all transaction counterparts. Avoid accepting bad checks or any unverified payment tools.

- Conduct KYT Investigations: Before transferring cryptocurrency, audit the recipient’s address for any financial history. Avoid transactions with addresses that have a history of risky interactions. For instance, the fraudulent address TA4M39 in this case had prior interactions with numerous illicit trade risk addresses before the fraud occurred. VAOTC groups should establish risk control awareness and incorporate KYT as a necessary part of their business processes.

Conclusion

The fraudulent use of bad checks to scam USDT reveals the evolving fraud risks in the cryptocurrency field. Investors and VAOTC operators must remain vigilant, enhance self-protection awareness, and avoid significant losses.

Contact us:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: https://x.com/Bitrace_team

LinkedIn:https://hk.linkedin.com/company/bitrace-tech