Cambodia’s crackdown on telecom fraud has disrupted the core operations of Southeast Asia’s largest illegal transaction guarantee platform

In late February this year, the Cambodian government established an anti-cyber fraud committee led directly by the Prime Minister. On July 14, an executive order was signed to launch a nationwide crackdown on telecom network crimes, aimed at maintaining public order and social stability. According to Cambodia’s Minister of Information, as of the evening of July 18 local time, a total of 2,270 suspects have been arrested in the recent crackdown operation.

This initiative has dealt a significant blow to the local black and gray industries and the surrounding support ecosystem, including the temporary dismantling of telecom fraud compounds, the suspension of illegal human trafficking routes, and the shutdown of illicit online gambling platforms.

This article aims to assess the impact of this anti-fraud campaign from an on-chain perspective by disclosing recent business data from Tudou Guarantee—the largest illegal crypto-based transaction guarantee platform in Southeast Asia, based in Cambodia—providing insight for law enforcement investigators and crypto risk control professionals.

Introduction to Tudou Guarantee

Transaction guarantee platforms offer an age-old intermediary service, enabling trustless commodity exchanges between strangers by matching buyers and sellers and holding funds in escrow. In recent years, with the integration of anonymous messaging apps and cryptocurrency, such platforms in Southeast Asia have evolved into critical infrastructure supporting organized crime networks in the region.

Tudou Guarantee originated from Huione Guarantee, a platform under Cambodia’s Huione Group. Huione Guarantee primarily served money laundering syndicates, telecom fraud groups, and illegal online gambling platforms, with transaction volumes far exceeding its competitors. Before being shut down earlier this year, it was the largest crypto-based transaction guarantee platform in Southeast Asia.

As the successor to Huione Guarantee’s business operations, Tudou Guarantee has now fully inherited its transaction volume.

Analysis of Tudou Guarantee’s public group deposit addresses

Tudou Guarantee’s business is divided into two main categories—Public Group transactions and Private Group transactions—which respectively offer long-term and temporary transaction guarantee services. Each system has its own set of deposit, intermediary, and withdrawal addresses, enabling detailed data tracking of Tudou’s operations.

In Public Group transactions, one party in the trade must submit funds to a designated Public Group deposit address, serving as both a security deposit and prepaid commission. The party making the deposit is referred to as a Public Group Merchant and is allowed to conduct repeated transactions within the deposit limit. Once services are terminated by mutual agreement, the platform transfers the remaining deposit (after deducting commission) from a designated withdrawal address to the merchant’s specified wallet.

On July 18, 2025, rumors began circulating within the Southeast Asian Telegram community that several ‘dealers’ from Tudou Guarantee had been arrested during Cambodia’s anti-fraud operation. As a result, the withdrawal address stopped returning or reducing deposits to merchants, causing a small-scale panic among the merchant community.

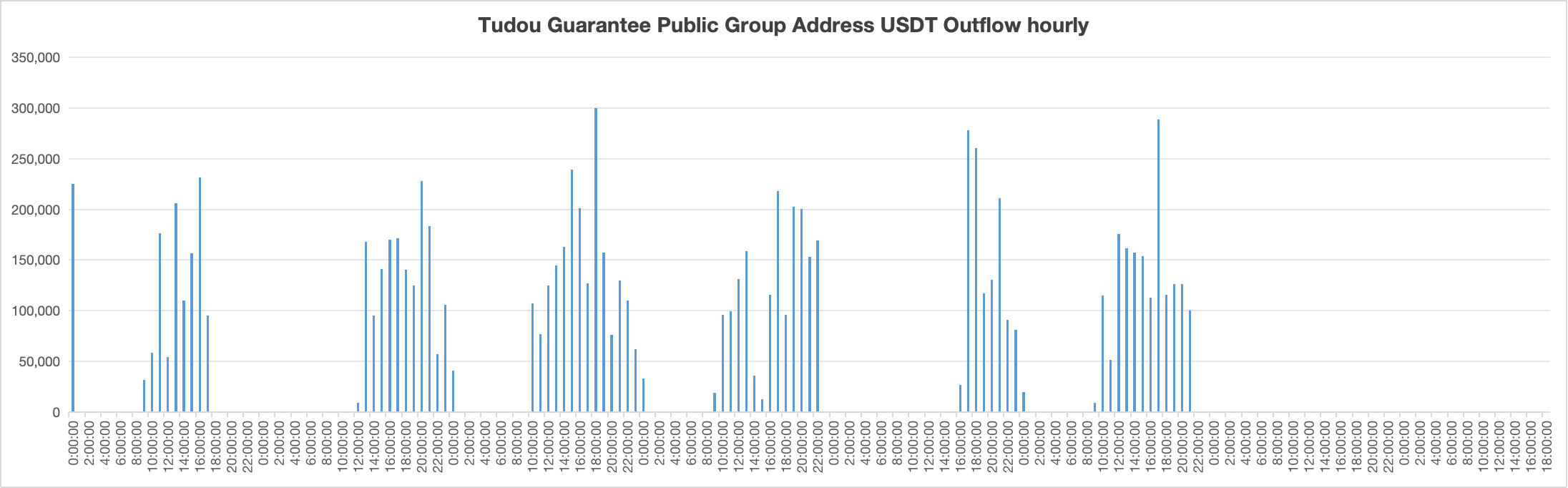

Bitrace conducted an hourly analysis of fund outflows from Tudou Guarantee’s public group withdrawal address over the past seven days. The data shows that during working hours on July 18, from 10:00 to 17:00 UTC+8, Tudou Guarantee did not process any deposit refunds. Although refund activity briefly resumed on July 19, it has since come to a complete halt and had not resumed as of the time this article was written.

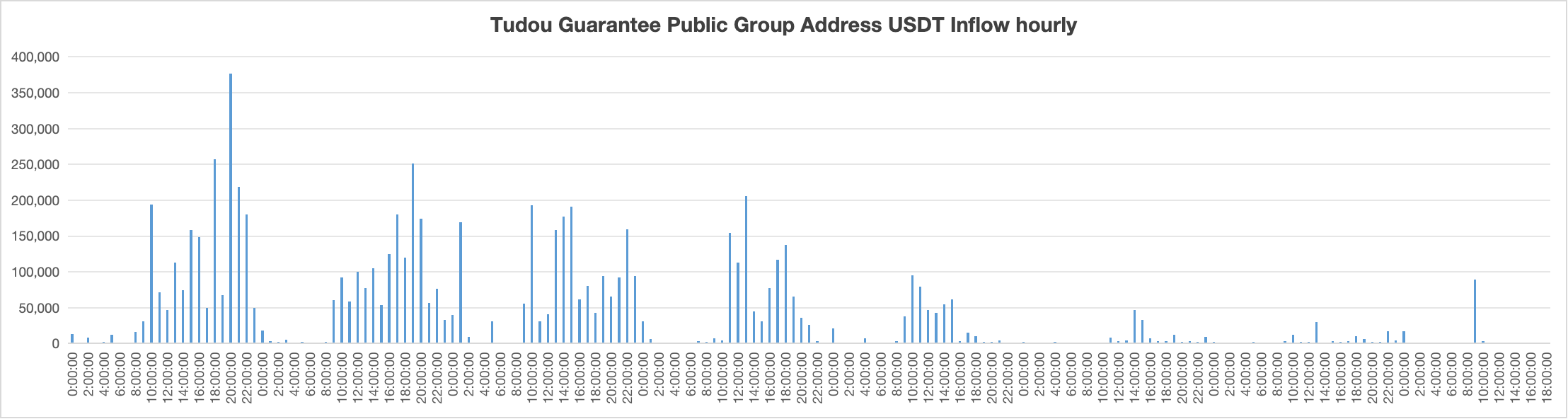

After Tudou Guarantee delayed deposit refunds on July 18, the scale of merchant deposit submissions dropped to nearly zero.

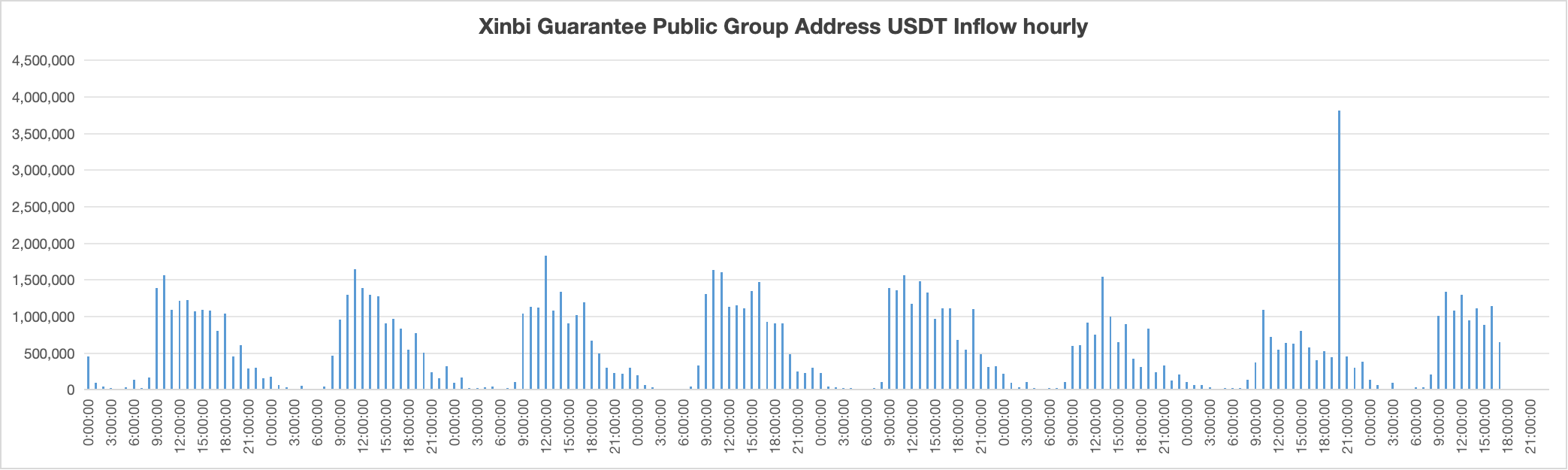

Meanwhile, its competitor Xinbi Guarantee (located outside Cambodia) has seen almost no impact on its public group deposit addresses.

Analysis of Tudou Guarantee’s private group deposit addresses

In private group transactions, either party can request the involvement of the guarantee platform before initiating the trade. Once the transaction details are agreed upon, the buyer transfers funds to the designated private group deposit address. The platform holds the funds in escrow until the transaction is confirmed, after which the remaining amount—minus commission—is transferred to the seller. This transaction model is essentially identical to the C2C model used by centralized exchanges.

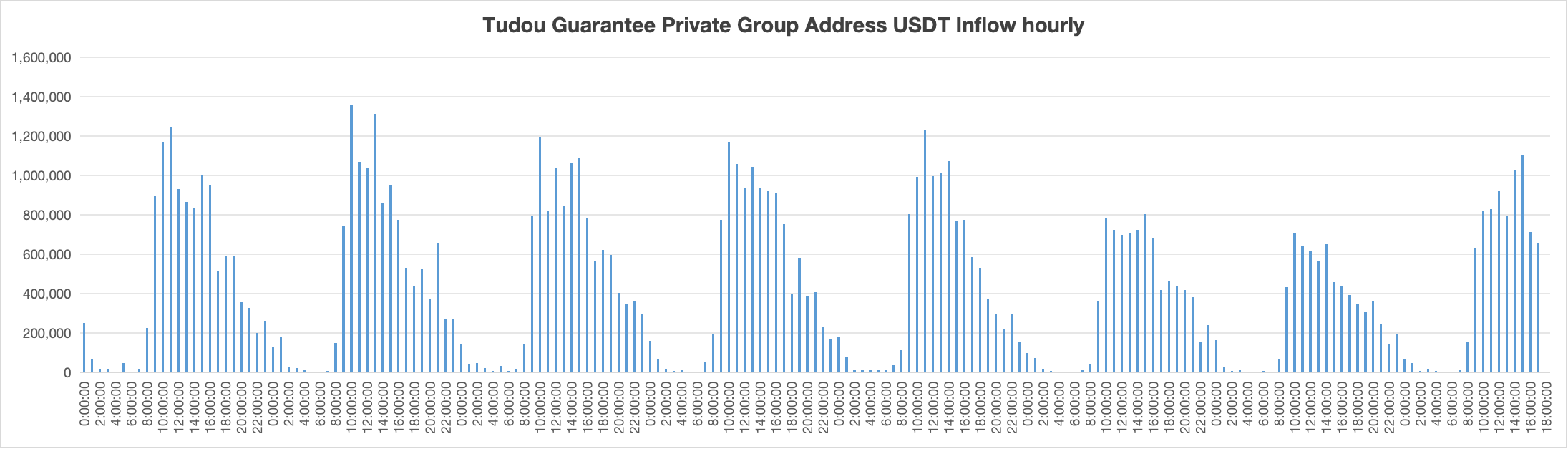

Investigations show that on July 19 and 20, 2025, Tudou Guarantee’s private group operations were also affected to some extent, with transaction volume dropping by approximately 35% compared to recent weekdays. As of July 21, transaction volume has recovered.

This indicates that, unlike its public group operations, Tudou Guarantee’s private group business continues to function normally despite the disruption.

Conclusion

As of now, Cambodia’s crackdown on underground economies in Southeast Asia has yielded remarkable results, including:

- The complete shutdown of public group operations at Tudou Guarantee, the region’s largest transaction guarantee platform;

- Enterprise-level public group merchants have suffered more severe disruptions compared to individual traders;

- Underground criminal activity outside Cambodia has also been curbed to a certain extent.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech