Crypto Laundering by Student: Southeast Asian Crime Networks Penetrate Hong Kong

As a world-renowned free port and international financial center, Hong Kong has long fostered a thriving crypto economy, even years before the introduction of official incentive policies. Among its most distinctive features is the presence of Virtual Asset Over-the-Counter (VAOTC) service providers, which operate through physical storefronts and online community groups. These VAOTC providers, alongside both local and international Virtual Asset Trading Platforms (VATPs), collectively offer token exchange and fiat on/off-ramp services to crypto investors in Hong Kong.

Due to the high anonymity and borderless nature of blockchain-based virtual assets, various crypto assets associated with criminal activities—particularly stablecoins—can flow seamlessly into Hong Kong’s crypto ecosystem. This unrestricted inflow contaminates business addresses used by local operators and individual investors, posing legal and compliance risks.

This article aims to use the recent money laundering incident involving mainland college students in Hong Kong as a starting point for analysis, explore how the Southeast Asian fraud industry has harmed Hong Kong's crypto economy in this incident, and disclose relevant data.

Event Description

On March 26, 2025, a university student from Mainland China was recruited via a second-hand trading platform for a part-time job. The task required the student to travel to Hong Kong and purchase a specified amount of Tether (USDT) through local currency exchange shops, then transfer the funds to a designated blockchain address. The process involved using the student’s personal bank card to receive RMB, exchanging it for Hong Kong dollars at a local fiat exchange store, and then purchasing USDT from a cryptocurrency exchange shop, instructing the shop to directly transfer the funds to the specified wallet.

After purchasing tens of thousands of RMB worth of USDT through this process, the student's bank card and WeChat Pay account were frozen by mainland law enforcement, who informed them that the funds they had received originated from a previous fraud case involving victim-transferred assets.

Following an investigation by Bitrace and Mankun Law Firm, it was revealed that this was a classic “Crypto-based money laundering”scheme, closely linked to organized crime networks operating in Southeast Asia.

On-chain analysis

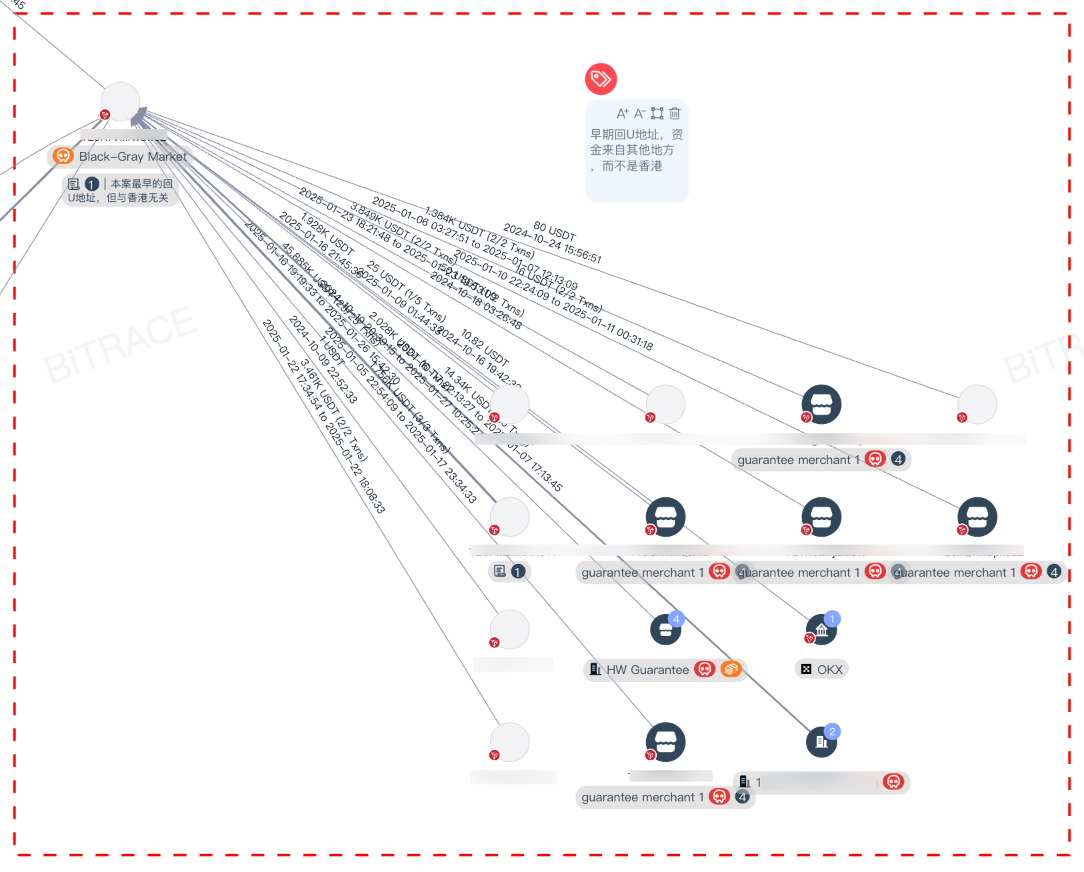

An analysis of the designated USDT receiving address TTb8Fk revealed that the student purchased 2,396 USDT from the specified currency exchange shop. The funds were subsequently transferred to the merchant address TKN5Vg, which has long-standing business ties with Huione Guarantee and Newcoin Guarantee, two major financial service providers operating in Southeast Asia.

These two guarantee platforms have long served organized crime networks in Southeast Asia, facilitating illegal online gambling, black-market activities, money laundering, and fraud. In this particular case, they played a critical role in processing upstream fraudulent funds.

This incident highlights a malicious financial laundering scheme in which a Southeast Asian fraud syndicate exploited Hong Kong's cryptocurrency exchange shops to clean illicit funds.

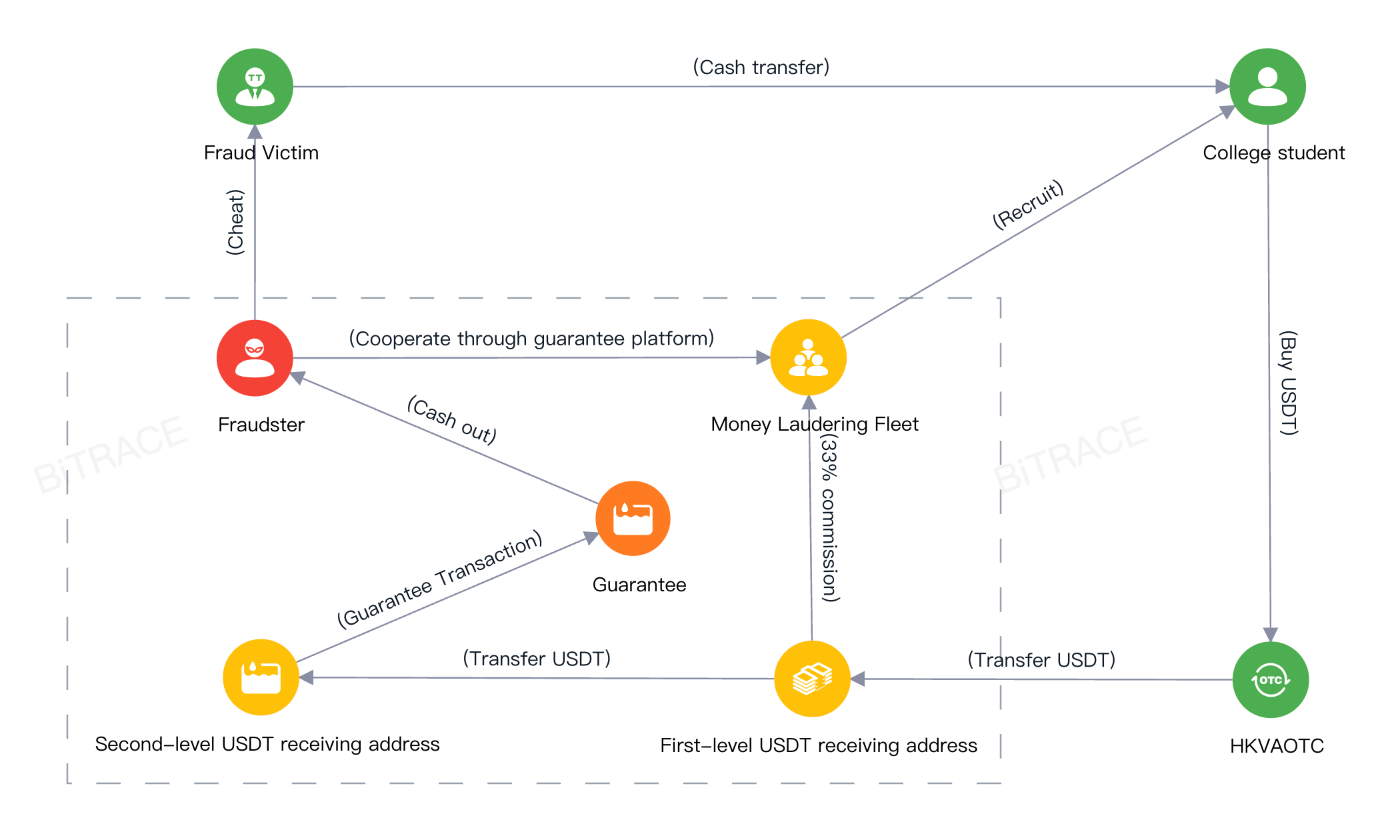

This case follows the common "Crypto-based money laundering" scheme, where launderers receive illicit fiat funds from fraud victims, quickly convert them to USDT through over-the-counter (OTC) crypto markets, and then transfer the funds back to fraud operators' blockchain addresses, earning a commission in the process. Since USDT purchases require multiple bank accounts and identity verification, money laundering networks recruit a large number of part-time workers to form a "Crypto Laundering Syndicate." These part-time workers are called money mules.

In this incident, the Mainland Chinese student unknowingly acted as a money mule, helping facilitate fund conversion alongside Hong Kong VAOTC operators. The acquired USDT first entered syndicate-controlled addresses, where a 33% commission was deducted before the remaining funds were transferred to guarantee merchants and ultimately settled through a financial guarantee platform.

Industrialization of Crypto Crime

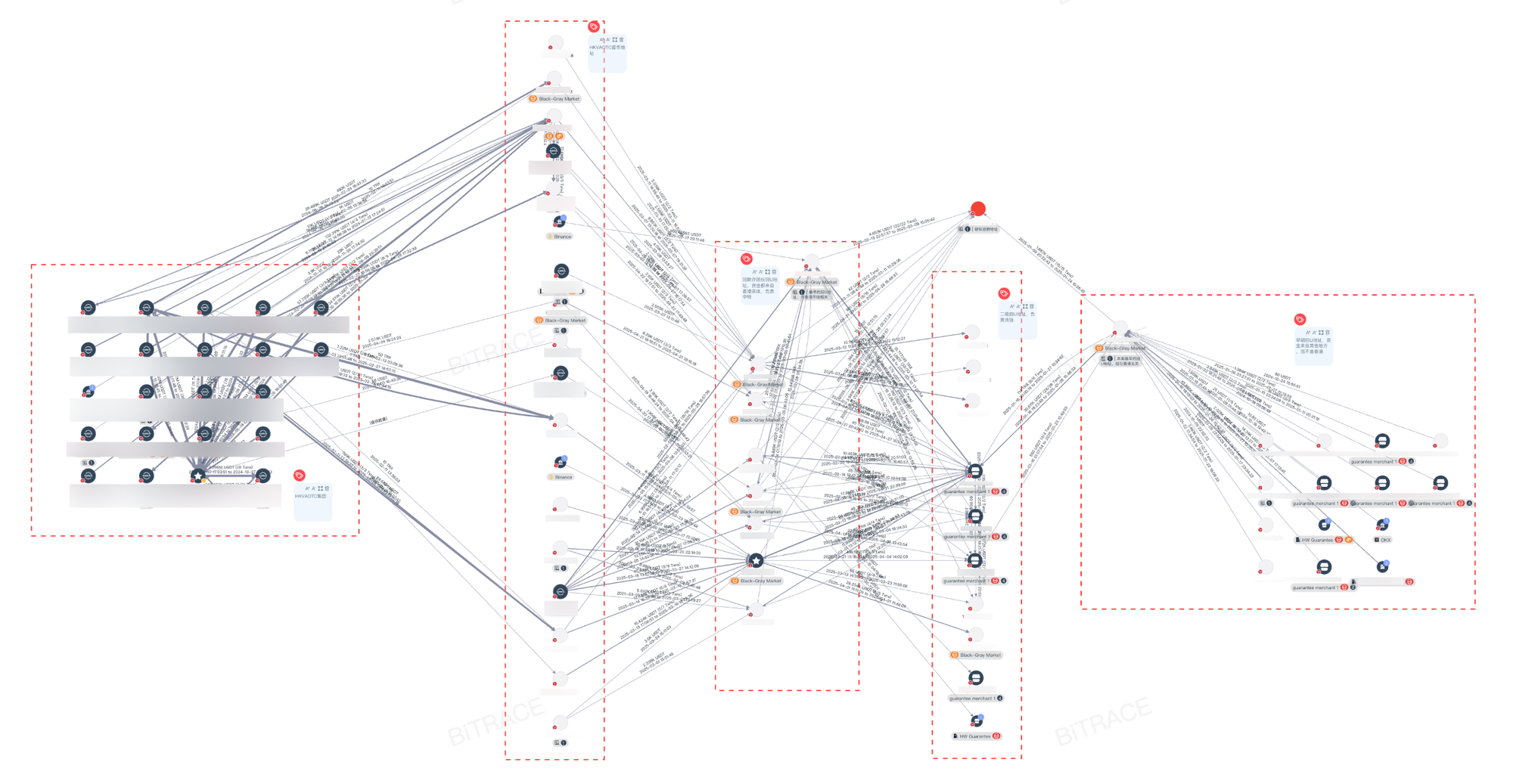

Bitrace further expanded its investigation into the kickback address TGeZzC used by the laundering syndicate, uncovering that this case was not an isolated incident but rather a small fragment of a highly industrialized large-scale money laundering network.

Tracing the funding sources of the kickback address, Bitrace identified seven additional primary USDT laundering addresses (Left Three). These addresses operate at the same hierarchical level as TTb8Fk, all receiving varying amounts of USDT from Hong Kong OTC exchange shops (Left One & Left Two, HKVAOTC). From these transactions, 33% of the funds were funneled into kickback addresses (marked in red), while the remaining 67% were transferred to secondary laundering addresses (Right Two). The funds were then disposed of via guarantee platforms, showcasing a highly structured and well-defined operational division within the laundering process.

Analysis indicates that this cluster of addresses first became active in 2024, with initial fund sources originating from Southeast Asian high-risk illicit markets rather than Hong Kong. This further confirms that the case is tied to an organized crime syndicate operating within Southeast Asia.

Within just three months, this single laundering network alone has illicitly processed over $310,000 through Hong Kong's VAOTC infrastructure using the same laundering methods. Given that additional addresses have yet to be identified, and other syndicate-operated addresses may remain undetected, the actual scale of industrialized money laundering exploiting HKVAOTC could be far larger.

Hong Kong VAOTC Industry at Dawn

Shao Shiwei, an attorney at Mankun Law Firm in Shanghai, stated that OTC merchant regulations remain inconsistent across different countries and regions on a global scale. However, key jurisdictions such as Hong Kong, the European Union, and the United States—major hubs for OTC operations—have already begun drafting relevant legislation and licensing frameworks to establish clearer oversight.

For example, in Hong Kong, the Financial Services and the Treasury Bureau (FSTB) released a legislative consultation document on over-the-counter (OTC) virtual asset services in February 2024. One of the key proposals suggests introducing an OTC licensing regime under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). According to the proposal, Hong Kong aims to establish an OTC merchant licensing framework through AMLO, with the primary objective of ensuring that these companies comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations. This means that all entities engaged in OTC virtual asset trading, including OTC merchants, would be required to apply for a license from the Hong Kong Customs and Excise Department (CCE) and strictly adhere to regulatory requirements. However, as of now, the legislation remains at the consultation stage, and specific implementation details and the official enforcement timeline are yet to be announced by the government.

Industry need to actively respond to supervision

At present, Virtual Asset Over-the-Counter (VAOTC) services have become an indispensable part of the cryptocurrency market, playing a critical role in market stability and industry growth. With Hong Kong preparing to introduce OTC compliance regulations, industry operators must adopt a proactive approach to meet evolving regulatory requirements.

Beyond strictly adhering to the upcoming licensing framework, operators should establish and refine internal compliance systems, ensuring all transactions meet Anti-Money Laundering (AML) and Know Your Customer (KYC) standards.

Furthermore, operators should strengthen communication with regulators, actively staying informed on policy developments, and engaging in self-regulatory industry organizations to contribute to the overall standardization and healthy development of the sector.

In this process, industry participants must be vigilant in avoiding any association with illicit crypto funds. Implementing rigorous customer due diligence (CDD) and transaction monitoring measures is crucial to detect and block suspicious capital flows, preventing any facilitation of illegal activities.

Not only does this safeguard a company’s corporate reputation, but it also reflects a commitment to social responsibility.

Overall, Hong Kong’s upcoming OTC compliance framework presents a valuable opportunity for the virtual asset OTC industry to move towards a more structured and regulated future. Industry players must seize this moment, proactively adjust to the evolving regulatory landscape, and continuously enhance their compliance practices to strengthen their market position. Only through such efforts can they secure long-term success in Hong Kong’s flourishing crypto economy.

About Bitrace

Bitrace is a RegTech company specializing in cryptocurrency risk data analysis. We leverage AI and big data technologies to more accurately and efficiently identify, monitor, and investigate risks and criminal activities occurring on blockchain networks. Our mission is to provide clients with leading regulatory, compliance, and investigative tools to support their security needs.

About Mankun

Founded in 2015, Shanghai Mankun Law Firm is a boutique law firm in China that focuses on the new economy of Web3.0 and is deeply involved in the blockchain industry. It provides comprehensive legal services such as business architecture design, project investment and financing, transaction planning, operational compliance, complex civil and commercial dispute resolution, criminal risk prevention and control, and criminal defense to new economy companies such as Web3.0, blockchain, NFT, digital collectibles, metaverse, GameFi, etc.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech