Detrust: A Blockchain Risk Fund Monitoring and Management Platform

As the crypto economy continues to flourish, cryptocurrencies and their infrastructure are increasingly attracting the attention of criminal organizations. Illegal online gambling platforms, black market operations, money laundering, and fraud rings are extensively using cryptocurrencies to enhance the anonymity of their activities. Significant amounts of risk funds are flowing into the addresses of crypto enterprise platforms (exchanges, centralized wallets, etc.), leading to inevitable sanctions or law enforcement actions against these enterprises.

On September 21, 2021, the cryptocurrency trading platform SUEX was sanctioned by the U.S. Treasury Department for allegedly assisting ransomware groups in laundering illicit crypto funds, causing substantial losses to American businesses.

On August 8, 2022, the mixing service TornadoCash was accused of posing a threat to U.S. national security by assisting the hacker group Lazarus Group in laundering large amounts of stolen crypto funds. This led to sanctions by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), arrests of some developers, and penalties for any individuals or entities interacting with certain associated addresses.

On May 31, 2023, the cryptocurrency trading platform BKEX announced the suspension of crypto deposits and withdrawals to cooperate with Chinese police in investigating accounts suspected of money laundering. The platform has not yet resumed normal operations.

Clearly, in the face of increasingly stringent anti-money laundering compliance policies and enforcement risks, cryptocurrency enterprises must establish specialized compliance and enforcement collaboration departments. These departments need to conduct thorough evaluations of platform customers’ address activities and sources of funds to minimize the impact of risky crypto funds on the platform and its users.

To help crypto enterprises better identify, monitor, and manage fund risks, Bitrace has officially launched the Detrust On-Chain Risk Fund Monitoring and Management Platform.

What Detrust Can Do

Leveraging Bitrace’s advanced crime risk tagging database, address profiling, and criminal fund monitoring and alert capabilities, Detrust provides relevant data to help crypto enterprises identify cryptocurrency transactions involved in illegal activities such as online gambling, money laundering, coin theft, extortion, and fraud. This reduces the association with criminal funds and compliance risks for businesses.

Key features include risk dynamic monitoring, risk data perception, and risk event management, applicable to business addresses on major blockchain networks such as TRON and Ethereum, with plans to support more networks in the future.

Risk Dynamic Monitoring

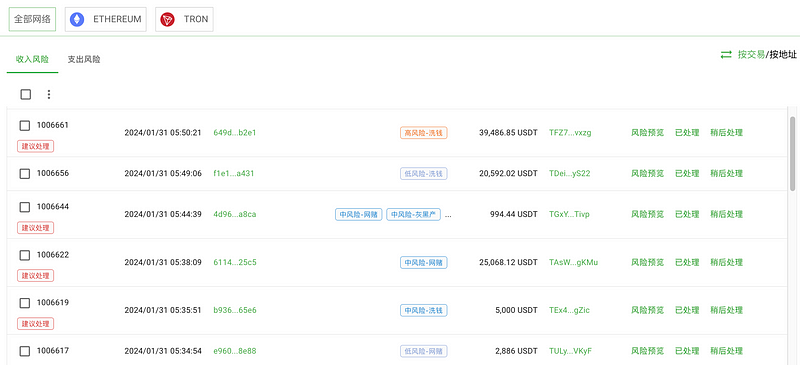

Detrust utilizes on-chain KYT and KYA capabilities to assist clients in conducting pre-transaction risk investigations and post-transaction continuous fund movement monitoring. It also supports customized risk control strategies to ensure compliance in fund inflows and outflows.

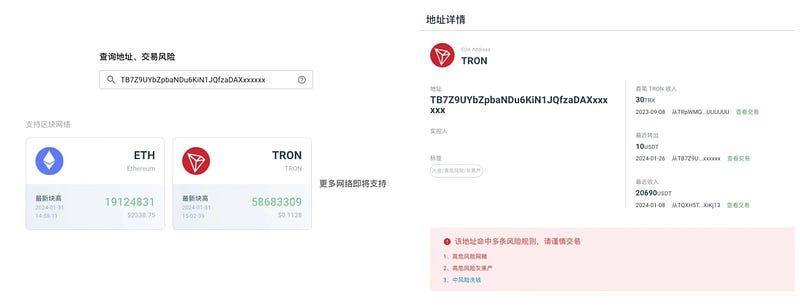

In business scenarios with low fund interaction frequency, clients can use the “Quick Check” feature to instantly assess the fund risks of user addresses on the platform. When a counterparty submits a transaction request to the client, as part of the internal anti-money laundering procedures, the client can input the counterparty’s address into Detrust to view a comprehensive risk assessment of the address before the actual transaction occurs.

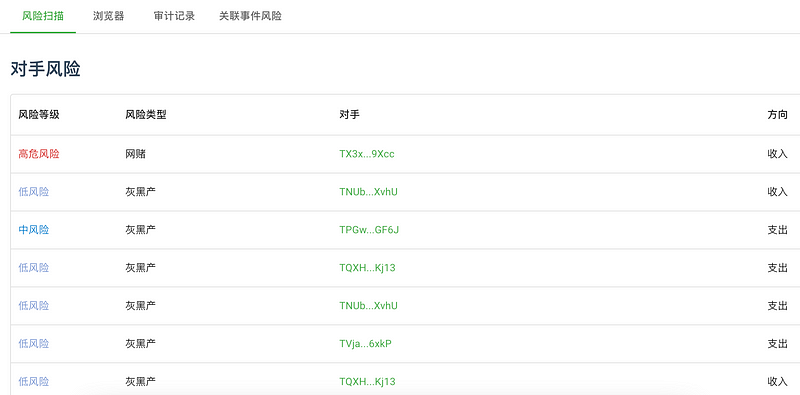

Detrust has already tagged known risk addresses and determined their threat level based on their fund hierarchy and risk category. If the counterparty triggers high-risk rules, the client should avoid completing the transaction; otherwise, their own address may also be contaminated. Clients can also scroll down on the current page to view and verify the specific risk fund sources of the counterparty’s address, aiding them in making prudent transaction decisions.

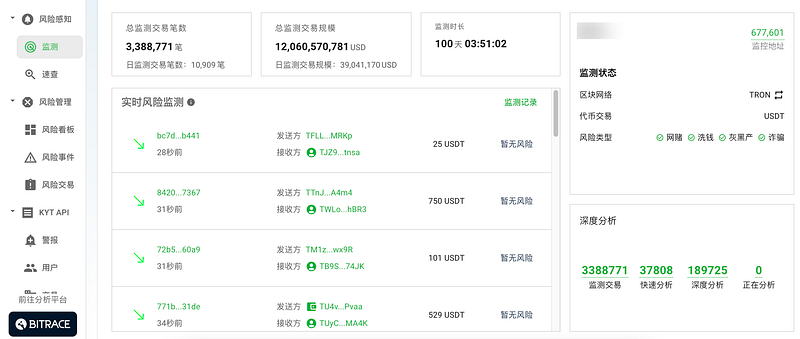

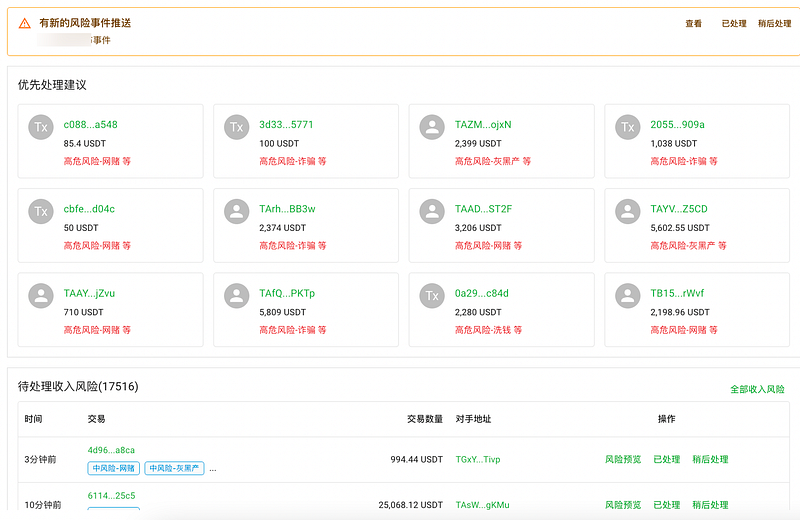

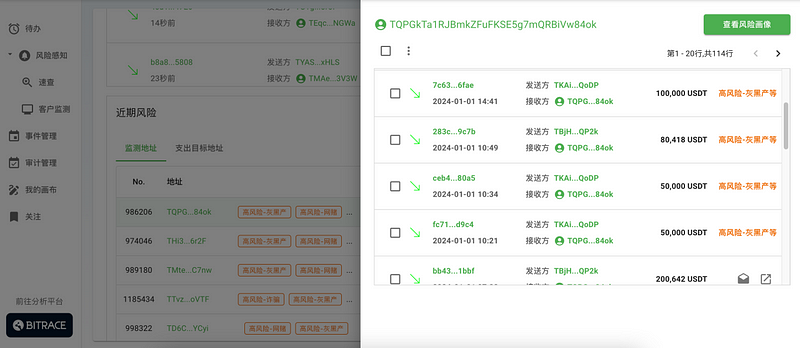

In business scenarios with high fund interaction frequency, risk control personnel can use the “Monitoring” feature to cover all transactions of the platform’s business addresses. For enterprises that have integrated their business addresses into the monitoring system, Detrust provides continuous monitoring of all fund transfer transactions. When a risk transaction occurs — including the inflow of risk funds and the outflow to risk addresses — risk control personnel will receive real-time alerts via email, community bots, and other channels. This enables timely handling of ongoing or imminent user risk activities.

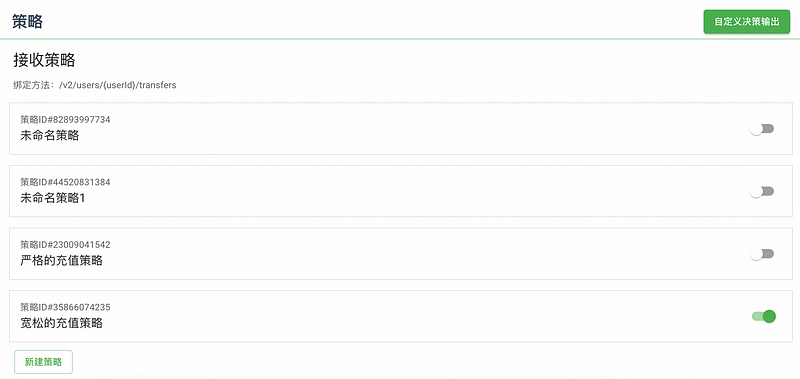

Clients can also customize compliance risk control strategies to address specific types of risk events in different ways, rather than being limited to the platform’s default rules. This provides greater convenience and flexibility for the risk control department.

Risk Data Perception

Detrust utilizes a risk rule engine and AI recognition engine to identify addresses associated with scams, coin theft, money laundering, extortion, terrorism, and illegal online gambling. It promptly pushes multi-chain risk fund alerts, helping clients avoid business compliance risks in real-time and build a robust anti-fraud security defense.

For example, if an address interacts with multiple decentralized addresses within a short period, shows significant fund flows, and receives multiple crypto funds from known black market entities, Detrust will flag it as a black market inflow address upon hitting corresponding rules. If this address transfers funds to a client’s address, it will immediately trigger a risk alert.

Based on the specific business type, clients will be able to receive real-time risk dynamic alerts for their business addresses through various channels, including Webhook, Telegram community bots, browser desktop notifications, and email alerts. The platform can also provide customized tools to meet different client needs.

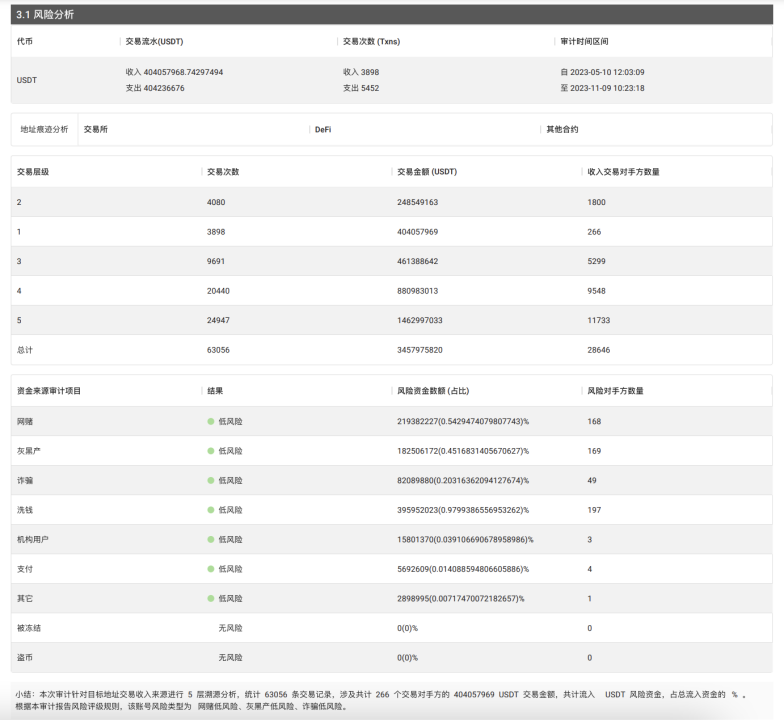

Detrust also supports generating “Cryptocurrency Fund Compliance Risk Audit Reports” for clients’ business addresses. These reports include key information such as the analysis of risk income transaction sources, income transaction flow distribution, and primary counterparties of the address. This helps clients periodically review address interactions, gain a thorough understanding of the funds’ risk profile, and adjust their overall risk control strategies accordingly.

Risk Event Management

Clients can manage risk events identified through self-inspection and platform smart detection, including tracking progress and maintaining complete records of investigation results. They can also invite multiple parties to collaborate on the investigation, interception, freezing, and recovery of risk events.

The Detrust risk control team continuously monitors industry trends, public opinion, regional policies, and security incidents. Through this module, they push critical risk event information that requires high attention to clients. This includes, but is not limited to, large-scale hacker attacks, stolen funds, sanctions-related funds, and risk alerts for inflows of funds involved in criminal cases.

Clients can not only receive critical risk alerts through risk events but also interactively visualize the fund paths, exact transaction hashes, addresses, risk handling suggestions, and event analysis reports within the risk events. Based on their specific situation, clients can comprehensively assess risks and impacts, and take actions such as blacklisting or freezing involved addresses and transactions.

Analysis Platform — Bitrace Pro

Bitrace Pro is a cryptocurrency multi-party collaboration analysis platform launched by Bitrace. Leveraging machine learning and pattern recognition algorithms, Bitrace has built a tag library of over 300 million addresses. This library includes entity tags (DeFi platforms, mining pools, digital asset exchanges, etc.) and risk behavior tags (scams, terrorism, drugs, illegal gambling, money laundering, and black market activities), helping clients quickly identify the actual controllers or purposes behind addresses.

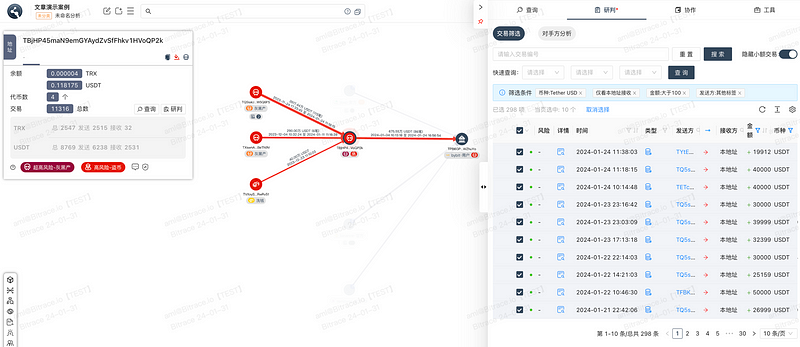

As a companion product to Detrust, both platforms share the same set of login accounts. Clients can quickly create analysis graphs through the “My Graphs” section in Detrust, and can also click on risk addresses in multiple functional sections to jump directly to the analysis graphs.

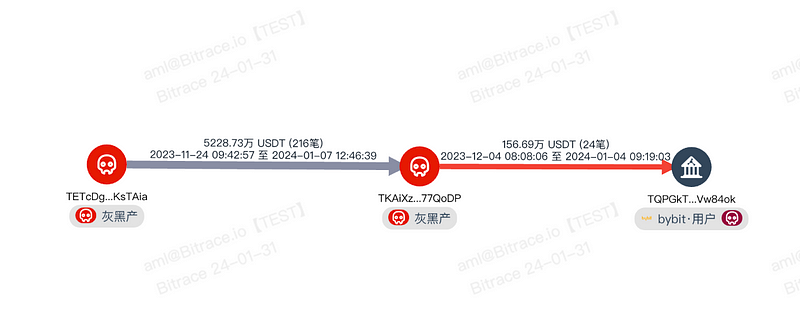

Bitrace Pro offers features such as graphs sharing, address tagging, intelligence interaction, and multi-task management, enabling efficient analysis and collaboration among multiple parties on a visual graphs. For on-chain investigators, Bitrace Pro not only provides an easy-to-use fund flow graphs but also directly tags a large number of addresses associated with fraud, black market activities, online gambling, money laundering, and other risk entities with real-time updates. This makes the function and destination of any risky funds highly transparent.

Clients can trace funds upstream to their origins and track them downstream to their destinations within the graphs, ultimately obtaining a complete fund flow diagram. This helps in better determining the source and type of risks.

Conclusion

Through Detrust and Bitrace Pro, crypto enterprises can gain a comprehensive understanding of the fund risks associated with their business addresses. Real-time risk alerts enable them to quickly initiate or respond to collaborations, keeping the impact of risky funds on business addresses to a minimum. This helps crypto enterprises better meet anti-money laundering regulatory and compliance requirements across different jurisdictions.

Detrust is currently in open testing and already supports the TRON and Ethereum networks. Future updates will gradually add support for more blockchain networks. Any crypto enterprise can contact us through the following channels:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: https://x.com/Bitrace_team