Hong Kong Implements Stablecoin Issuer Regulatory Regime: Bitrace Offers Comprehensive AML and Risk Monitoring Support

Starting from August 1, 2025, the Hong Kong Monetary Authority (HKMA) will officially implement the licensing regime for stablecoin issuers. Simultaneously, the Guideline on Anti-Money Laundering and Counter-Financing of Terrorism (For Licensed Stablecoin Issuers) will take effect, further defining the obligations and technical requirements of licensed issuers in the areas of Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT). The guideline explicitly requires stablecoin issuers to adopt ongoing and prudent risk-based monitoring measures at key stages such as issuance, redemption, and transfer, and strengthens technical and procedural standards for on-chain data tracking, wallet address screening, and suspicious transaction reporting.

As a Hong Kong-based RegTech company, Bitrace has long focused on AML/CFT risk control technologies for crypto assets. In response to the new stablecoin regime, Bitrace has launched an all-in-one Stablecoin Risk Monitoring Solution that fully meets the technical compliance requirements outlined in the guideline.

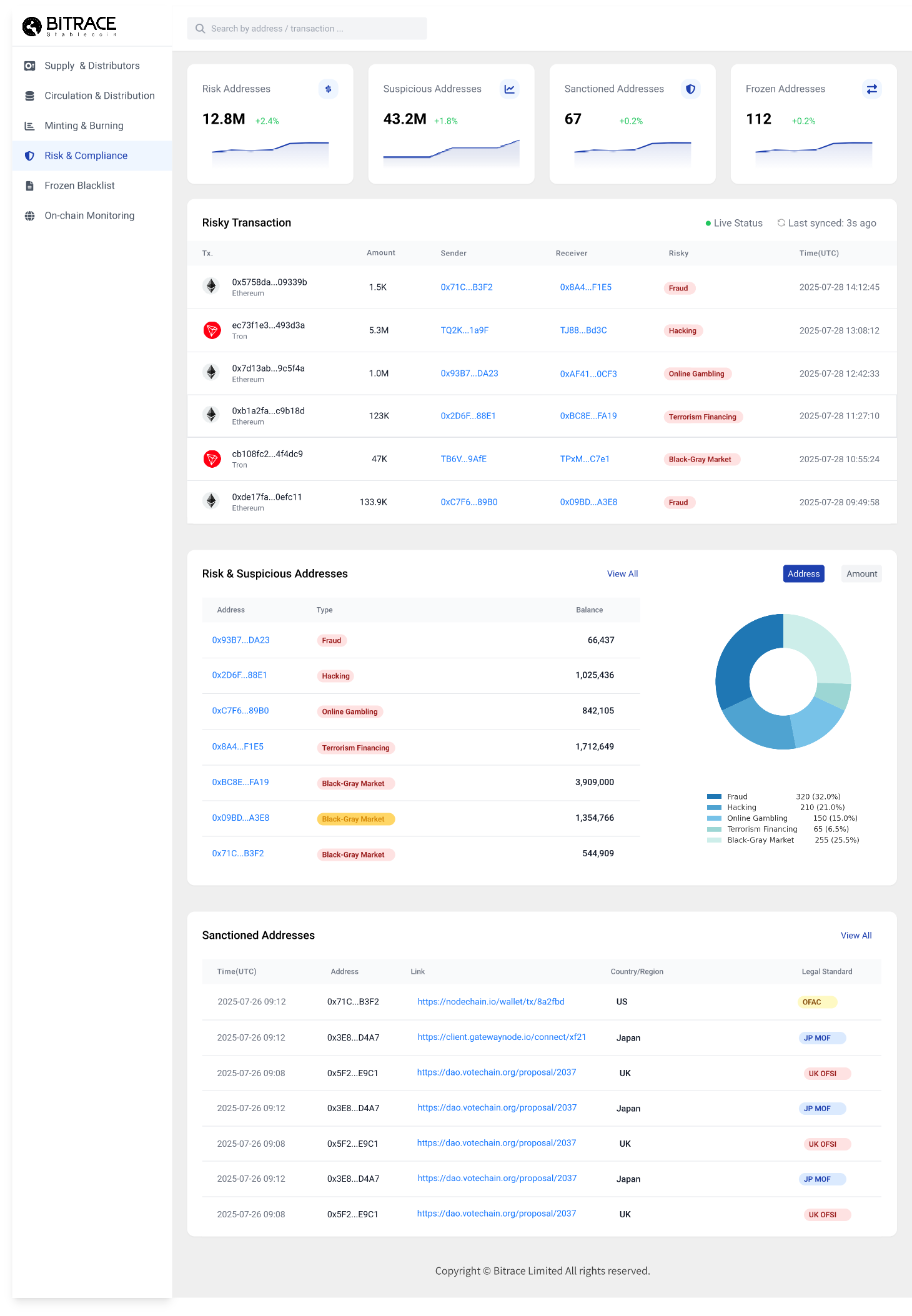

1. Establishing a Risk-Based Transaction Monitoring Mechanism

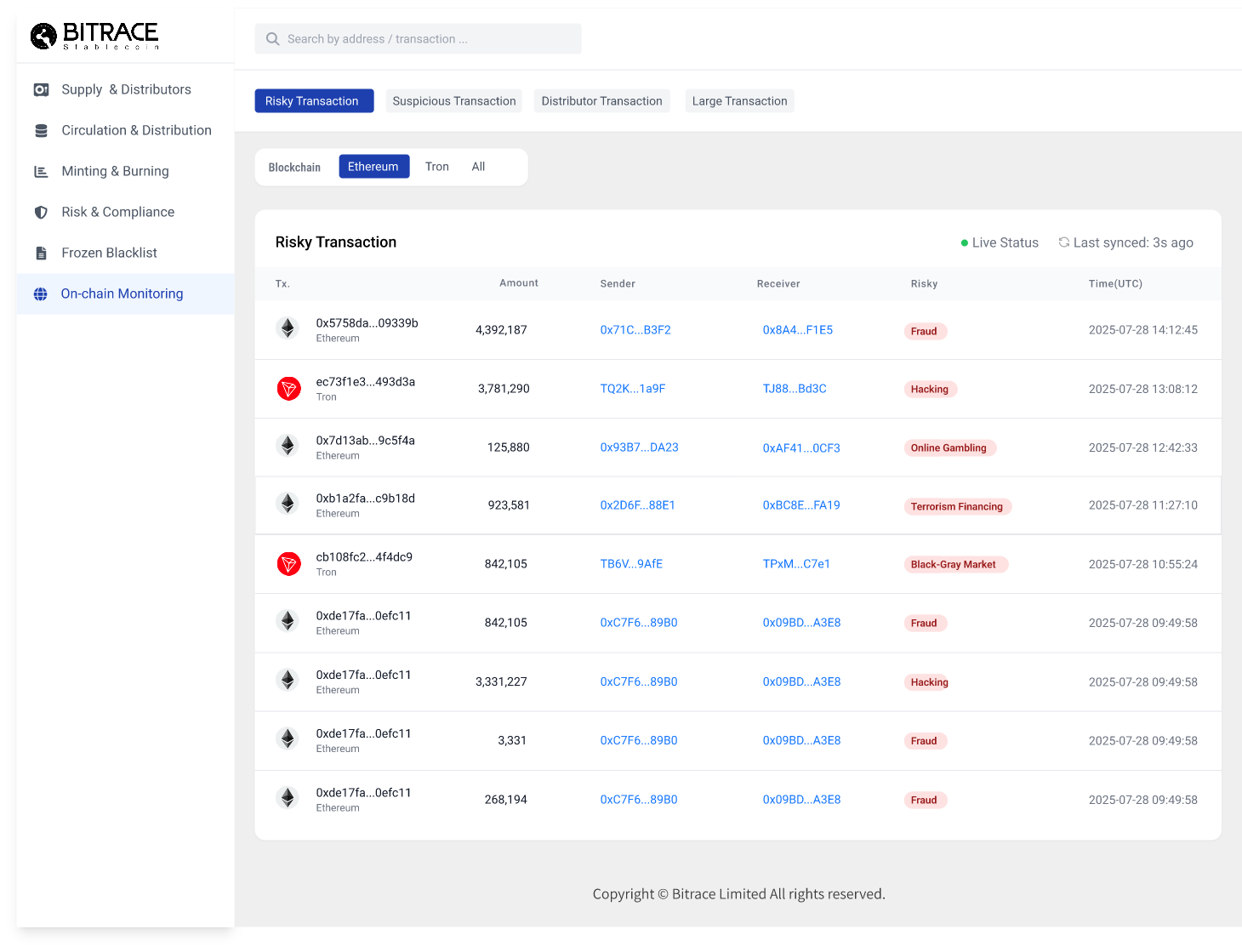

According to Sections 5.4, 5.7, and 5.8 of the Guideline, licensed stablecoin issuers must implement a Risk-Based Approach (RBA) for monitoring transactions during the issuance and redemption processes. Issuers are required to use technological tools to assess the purpose, background, and complexity of transactions, and promptly detect activities inconsistent with their business model—such as unusually large or complex transactions with no apparent purpose or interactions with high-risk addresses. Blockchain analytics platforms enable transaction profiling and behavioral pattern recognition, helping compliance teams detect and respond to potential risks.

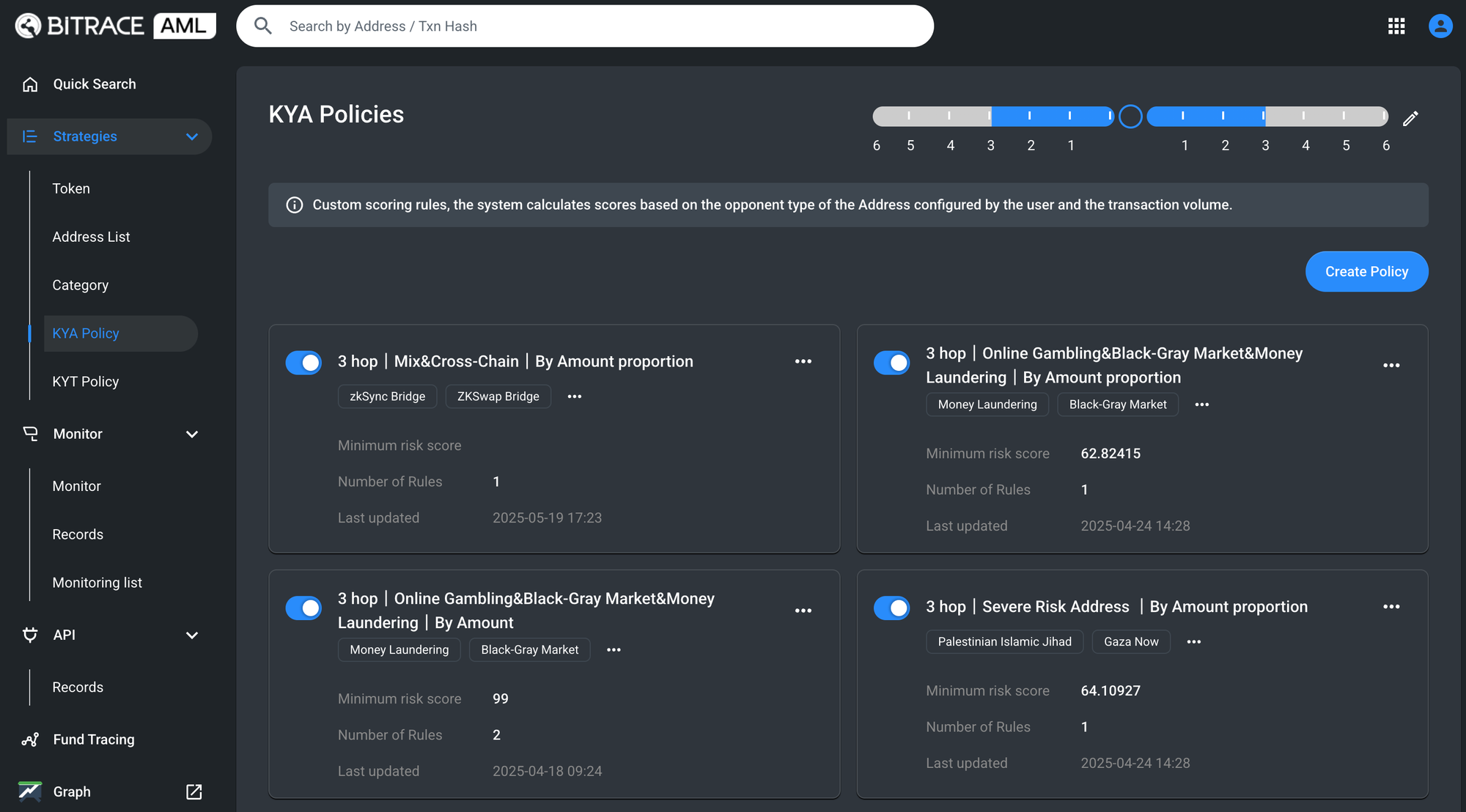

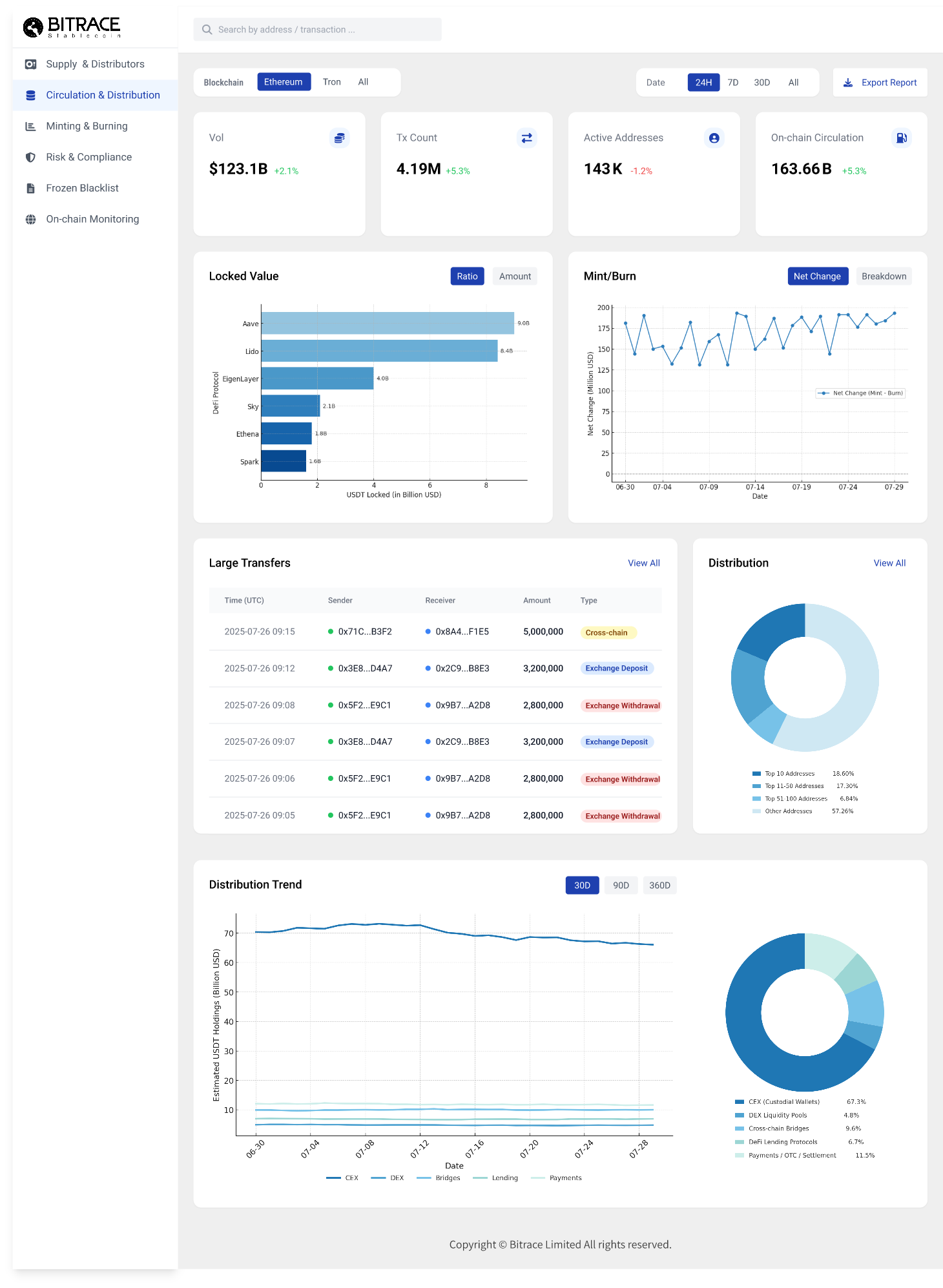

Bitrace's Stablecoin Risk Monitoring System includes:

- A database of over one billion entity and risk tags, covering money laundering, terrorist financing, fraud, gambling, illicit activities (including darknet), sanctions, asset freezing, and hacking;

- Abnormal transaction detection based on counterparty, amount, frequency, pattern, and use of special protocols;

- Automated risk scoring with customizable Know Your Address (KYA) and Know Your Transaction (KYT) rules tailored to business or regional regulatory needs.

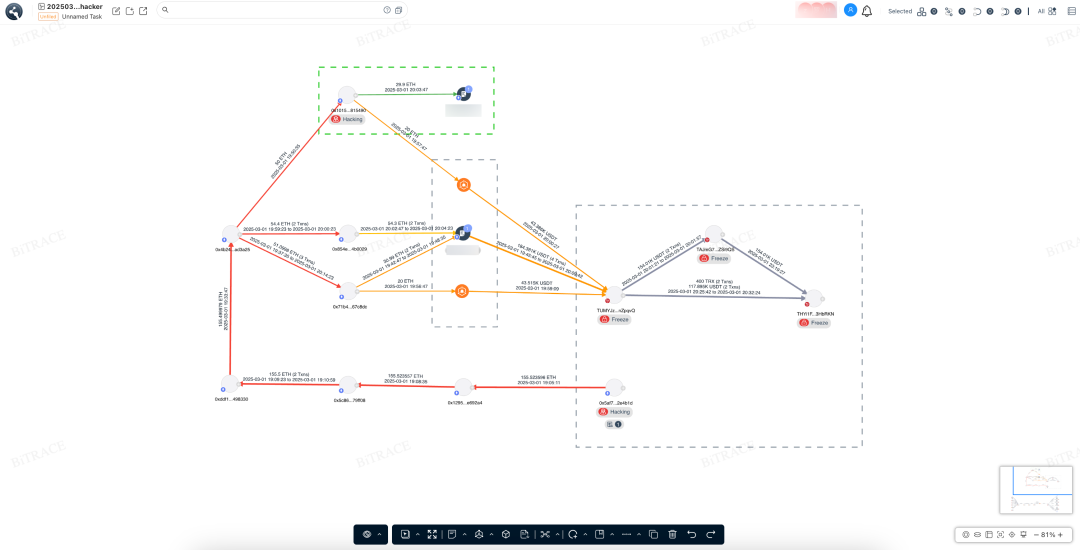

2. Accurately Tracing Stablecoin Sources and Flows

The pseudonymous and transferable nature of stablecoins poses challenges to AML efforts. The guideline requires issuers to “reasonably identify the source and destination of stablecoin funds.” Sections 5.4(a)(b) and 5.5 stipulate that licensed issuers must adopt suitable technology solutions to trace the full flow of stablecoins from origin to endpoint, and determine whether the transaction path involves illicit funds, sanctioned entities, suspicious intermediaries, or unlawful sources.

Bitrace’s system integrates multi-chain address clustering, tagging databases, and address profiling to:

- Trace transaction pathways and identify risky nodes along the flow;

- Detect high-risk addresses in real time (e.g., known darknet wallets, sanctioned entities, mixers);

- Generate visual chain-of-funds diagrams to support compliance assessments and documentation.

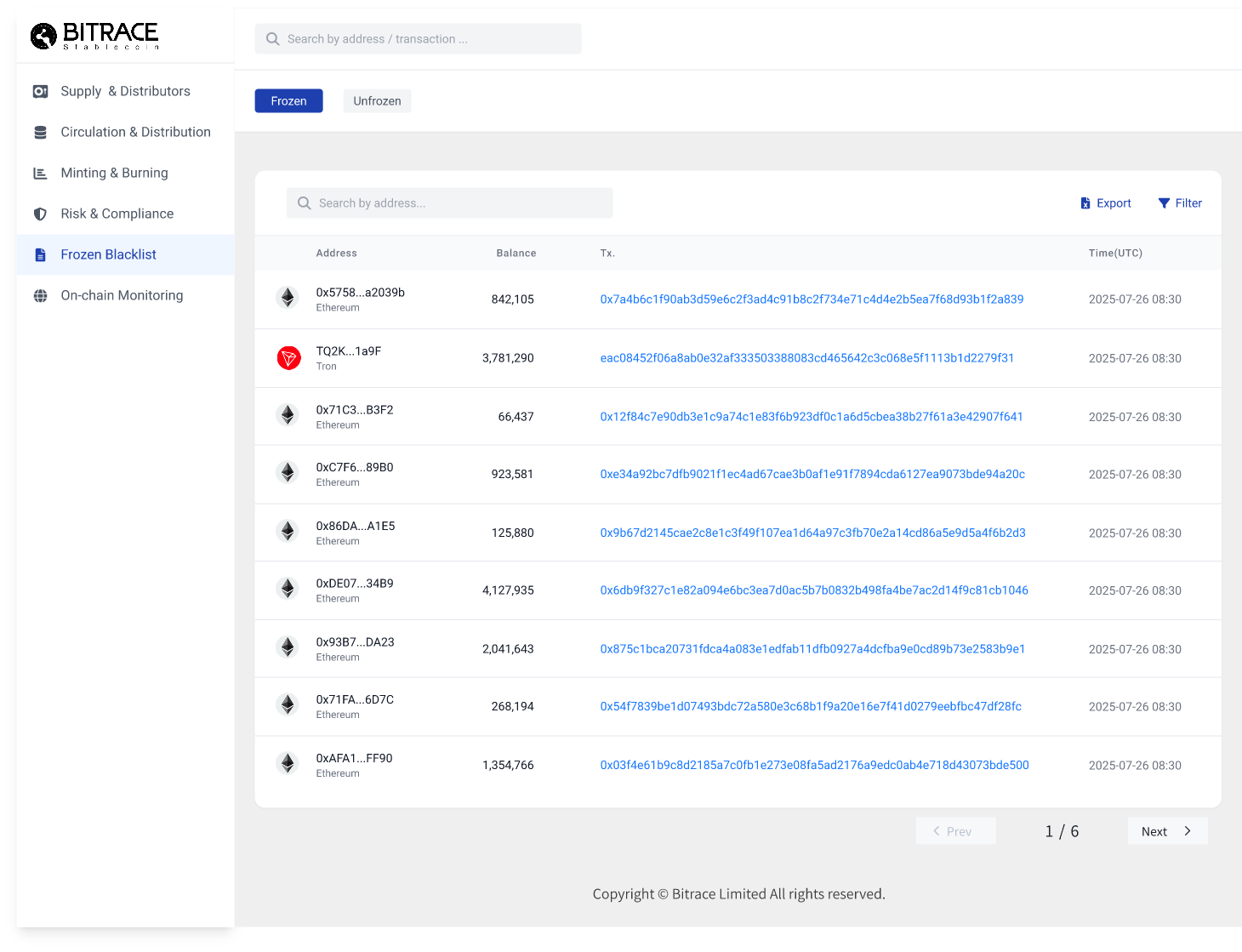

3. Real-Time Screening of On-Chain Transactions and Blacklisted Addresses

Section 5.10 of the Guideline emphasizes the traceability of all on-chain stablecoin transactions and mandates real-time screening mechanisms to detect high-risk interactions and blacklist matches. Where necessary, licensed issuers must cooperate with enforcement or regulatory authorities in freezing and handling illicit assets.

To support blacklist management and real-time freezing capabilities emphasized by regulators, Bitrace’s system:

- Integrates dynamic blacklists from sanction sources such as OFAC, the UN, and others;

- Monitors transaction inflows and outflows in real time, triggering automatic freezing strategies when high-risk tags are detected.

4. End-to-End Monitoring of Stablecoin Circulation

Sections 5.9 and 6.36 of the Guideline clarify that compliance obligations do not end at the point of issuance. Licensed issuers must continuously monitor stablecoins in circulation, especially changes in the risk profile of transacting counterparties and exposure to money laundering risks.

The Guideline explicitly requires “ongoing monitoring of all on-chain transactions.” Bitrace supports this through:

- Proactive monitoring of stablecoin contract activities;

- Dynamic identification of newly emerging risk-related addresses;

- Adjusting transaction screening depth based on counterparty tags and risk scores.

The system also enables periodic backtesting and retrospective analysis to support risk reassessment and regulatory reporting.

5. High-Quality Suspicious Transaction Reporting (STR) Mechanism

Chapter 8 of the Guideline requires issuers to establish mechanisms for prompt and accurate submission of Suspicious Transaction Reports (STRs), ensuring reports are comprehensive, risk-based, and logically structured. Timely STR submission must be supported by efficient and intelligent transaction detection capabilities.

Bitrace’s platform provides advanced risk identification and visualization features:

- Automatically detects transactions involving high-risk addresses (e.g., linked to fraud rings, illicit markets, gambling platforms);

- Visualizes transaction paths and aggregates on-chain fund flows and related address risks;

- Supports customizable risk rules and alert thresholds, enabling real-time risk warnings aligned with the issuer’s business model and risk appetite.

6. Ongoing Staff Training and Capacity Building

Section 3.8 of the Guideline highlights that continuous staff training is essential for preventing and detecting money laundering and terrorist financing. Licensed issuers should design training content and frequency based on employees’ roles, functions, and experience to ensure they possess sufficient compliance awareness and practical capabilities.

Bitrace offers customized AML/CFT training programs to help licensed institutions build efficient and professional compliance teams. Training topics include:

- The use of stablecoins in crypto-related crime and money laundering

- On-chain risk identification in stablecoin scenarios

- Tracking suspicious transactions and analyzing fund flows related to stablecoins

Bitrace has provided multiple training sessions to Hong Kong regulatory and enforcement bodies, including the Hong Kong Police Force, Hong Kong Customs, and the Securities and Futures Commission (SFC). Each training session is tailored to different levels of needs and continuously updated based on the latest trends in crypto crime and technological developments, ensuring that Hong Kong’s regulators and enforcement agencies stay at the forefront of innovation and remain effective in combating cybercrime.

Conclusion

As Hong Kong’s regulatory framework for stablecoins becomes increasingly detailed and enforced, the industry is undergoing a comprehensive transformation across both technology and compliance. Bitrace remains committed to its mission of “enabling compliance through technology and driving safety with data,” helping stablecoin issuers build robust and trustworthy AML/CFT risk management systems, and supporting Hong Kong in becoming a global leader in digital asset regulation.

For more information on Bitrace's Stablecoin Risk Monitoring Solution or trial arrangements, please contact us at: bd@bitrace.io

References:

- Guideline on Supervision of Licensed Stablecoin Issuers (HKMA):

https://www.hkma.gov.hk/media/eng/doc/key-functions/ifc/stablecoin-issuers/Guideline_on_supervision_of_licensed_stablecoin_issuers_eng.pdf - Guideline on Anti-Money Laundering and Counter-Financing of Terrorism (For Licensed Stablecoin Issuers) (HKMA):

https://www.hkma.gov.hk/media/eng/doc/key-functions/banking-stability/aml-cft/Guideline_on_Anti-Money_Laundering_and_Counter-Financing_of_Terrorism_For_Licensed_Stablecoin_Issuers_eng.pdf