KYT Practices in the Crypto Market

According to Bitrace data, from January 2021 to September 2023, more than 41.52 billion USDT classified as high-risk flowed into certain centralized exchange addresses on the Tron network, while 33.46 billion USDT flowed into addresses associated with cryptocurrency payment platforms. This indicates that USDT is widely used in activities such as gambling, money laundering, and other illicit industries. The influx of these high-risk funds into the market can easily contaminate innocent addresses. Given this context, conducting a financial audit of the recipient’s address before making a transaction is crucial. This article will explore KYT (Know Your Transaction) practices in the cryptocurrency sector and provide practical solutions.

Challenges Faced by KYT

Address Anonymity

The anonymity of cryptocurrency transactions provides users with a higher degree of privacy protection and financial freedom, obscuring the direct link between a user’s real identity and their transaction activities. However, this anonymity also poses challenges, particularly when cryptocurrencies are used for illegal activities, complicating regulatory and law enforcement efforts. Additionally, the anonymous nature of these transactions makes it difficult to trace funds, and even if an address is identified, linking it to the entity behind it can be challenging.

Complex Judgments

Not all addresses associated with high-risk funds are illegal. Judging an address’s risk based on a single dimension can be overly arbitrary. For instance, in the Tornado Cash poisoning incident, some anonymous addresses sent 0.1 ETH from a sanctioned Tornado Cash wallet to the wallets of well-known crypto figures, causing the latter to trigger risk control rules inadvertently and lose access to certain DeFi protocols.

In this case, the platform’s inappropriate KYT rules led to operational errors and a poor user experience. Therefore, determining whether an address should be sanctioned requires understanding the initial intent behind obscuring the funds’ origin, conducting thorough investigations, and making reasonable assessments. Clearly, the addresses involved in the poisoning incident should not be simply classified as high-risk.

Different Regulatory Environments Across Countries

For the cryptocurrency industry to achieve genuine compliance, it is essential to ensure that all relevant parties are involved in regulation and reach a consensus. For example, the recent arrest of Telegram’s Russian founder, Pavel Durov, in France highlights the challenges. He faces charges of terrorism, money laundering, and drug trafficking. France arrested him for allegedly allowing criminal activities on his platform, while in countries like Russia and Ukraine, Telegram is widely used for its excellent privacy features. Following Durov’s arrest, the Deputy Speaker of Russia’s State Duma immediately protested and urged the French government to release Durov.

This case underscores the importance of compliance regulation in any market. Although cryptocurrencies can easily achieve cross-border circulation, combating crypto-related crimes requires real-world enforcement, and regulatory environments vary significantly across countries. The different attitudes toward cryptocurrencies in different regions often lead to friction and cooperation challenges, creating obstacles in defining and enforcing compliance.

Bitrace’s KYT Practices

Address Tagging Database

Leveraging machine learning and pattern recognition algorithms, Bitrace has built a database with over 400 million tagged addresses. These include entity tags (such as DeFi platforms, mining pools, digital asset exchanges) and risk behavior tags (such as fraud, terrorism, drug trafficking, illegal gambling, money laundering, and other illicit activities). Additionally, the address tagging database includes data from partners and clients seeking assistance. These risk addresses and related intelligence undergo secondary verification by the technical team and are incorporated into the database after confirmation.

The extensive address tagging database enables tracking of the entities behind anonymous addresses and helps screen counterparties for financial risk. For example, in scams such as fake checks to obtain USDT or fake Binance mining pools offering ETH in exchange for BNB, Bitrace discovered that the addresses used for fraud had historical interactions with high-risk addresses involved in illicit transactions. In Bitrace’s newly launched Detrust risk check tool, these addresses were flagged as high-risk fraud addresses. This demonstrates that conducting a quick risk check on counterparties before transactions can effectively prevent fraud.

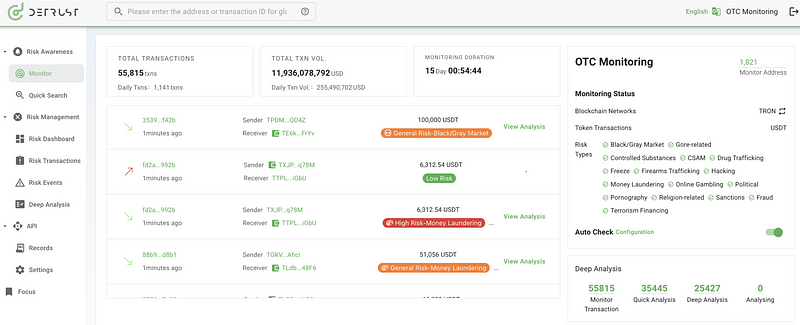

Detrust

Built on Bitrace’s advanced criminal risk tagging database, address profiling, and criminal fund monitoring and alerting capabilities, Detrust provides relevant data to crypto enterprises. By analyzing counterparties’ behavior, Detrust helps companies identify cryptocurrency transactions involving illegal activities and monitors anomalies by comparing current transactions with historical behavior.

The Monitor feature supports real-time automatic detection of each transaction. Based on pattern analysis, behavioral deviation analysis, and cluster analysis, it alerts users at the first sign of risk funds being transferred and assists in mitigating compliance risks related to criminal funds.

Custom Risk Control Strategies

The product allows users to customize risk control strategies, applying different responses to specific types of risk events rather than relying solely on the platform’s default rules. For example, users can define risk thresholds, categories, sources, and regional policies that trigger rules, providing greater flexibility to adapt to local compliance requirements.

Conclusion

Cryptocurrencies, especially stablecoins like USDT, are widely used by crypto companies for everyday financial transactions. These companies often require a comprehensive KYT mechanism to achieve compliance and risk management, ensuring the security of user funds. As global regulatory environments become increasingly stringent, KYT practices will evolve from a compliance requirement to an industry standard, helping to create a safer, more transparent, and efficient trading environment and promoting the healthy development of the blockchain industry.

Contact us:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: https://x.com/Bitrace_team