Law Enforcement Crackdowns and Tether Freezes: VAOTC’s Business Security Boundaries are Collapsing

As a product of smart contract programming, Tether (USDT) has code that allows its issuer, Tether, to sanction specific blockchain addresses for regulatory compliance, law enforcement cooperation, and security threats. These sanctions restrict the transfer or transaction permissions of USDT. Recently, with major developed economies focusing on cryptocurrency-related risks, such “freeze” sanctions are occurring on a large scale.

In July 2023, a cross-chain bridge for crypto assets ceased operations due to force majeure, leading to a massive outflow of assets from business contract addresses. Stablecoin issuers Circle and Tether urgently froze over $65 million in assets.

In September 2023, the Hong Kong police froze assets worth over $29 million related to the cryptocurrency exchange platform JPEX, including several VASP and VAOTC business addresses associated with the case.

In December 2023, the cryptocurrency exchange platform OKX announced that it had collaborated with Tether to freeze targeted assets totaling $225 million USDT across multiple on-chain addresses. These funds were alleged to be linked to pig-butchering scams and human trafficking activities.

In the face of frequent law enforcement crackdowns and compliance freezes, Virtual Asset Service Providers (VASPs) and Virtual Asset Over-the-Counter (VAOTC) platforms are both affected. However, they exhibit distinctly different response strategies and development paths, creating a stark “divergent” trend. This article aims to analyze this phenomenon, explore the reasons behind it, and discuss the potential impact on the industry’s future.

VASP’s Solutions: Diversification and Compliance

In response to the wave of Tether freezes, Virtual Asset Service Providers (VASPs), such as cryptocurrency exchanges and custodians, generally adopt the following strategies to mitigate risks and meet market demand:

Promoting Stablecoin Diversification

VASPs are actively introducing other compliant and transparent stablecoin alternatives, such as USDC, BUSD, and DAI, to diversify risks and offer users more choices. This diversified stablecoin strategy helps reduce reliance on a single stablecoin and enhances the platform’s risk resilience.

For instance, after Paxos (the issuer of BUSD) ceased issuing BUSD due to SEC regulatory pressure, Binance introduced FDUSD, a stablecoin pegged to the US dollar issued by First Digital Trust, to fill this market gap. First Digital Trust is a qualified custodian and trust company based in Hong Kong, backed by traditional financial trust business experience and local cryptocurrency industry policies, ensuring both security and compliance.

Strengthening Compliance Operations

VASPs are enhancing communication with regulatory bodies, improving Anti-Money Laundering (AML) and Know Your Customer (KYC) standards, and ensuring that business processes comply with international and local regulations. Some VASPs are even proactively seeking to obtain relevant financial licenses to legitimize their service status and build user trust.

In Hong Kong, for example, the government released the “Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance 2022” to enhance the long-term competitiveness and attractiveness of Hong Kong’s virtual asset trading market while protecting investors. The ordinance includes introducing a licensing regime for VASPs, strengthening KYC measures, establishing a risk assessment framework for money laundering and terrorist financing, and increasing penalties for violations. Currently, three licensed virtual asset trading platforms — OSL, Hashkey, and HKVAX — are operating, with other mainstream cryptocurrency exchanges and local trading platforms gradually embracing regulation.

For VASPs, the regulatory paths of major economies are becoming clearer, and the enforcement collaboration processes for illegal crypto activities are maturing. Combined with a diverse stablecoin strategy, these measures can effectively reduce legal risks during operations.

VAOTC’s Dilemma: Navigating the Grey Areas

Virtual Asset Over-the-Counter (VAOTC) platforms engage in cryptocurrency trading, wallet services, exchanges, and transfers. These platforms are difficult to regulate and have become tools for criminal activities. Unlike VASPs, VAOTCs typically do not rely on specific entities and often allow a degree of user anonymity, attracting funds associated with high-risk activities. Regulatory bodies struggle to track and control the entities behind these risky transactions and the transaction processes themselves.

In the context of Tether freezes and increased global law enforcement crackdowns on illegal activities in the cryptocurrency space, VAOTCs face unprecedented challenges to their business security boundaries. These challenges are evident in both the operational risks to the VAOTC operators and the declining user trust:

The Tightening Grip of Legal Compliance

With regulatory bodies enforcing stricter Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations, VAOTCs that neglect or evade basic compliance obligations like Know Your Customer (KYC) and Know Your Transaction (KYT) will expose themselves to significant legal risks. Law enforcement agencies maintain a zero-tolerance policy towards funds associated with gambling, illicit activities, and money laundering. If a VAOTC platform is found to be a conduit for such activities, it could result in asset freezes and, in severe cases, criminal prosecution.

Declining User Trust

Frequent Tether freeze incidents and similar cases will cause market participants to doubt the safety and liquidity of VAOTC platforms. If users’ crypto addresses are frozen without warning due to receiving high-risk funds, it will severely damage user trust. For VAOTCs, losing user trust undermines the business foundation, leading to customer attrition and fund outflows, which directly impact the platform’s survival and growth.

In the JPEX case, 72 individuals were arrested during the Hong Kong police investigation, including many operators of online and offline VAOTCs. Some institutions permanently closed their stores or had their on-chain funds frozen by Tether. Clearly, without strengthening technical measures to identify and intercept illegal transactions, VAOTCs will struggle to avoid being suspected as channels for illicit funds, affecting their position and acceptance in the legitimate economic system.

KYT: Redefining VAOTC Business Security Boundaries

For VAOTCs to survive and thrive in an increasingly stringent regulatory environment, they must abandon evasive strategies and adopt a proactive compliance stance. This requires:

Establish Comprehensive KYC/AML Procedures

VAOTCs should implement and enforce rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, including user identity verification, transaction monitoring, and risk assessment. This not only helps identify and block illegal fund flows but also demonstrates a commitment to compliance.

Proactive Transparency

Increasing operational transparency, such as publicly auditing reports to show funds reserves and operational mechanisms, can enhance trust among users and regulatory bodies.

Flexible Business Model Adjustments

As regulatory frameworks evolve, VAOTCs need to adapt their business models and product designs to ensure ongoing compliance with the latest regulations.

Engage in Regulatory Dialogue

Proactively communicating with regulatory agencies and participating in policy discussions allows VAOTCs to prepare for upcoming regulations and influence policy development to support industry growth.

KYT (Know Your Transaction) serves as a foundational tool for 2C cryptocurrency businesses to maintain secure and compliant operations. It plays a crucial role in preventing illegal activities, protecting user assets, and enhancing platform credibility.

Currently, Bitrace utilizes machine learning and pattern recognition algorithms, having accumulated a database of over 400 million address labels. These include entity labels (such as DeFi platforms, mining pools, digital asset exchanges) and risk behavior labels (such as scams, terrorism, drugs, illegal gambling, money laundering, and illicit industries). This enables VAOTC operators to quickly identify the risk levels of users and their counterparties’ funds, promptly block high-risk funds from entering business and user addresses, and mitigate the risk of being involved in cases leading to fund freezes. Additionally, by establishing on-chain address risk profiles based on users’ historical interactions, VAOTCs can better manage business risks.

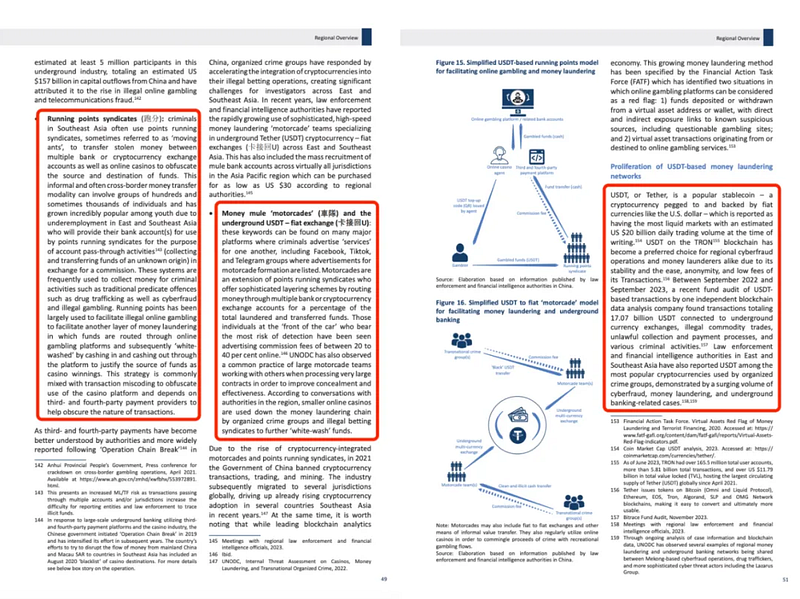

Bitrace’s professional capabilities have garnered recognition from both industry and external media and research institutions. Notably, the United Nations Office on Drugs and Crime (UNODC) cited Bitrace’s analysis of the use and scale of USDT in cybercriminal activities multiple times in its report published on January 15, 2024.

Moving forward, Bitrace will continue to leverage its data capabilities and product services to meet the compliance needs of cryptocurrency businesses effectively. This commitment aims to bring compliance and trust to the industry, supporting its sustainable growth.

Conclusion

While proactive compliance may increase operational costs and potentially reduce profit opportunities for VAOTCs in the short term, it is crucial for protecting brand reputation, maintaining user trust, and avoiding legal risks in the long run. As the industry matures, those who can balance compliance and innovation will be more likely to emerge as market leaders.

Contact us:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: https://x.com/Bitrace_team