Next-Gen Payment Summit: Bitrace Empowers Borderless Payments Through Compliance

On 9 February 2026, the Next-Gen Payment Summit was successfully held at Cyberport, Hong Kong. The summit focused on the convergence of next-generation payment systems, digital assets, and global financial infrastructure, bringing together international leaders from the payments, fintech, and Web3 sectors.

During the afternoon panel discussion, “Borderless Finance: Synchronising Payments with Digital Asset Integration,” Isabel Shi, Co-founder and CEO of Bitrace, was invited to join industry leaders to explore key topics including cross-border payments, digital asset compliance, and the evolution of future financial infrastructure.

When discussing how compliance can evolve from being a “stop button” in payments to becoming an invisible, real-time component of the transaction flow, Isabel shared insights drawn from Bitrace’s extensive collaboration with the Hong Kong Police and other law enforcement agencies on numerous crypto-related cases.

“By the time law enforcement formally steps in, it is often already too late,” Isabel noted. “Crypto moves extremely fast. It is inherently borderless and permissionless, allowing funds to move across chains and jurisdictions in a very short period of time.”

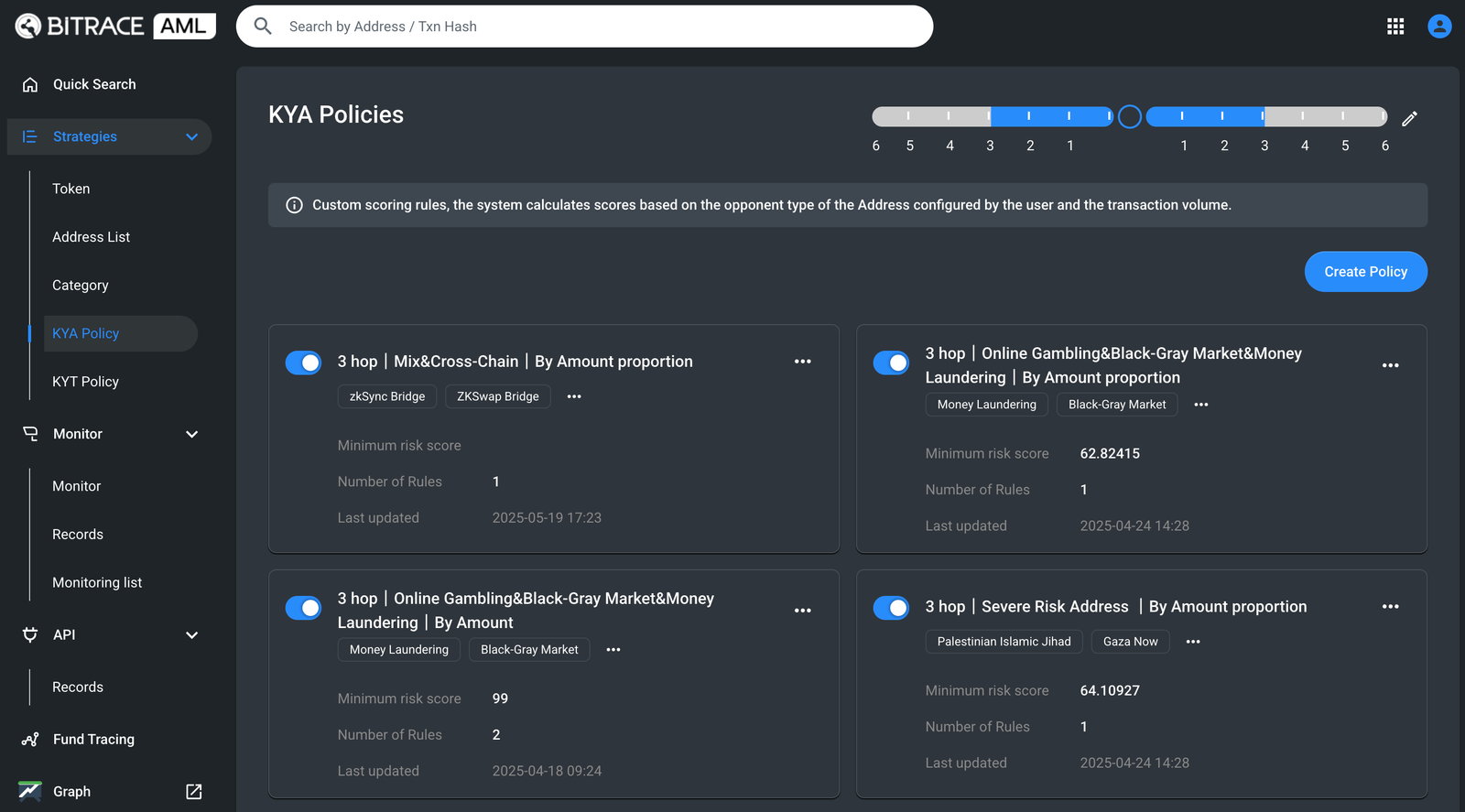

She further explained that many KYT and KYA tools currently on the market still rely heavily on post-event tagging, defining risk based on fixed hops or percentage thresholds. Such delayed and static approaches are relatively easy for sophisticated criminal and money laundering networks to bypass.

“We believe compliance must shift from post-event response to real-time identification and prevention,” Isabel said. To achieve this, Bitrace has moved its technical focus away from single address-based tagging toward the identification of crime typologies and money laundering patterns. By leveraging AI to model on-chain transaction behavior and combining both on-chain and off-chain intelligence, Bitrace aims to identify high-risk fund movements that are occurring—or about to occur—enabling effective intervention during the transaction process.

Addressing the follow-up question of how complex and noisy blockchain data can be transformed into a risk signal that traditional compliance officers can trust, Isabel shared Bitrace’s experience working with licensed and soon-to-be-licensed VASPs in Hong Kong.

She noted that many compliance officers in the Web3 space come from traditional banking backgrounds. As a result, Bitrace deliberately integrates familiar AML concepts—such as large-value transaction monitoring, layering behavior, abnormal transaction frequency, and unusual fund flow analysis—into its AML tools.

“On-chain data is massive and highly noisy, making it impractical for compliance teams to interpret raw data directly,” she explained. “Instead, we translate complex on-chain behavior into an intuitive and explainable risk score, which reflects the overall risk level of an address or a transaction.”

This risk scoring model is built on Bitrace’s long-term accumulation of large-scale on-chain data and real-world investigation experience. It evaluates multiple dimensions simultaneously, including fund distribution, transaction behavior, lifecycle patterns, and counterparty risk. The system also allows institutions to customize scoring strategies based on their own risk appetite and regulatory requirements.

Looking ahead to the future of global payments over the next decade, Isabel emphasized that more efficient and frictionless global settlement is an irreversible trend—and that blockchain technology provides a practical foundation for this transformation. However, she stressed that innovation must remain balanced with regulation.

“Without regulation, even the best technology can be misused. But with overly restrictive regulation, innovation simply has no room to grow,” she said. In her view, the industry is gradually reaching a consensus that compliant stablecoins will serve as a critical bridge between traditional finance and the digital asset ecosystem.

“By 2030, the ‘invisible asset’ synchronizing global trade may no longer be called ‘crypto,’” Isabel concluded. “Stablecoins are likely to become a regulated, trusted, and efficient settlement layer—ultimately perceived simply as money.”

Bitrace’s participation in the Next-Gen Payment Summit further highlights its professional influence in digital asset compliance, on-chain risk intelligence, and payment infrastructure security, underscoring the company’s long-term commitment to contributing to the global fintech ecosystem.

About Bitrace

Bitrace is a leading Web3 regulatory technology company in the Asia-Pacific region, headquartered in Hong Kong. Leveraging AI and big data technologies, Bitrace focuses on the accurate and efficient identification, monitoring, and analysis of on-chain risks and criminal activities. The company provides on-chain fund tracing, anti-money laundering (AML) compliance, and risk monitoring solutions for financial institutions, exchanges, payment companies, as well as regulatory and law enforcement agencies.

With a strong focus on crypto crime investigations, Bitrace works closely with regulatory and law enforcement bodies including the Hong Kong Police Force and Hong Kong Customs, and collaborates with law enforcement agencies and Web3 enterprises across multiple jurisdictions. To date, Bitrace has supported thousands of investigation cases, monitored hundreds of billions of dollars in high-risk funds, and successfully helped recover losses amounting to billions of US dollars.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech