OKX’s Risk Control Actions: Analyzing the Impact of Tornado Cash Account Closure

Recently, a user named Satoshi Friends raised concerns on social media after their OKX account was suddenly blocked and their funds were frozen. They urged users from the Commonwealth of Independent States (CIS) to withdraw their funds from OKX to avoid similar risks. As the situation escalated, OKX CEO Star responded, clarifying that the account was not frozen without reason. The user’s account had multiple transactions linked to sanctioned exchanges or DeFi protocols, and they were allowed to withdraw clean funds before the freeze. Additionally, Star mentioned that OKX will be closing accounts that have interacted with Tornado Cash.

Risk Control and User Concerns

Star emphasized that OKX must comply with applicable sanction policies, including U.S. sanctions. If users deposit funds from sanctioned entities like Garantex or Tornado Cash into their OKX accounts, or withdraw funds to these entities, the compliance risk control mechanism will be triggered, leading to account closure. Garantex was sanctioned by the U.S. and UK in April 2022 for allegedly facilitating money laundering, terrorism financing, and ransomware attacks. Tornado Cash, the world’s largest mixing platform, was used to launder illegal funds from hackers and was sanctioned by the U.S. Treasury’s Office of Foreign Assets Control (OFAC) in August 2022.

However, OKX’s account closures have raised concerns among users. The anonymity of on-chain addresses makes it difficult to verify whether the entity behind a deposit address matches the identity of the OKX account holder. This raises questions about whether the risky funds were deposited intentionally by the user. Despite Star’s assurance that ordinary users need not worry about arbitrary account freezes, many users remain skeptical of OKX’s compliance policies, fearing that accidental contamination by risky funds or malicious “poisoning” could trigger account freezes.

OKX Users and Their Links to Tornado Cash

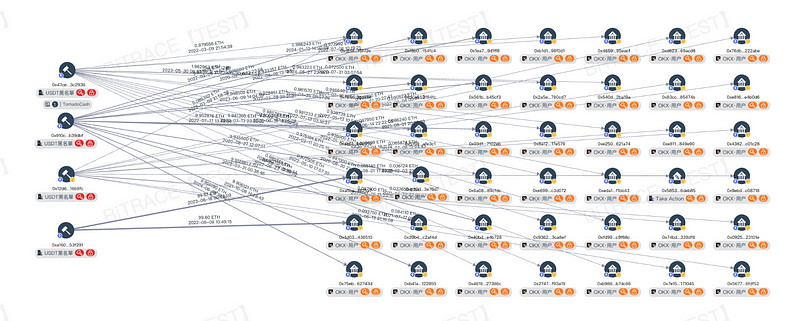

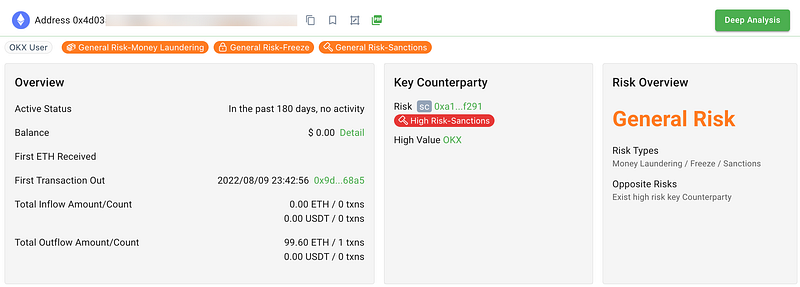

Bitrace conducted a study on the links between OKX users and the sanctioned mixing platform Tornado Cash. As of August 9, 2024, a quick audit of the recipients of funds from four active Tornado Cash addresses (0.1ETH, 1ETH, 10ETH, 100ETH) revealed that 42 OKX user addresses directly received funds from Tornado Cash, totaling 345.5ETH across 45 transactions.

Of these, only 12 transactions involved amounts below 0.1ETH, indicating that even if these were all cases of “malicious poisoning,” the overall impact would be minimal. Overall, based solely on the criterion of directly receiving funds from Tornado Cash, not many OKX users would be affected by sanctions.

Compared to OKX’s centralized exchange (CEX) users, its decentralized exchange (DEX) users pose a greater threat to OKX’s funds. During the audit period, Bitrace identified 199 OKX DEX user addresses, which made a total of 444 transfers, amounting to 3323.6ETH, to OKX DEX addresses. Additionally, 34 OKX DEX user addresses received 718.4ETH in risky funds from Tornado Cash across 83 transactions during the audit period.

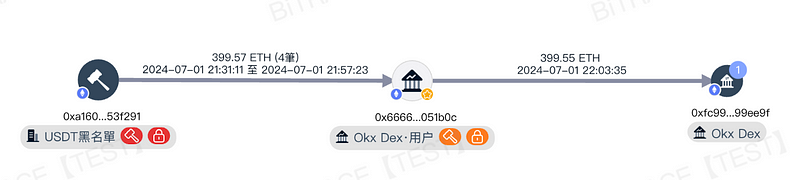

For instance, an OKX DEX user with the address 0x6666 received 400ETH from Tornado Cash and then further mixed these funds through OKX DEX, representing the largest contaminated transaction during the audit period, accounting for 12% of Tornado Cash funds flowing into OKX DEX.

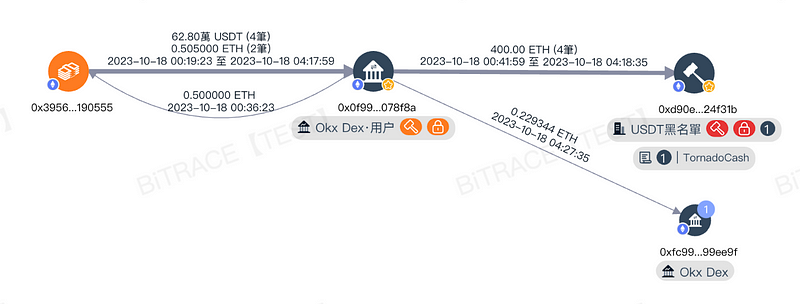

Another OKX DEX user, 0x0f99, received funds from a money laundering address, transferred 400ETH into Tornado Cash, and then laundered approximately 0.23ETH through OKX DEX. In this case, OKX DEX was effectively used as a “money laundering channel,” similar to Tornado Cash.

Tornado Cash’s Impact on Other CEXs

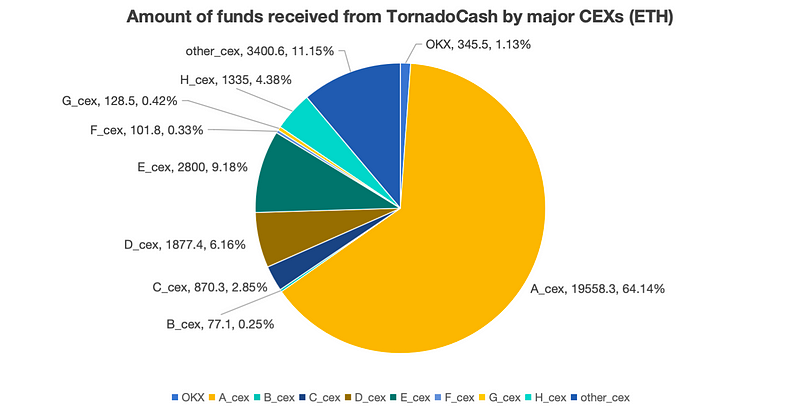

Besides OKX user addresses, Bitrace also audited the funds of users at other centralized exchanges (CEXs).

During the audit period, major CEXs received a total of 30,494.9ETH from Tornado Cash, with OKX accounting for only 1.13%, significantly lower than other major exchanges. Notably, one compliant exchange accounted for 9.18%, and a leading exchange accounted for as much as 64.14%, demonstrating the preference of risky funds for different exchanges and highlighting that the inflow of risky funds into major CEXs for laundering is a common phenomenon.

KYT, a Necessary Measure

The expansion of the crypto industry and the proliferation of risky funds have placed increasing compliance pressure on OKX and other Virtual Asset Service Providers (VASPs). Know Your Transaction (KYT) is a fundamental tool for cryptocurrency businesses to maintain safe and compliant operations. It plays a crucial role in preventing illegal activities, safeguarding user assets, and enhancing platform reputation.

Incorporating KYT into business processes helps VASPs identify and block illegal fund flows, demonstrating a commitment to compliance. Leveraging Bitrace’s leading criminal risk label database, address profiling, and criminal fund monitoring capabilities, Detrust provides crypto businesses with the data needed to identify transactions involving illegal activities such as gambling, money laundering, theft, extortion, and fraud. When users deposit risky funds, Detrust immediately alerts and assists in handling the situation, reducing the risk of criminal fund association and business compliance risks.

For any risk control personnel at companies with KYT needs, you can contact us through multiple channels to request a demo.

Contact us:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: https://x.com/Bitrace_team