On-Chain Investigation: How to Read and Understand the 2025 Prediction Markets Like a Professional Analyst

Recently, a single trade exploded across various communities:

The day before the U.S. launched a surprise action against Venezuela, a newly registered mysterious account precisely placed a $30,000 bet on the related prediction market on Polymarket. Just 24 hours later, this position had surged to $400,000.

Prediction markets appear to consistently move faster than news headlines. From U.S. presidential elections to geopolitical "black swan" events — virtually anything can be traded. The market is currently talking about Polymarket, while some favor the regulated Kalshi or the emerging newcomer Limitless. These platforms are located variously in the United States or Panama; some settle in fiat USD, others in cryptocurrency; some record trades in internal databases, others on the blockchain.

However, determining who the true leader is cannot be reliably done by reading press releases or news articles alone. This report attempts to provide a deeper, data-driven analysis by leveraging the Prediction Markets Dashboard built by @datadashboards on Dune Analytics. It explains the code logic used to clean and reconstruct on-chain transaction data from six major prediction platforms, aiming to reveal the most realistic picture of actual market flow.

I. Data Sources and Coverage

Prediction market data is inherently heterogeneous. To achieve a comprehensive cross-platform view, the analytical model covers the following core platforms and networks:

- Polymarket (Polygon): Still the largest by volume, supporting both AMM and Orderbook trading modes.

- Limitless (Base): Emerging platform built on Base, also featuring hybrid trading mechanisms.

- Kalshi (Web2/Regulated): U.S. CFTC-regulated platform, USD-settled only.

- Myriad (Abstract/BNB/Linea): Multi-chain prediction protocol allowing market creation across different chains (notably active recently).

- Opinion (BNB): Highly active decentralized prediction platform on BNB Chain.

- Predict (BNB): Deeply integrated into the BNB ecosystem, serving a large Binance Chain user base with predictions on popular events — a key hub for Binance-native users.

The primary challenge lies in the fact that these platforms are scattered across different blockchain networks with distinct trading mechanisms, making direct comparison difficult.

II. Core Analytical Logic

To construct a standardized "total volume" metric, the following three-layer cleaning logic was applied:

- Aggregation of Heterogeneous Data

This is the most complex step. Custom extraction logic must be written for each platform's unique contract architecture.

- AMM Mode

- Basic principle: Users trade directly against smart contract liquidity pools; prices are automatically determined by mathematical formulas (e.g., constant product).

- Key advantage: Friendly to long-tail markets. Even for low-attention events (e.g. "Will it rain in Paris next Tuesday?"), AMM ensures constant buy/sell availability without relying on professional market makers.

- Data extraction: Track all pools created by the FixedProductMarketMaker factory contract and monitor Swap events.

- Orderbook Mode

- Basic principle: Buyers and sellers place limit orders (Bid/Ask); a matching engine executes peer-to-peer trades.

- Key advantage: Preferred for high-volume, high-attention events (e.g. U.S. election). Offers deep liquidity and minimal slippage; more efficient price discovery under high-frequency trading conditions compared to AMM.

- Data extraction: Directly track OrderFilled events from the Exchange Contract. To accurately identify direction and amount, complex matching logs are parsed to determine which side provides the base asset. Once the funding side is identified, the real principal amount is reverse-calculated by dividing the opponent's prediction token amount by 2.

Millions of transaction logs scattered across Abstract, Base, Polygon, BNB and other chains are aggregated into one standardized transaction dataset.

- Volume Standardization

Raw on-chain numbers cannot be used directly and require careful normalization:

- Precision handling: Different platforms support different tokens. Price oracles are used to convert all native token amounts into USD.

- Double-counting removal: In orderbook models, a single matched trade often generates two log entries (A sells, B buys). In some cases, 1 unit of principal mints 2 tokens (YES + NO). To avoid inflation, total volume for Myriad, Limitless, Polymarket, Opinion, and Predict is strictly calculated as Volume / 2, ensuring only genuine single-side capital inflow is counted.

- Time Dimension Perspective

To capture market trends, multi-dimensional time-based views are constructed in the final query stage.

In addition to cumulative historical volume, annual and monthly pivot tables are built. This allows answering key questions such as:

- Stock vs Flow: Which platforms are living off early accumulated volume, and which show strong incremental growth in 2025 Q1?

- Market cyclicality: How do traffic retention rates behave around major events (elections, major sports finals)?

III. Analysis Results & Key Insights

Through this rigorous "clean → convert → deduplicate" pipeline, a complete market report as of end-2025 was produced, revealing three major observations —

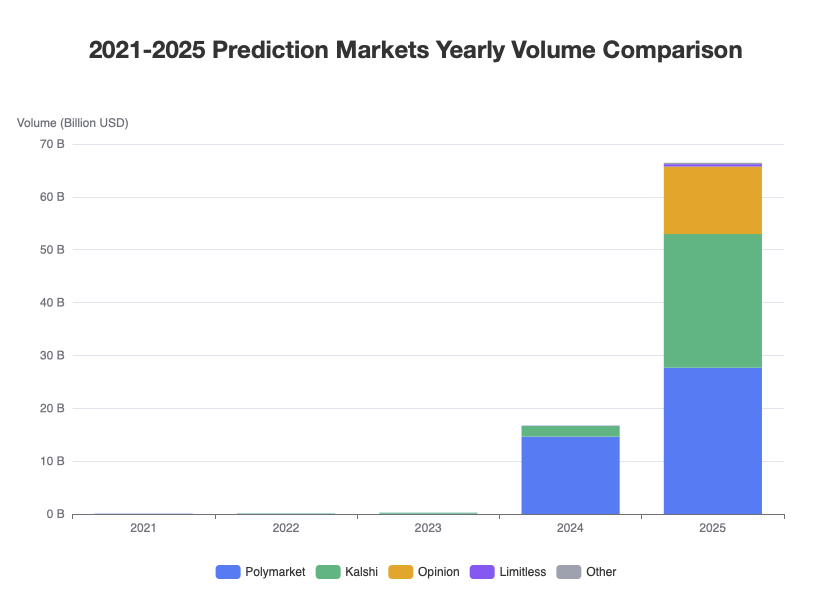

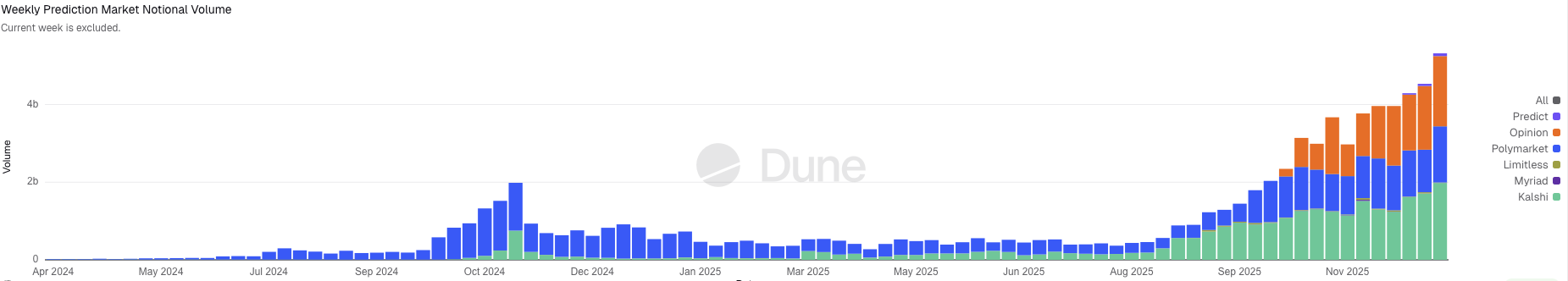

- Prediction markets showed strong growth in 2025

The data does not lie. Polymarket’s total volume in 2024 was approximately $14.6 billion. By 2025, this figure had surged to $27.6 billion. The overall capital flowing through the entire prediction market sector doubled within a single year. Prediction markets are no longer a niche toy for enthusiasts.

- Mysterious dark horse — Opinion

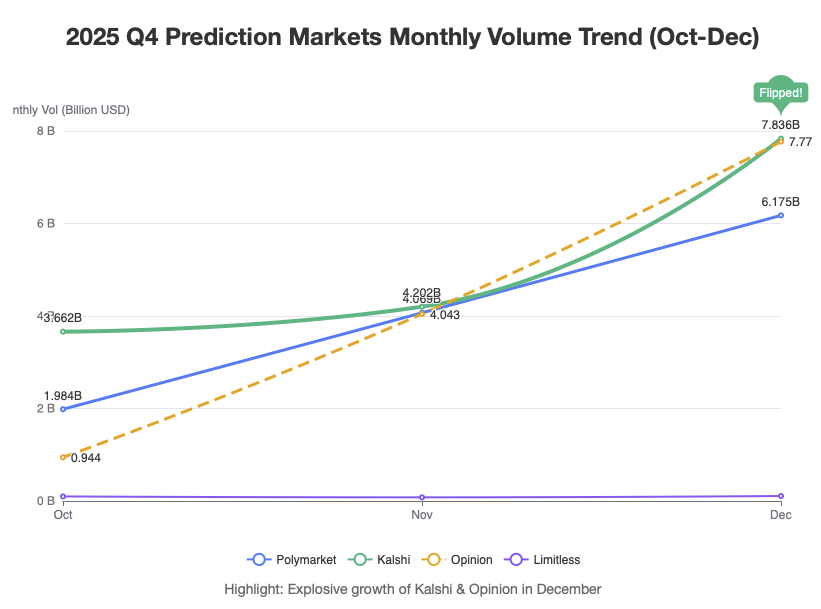

Regulated platforms take the lead — Kalshi surges to the top

If you only follow the news, you might still believe Polymarket remains the undisputed leader. However, the data reveals a striking turning point: while Polymarket still holds the highest annual total volume, in December 2025, the regulated platform Kalshi achieved an astonishing monthly volume of $7.8 billion, surpassing Polymarket’s $6.1 billion in the same month.This indicates that compliant, regulated capital is entering the space in large scale, and the market’s center of gravity has quietly shifted.

This is the biggest surprise uncovered by the data mining.

Opinion (built on BNB Chain) was practically invisible before October 2025.

Yet, in just the three months of Q4, it achieved terrifying growth — from nearly zero to a single-month volume of $7.7 billion. By December, it was running neck-and-neck with Kalshi, leaving the established giants far behind.

IV. Conclusion

The value of on-chain data analysis lies not only in tallying up every number, but more importantly in applying rigorous logic to neutralize technical differences across platforms, thereby constructing a fair, apples-to-apples comparison framework. Only through this approach can we obtain objective insights into the new generation of cryptocurrency-based prediction markets.

Although platforms of this type remain highly controversial at present, the market has clearly poured tremendous enthusiasm into them. Bitrace will continue to monitor developments in this sector with prudence and diligence in the future.

Contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech