Project Ensemble: Hong Kong Launches New Sandbox for Asset Tokenization

In August 2024, the Hong Kong Monetary Authority (HKMA) officially launched the Ensemble Sandbox project, allowing institutions to experiment with the tokenization of traditional securities and Real World Assets (RWA). This marks a significant step by the HKMA and the industry toward exploring the application of tokenization in real-world business scenarios.

What is Asset Tokenization?

Asset tokenization refers to the process of converting real-world assets (such as real estate or gold) and intangible assets (such as bonds or equity) into digital tokens on the blockchain. These tokens represent ownership of the original assets and can be traded and circulated on the blockchain.

Through tokenization, RWAs can be traded in smaller, more flexible units, making the process transparent and efficient. This allows smaller investors to participate in high-value asset investments, such as dividing real estate into smaller units so more people can invest in property. As an international financial hub, Hong Kong’s HKMA aims to explore the potential of financial technology and blockchain through the Ensemble Sandbox.

Ensemble Sandbox Overview

Ensemble Sandbox, created by the HKMA, is a “testing ground” for financial technology companies to experiment with asset tokenization in a safe and controlled environment. The Sandbox’s goal is to drive Hong Kong’s financial market’s digital transformation by focusing on testing asset tokenization’s interoperability, identifying associated risks, and exploring scalable regulatory frameworks.

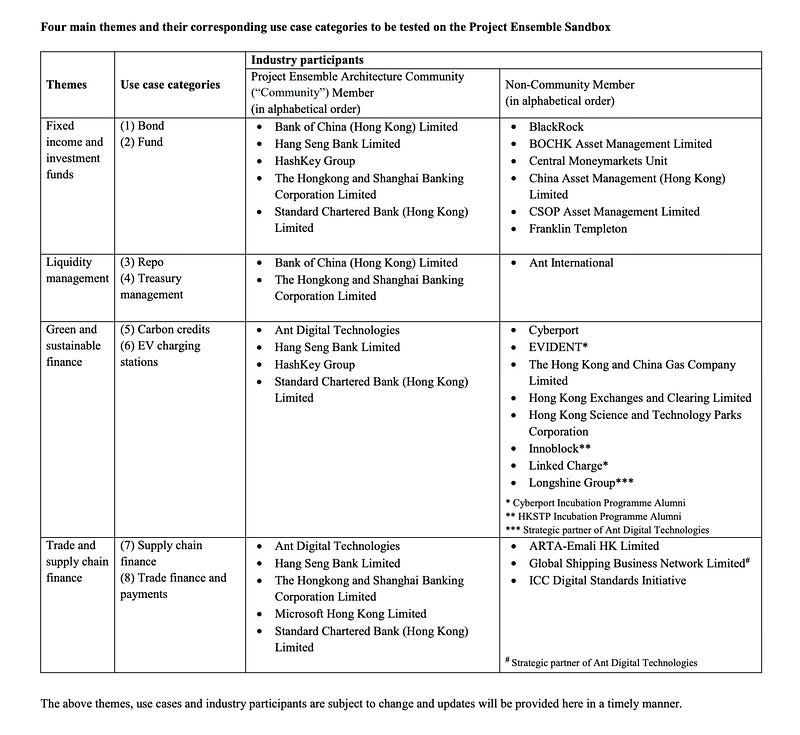

HKMA CEO Eddie Yue stated that the Sandbox would explore the application of tokenization in finance through testing. The HKMA will continue to collaborate with the Securities and Futures Commission (SFC) and industry participants to promote the healthy development of the tokenization market in Hong Kong and provide insights for the global market. The first trials will focus on tokenizing traditional financial assets and physical assets, with initial applications in fixed income, investment funds, liquidity management, green finance, and supply chain finance.

Currently, four banks — Bank of China (Hong Kong), Hang Seng Bank, HSBC, and Standard Chartered Bank (Hong Kong) — are providing tokenized deposits for Ensemble. Other key participants include Microsoft Hong Kong, Ant Digital Technologies (ADT), and Hashkey Group, a leader in digital assets. This establishes the industry ecosystem for the project and provides infrastructure support for tokenized asset circulation and trading, laying the foundation for changing how financial assets are managed and traded.

Additionally, the Global Shipping Business Network (GSBN) has joined the Sandbox to explore the issuance of electronic bills of lading on blockchain infrastructure. The HKMA also plans to collaborate internationally with the Bank for International Settlements Innovation Hub’s Hong Kong Centre and the CBDC working group to advance the Sandbox through expertise in multiple thematic areas.

Compliance and Innovation

SFC CEO Julia Leung emphasized that the Sandbox is a clear example of how innovation and regulation can progress together to pave the way for Hong Kong’s financial markets. Both the SFC and the HKMA share a common vision and determination to future-proof Hong Kong’s financial system through innovative market infrastructure. Their support for the Ensemble project shows regulatory bodies’ openness to blockchain technology and financial innovation, creating a favorable regulatory environment for industry growth.

As one of the first regulatory technology companies to enter the Hong Kong market, Bitrace has maintained close communication and collaboration with regulatory and law enforcement agencies. Bitrace CEO Isabel Shi has repeatedly emphasized the need to balance regulation and industry growth — Web3 industries cannot develop without regulation. Striking a balance during industry development is crucial. Over-regulation can stifle growth, while too little regulation could turn the industry into a haven for illicit activities. Appropriate regulatory policies aligned with industry development will create a healthier environment for crypto enterprises and lay a solid foundation for the growth of Hong Kong’s crypto market.

The emergence of the Ensemble Sandbox provides opportunities for numerous companies to experiment. By conducting trials in the Sandbox, industry participants can ensure the scalability and global market integration of their solutions while offering regulators the necessary data to create informed and effective regulatory policies, thereby promoting the healthy development of Hong Kong’s fintech industry. Companies participating in the Sandbox are taking a proactive compliance stance, engaging in regulatory dialogues, adjusting business models, and ensuring transparency.

As the industry matures, those who find a balance between compliance and innovation will likely emerge as market leaders. In this context, Bitrace’s KYT tool provides blockchain security and compliance solutions, helping businesses block risky funds, reduce operational risks, prevent illegal activities, protect user assets, and enhance platform credibility.

Previously, Bitrace’s data on the use of USDT in cybercriminal activities was cited multiple times by the UNODC (United Nations Office on Drugs and Crime), highlighting its professional expertise. With a machine learning and pattern recognition-based model, Bitrace’s KYT tool has built a database of over 400 million address labels, including entity and risk behavior tags. By tracing and tracking the origin and flow of funds, investigating abnormal transactions, and auditing counterparties’ financial risks, Bitrace helps businesses avoid or reduce risks. In the future, Bitrace will continue to leverage its data capabilities and services to meet the compliance needs of crypto companies and assist regulatory authorities in understanding and overseeing the industry, contributing to a more open and transparent financial ecosystem in Hong Kong.

Contact us:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: https://x.com/Bitrace_team