Stablecoin Freeze Analysis: Beware of the Threat from Human Trafficking Funds

Illegal cross-border human trafficking in South Asia is one of the primary foundational industries of local organized crime networks. Numerous parks operating illegal businesses annually recruit large numbers of young men from various countries and regions through fraud, kidnapping, and other means. The strong demand for labor has given rise to a criminal industrial chain that integrates job placement syndicates, overseas labor agents, transaction guarantee platforms, domestic labor intermediaries, and illicit payment tools.

At present, the USD stablecoin Tether (hereinafter referred to as USDT) has been widely used in the Southeast Asian illegal cross-border human trafficking market and has successfully attracted the attention of law enforcement agents. As a result, authorities have begun to collaborate with Tether (the company behind USDT) and centralized exchanges to carry out targeted freezes on involved addresses or accounts.

This article aims to analyze one specific stablecoin freeze case and disclose the associated financial threat.

Analysis of the “Tianhe Global” Business Address Freeze

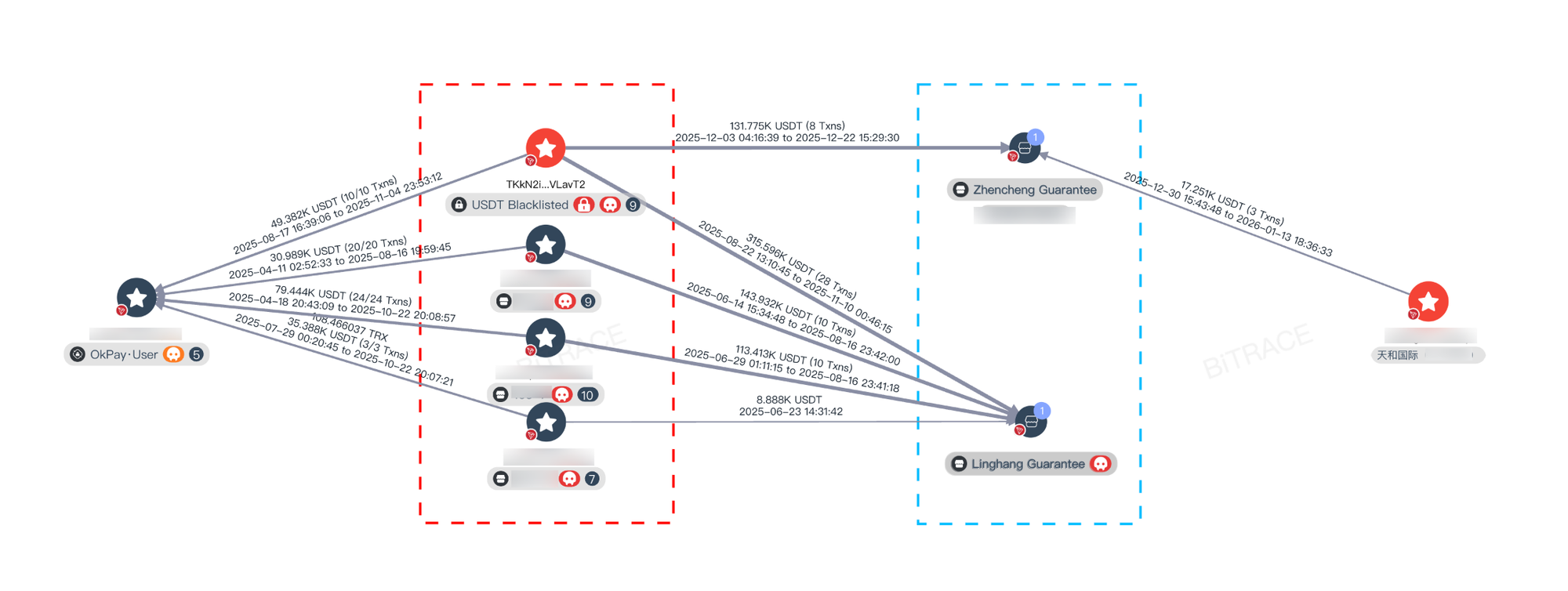

On December 24, 2025, Tether executed an on-chain freeze targeting 24 addresses in a single operation. According to Bitrace intelligence, at least 4 of these addresses belong to entities involved in Southeast Asian illegal cross-border human trafficking. Taking the address marked as a “Human Trafficking Merchant” under the entity known as “Tianhe Global” (Tianhe International) — TKkN2i3ruCis2NoGm7uNr9HeeLfaVLavT2 — as an example.

This entity is an established veteran human trafficking merchant, primarily assisting illegal industrial parks in Southeast Asia with the purchase of employees. It has been in operation for three years and enjoys considerable notoriety within the industry. Its procurement methods are mainly divided into three categories: naked run, guaranteed, and second-hand.

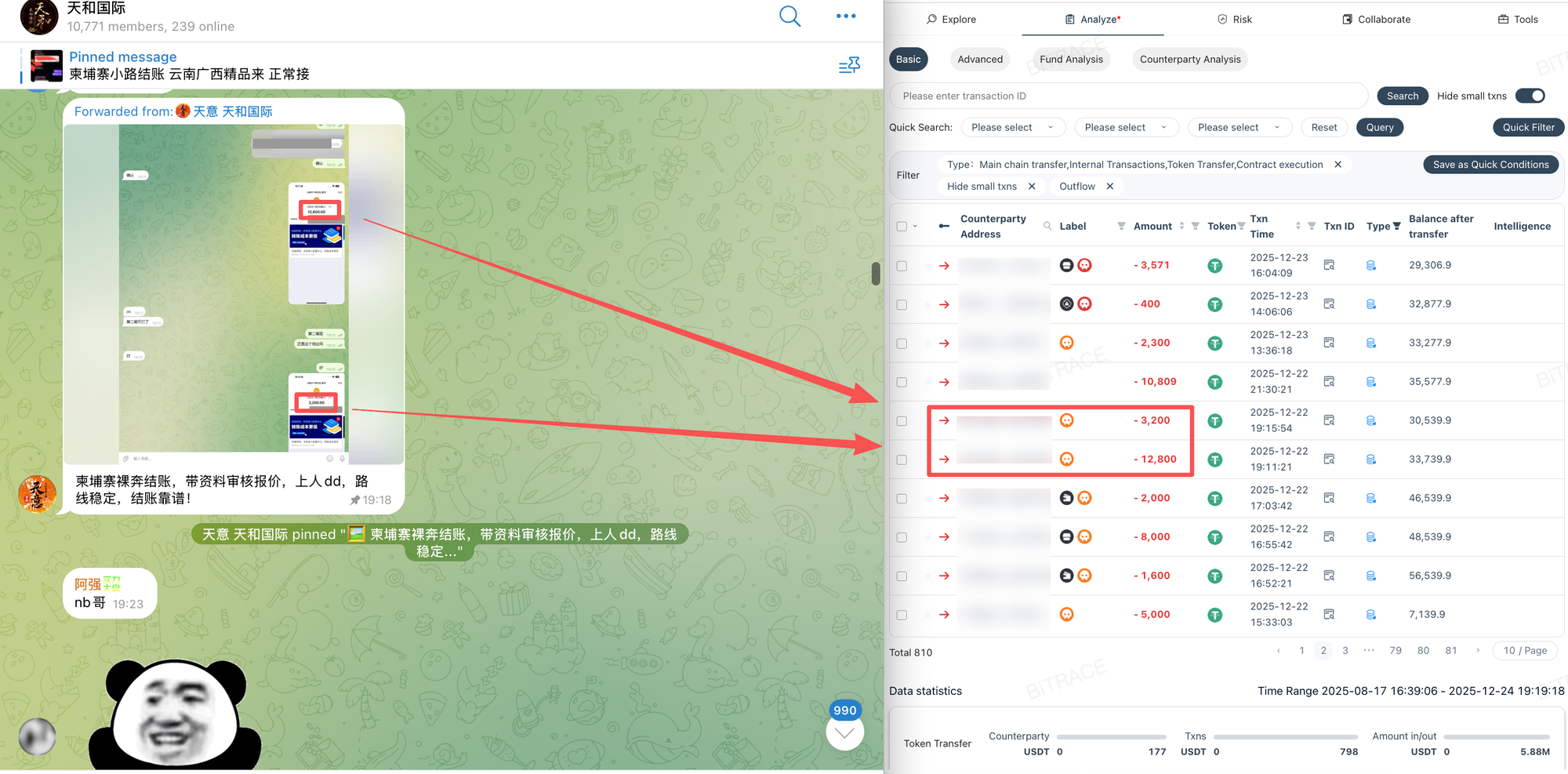

As the literal meaning suggests, “naked run(裸奔)” refers to human trafficking activities conducted without any protective measures.Human Trafficking agents located within China lure victims out of the country and deliver them to overseas merchants. After delivery, the merchant directly sends payment to the intermediary’s receiving address. Since the two parties do not meet in person, there is a significant possibility of mutual deception. Therefore, this transaction method carries extremely high risk and is typically supported in large volumes only by merchants with high industry reputation.

As shown in the image above, this 16,000 USDT transaction payment was sent directly to the agent’s address in two separate transfers, and the victim was transported to Cambodia.

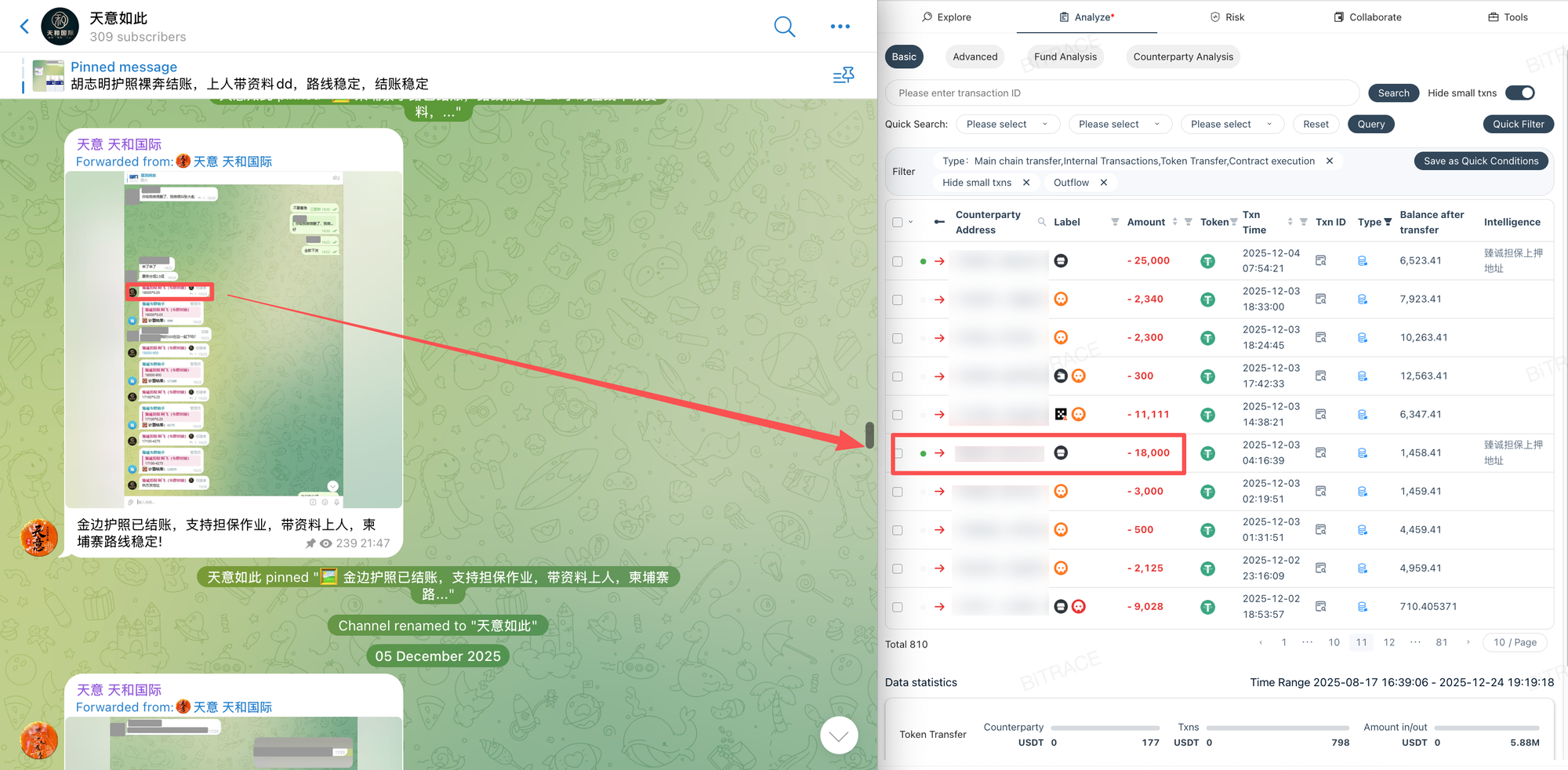

“Guaranteed” (担保) refers to a transaction method in which, when the two parties do not trust each other, an illegal transaction guarantee platform intervenes to act as the transaction arbiter.In this scenario, the merchant must first send the agreed-upon payment to the deposit address of the illegal transaction guarantee platform. After the transaction is completed and both parties have no objections, the guarantee platform then releases the transaction funds to the agent.

As shown in the image above, this transaction worth 18,000 USDT was completed with the intervention of the emerging human trafficking transaction guarantee platform Zhencheng Guarantee (臻诚担保), which earned a 5% commission totaling 900 USDT. The victim was transported to Cambodia.

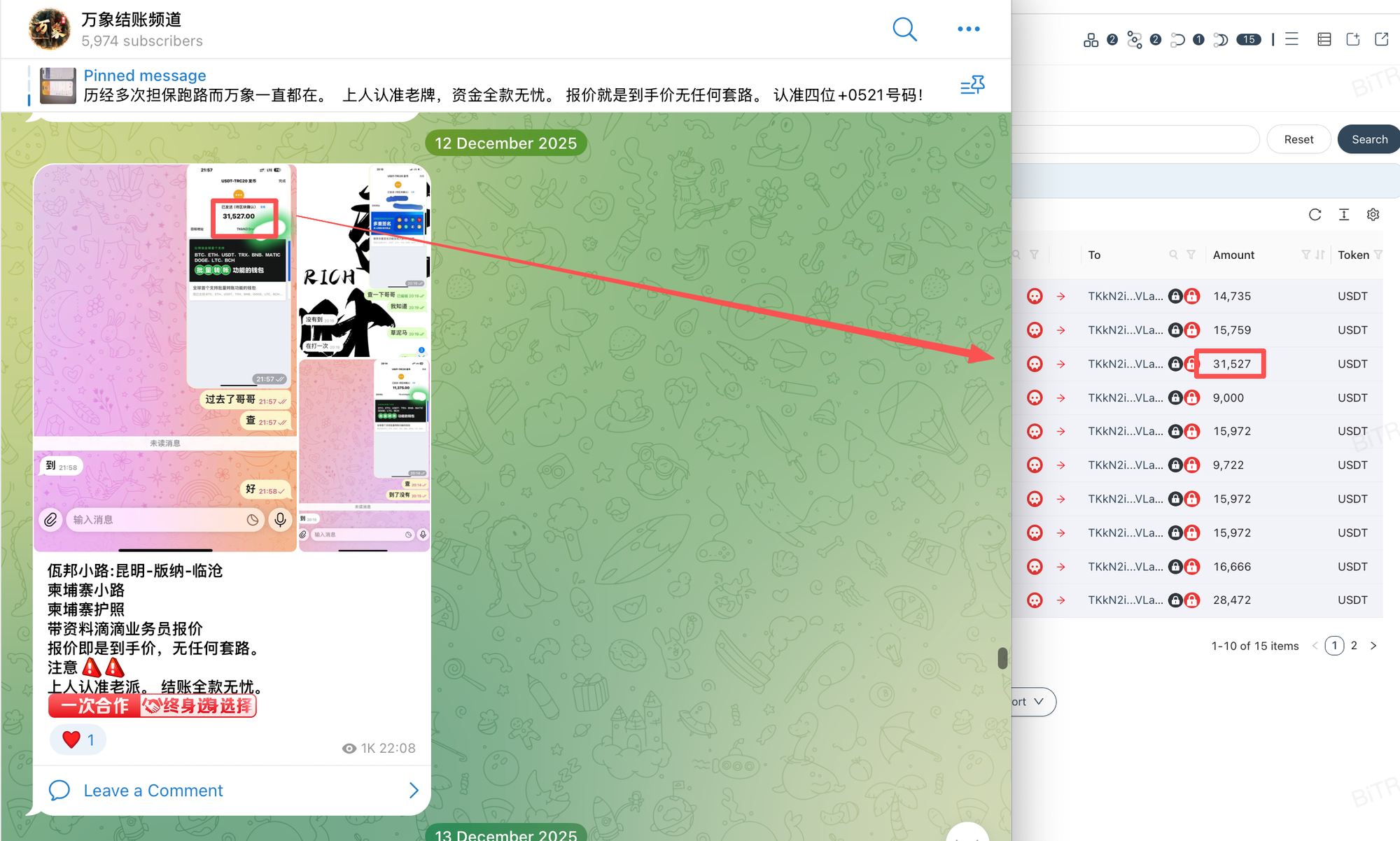

“Second-hand” (二手) refers to the transaction behavior in which a human trafficking merchant does not purchase people directly from agents, but instead buys them from other human trafficking merchants.

As shown in the image above, on December 12, 2025, Tianhe Global spent 31,527 USDT to purchase one or a batch of people from another merchant named Wanxiang Group (万象集团). Historical records show that transactions between these two entities were not limited to this single instance.

“Tianhe Global” Business Volume Statistics

After its core business addresses were frozen by Tether, Tianhe Global quickly activated new addresses and continued to conduct human trafficking transactions by making deposits on Zhencheng Guarantee.

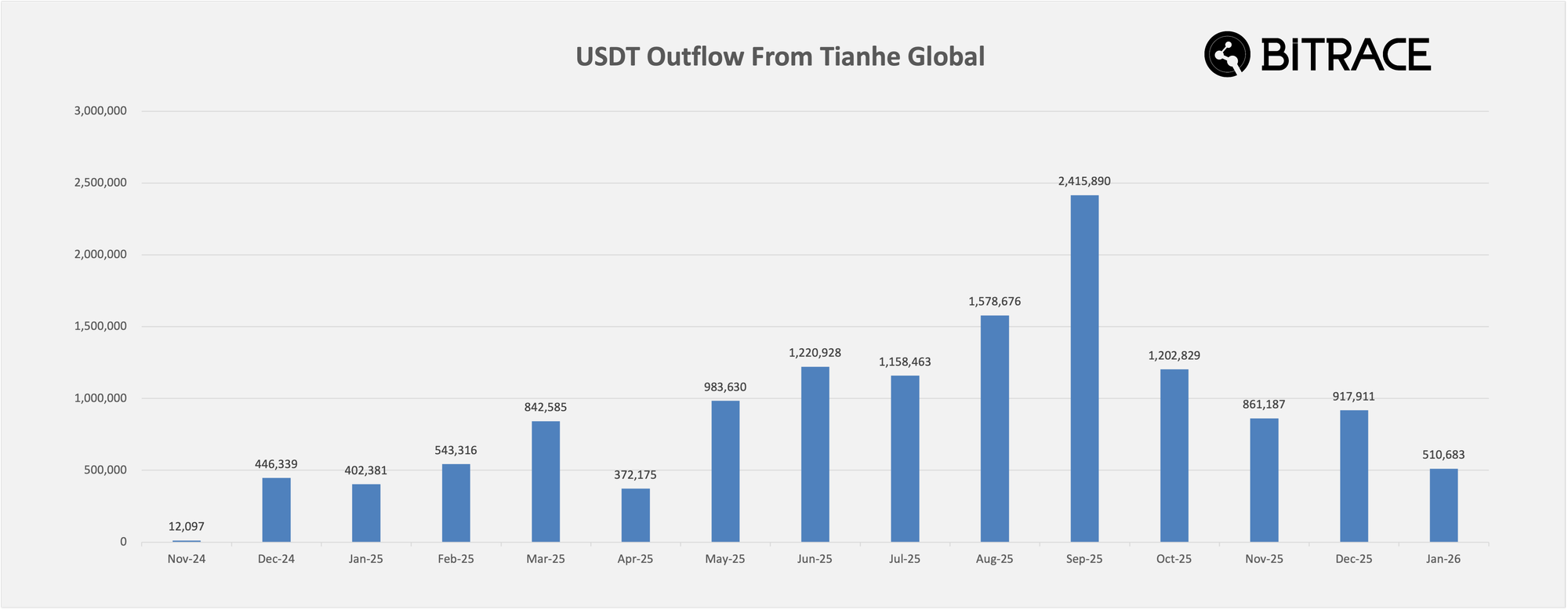

Statistics on the known addresses show that, from September 3, 2024 to January 29, 2026, after excluding internal address-to-address transfers, Tianhe Global transferred out at least 13.47 million USDT to external parties. This amount was used to pay agents for human trafficking expenses. Even when calculated at a relatively high unit price of 20,000 USDT per person, this indicates that more than 600 victims were illegally trafficked by this entity.

What is even more noteworthy is that this figure does not include internal transfers conducted through centralized institutions or fiat currency transfers. The actual number of victims is likely far greater than imagined.

“Tianhe Global” Financial Threat

Compared to transaction guarantee platforms and merchants that serve as the core of organized crime networks, domestic agents who directly lure victims generally lack sufficient funds risk control literacy. In real-world cases, a large number of agents directly use centralized exchange deposit addresses to receive payments, resulting in human trafficking funds flowing straight into exchanges.

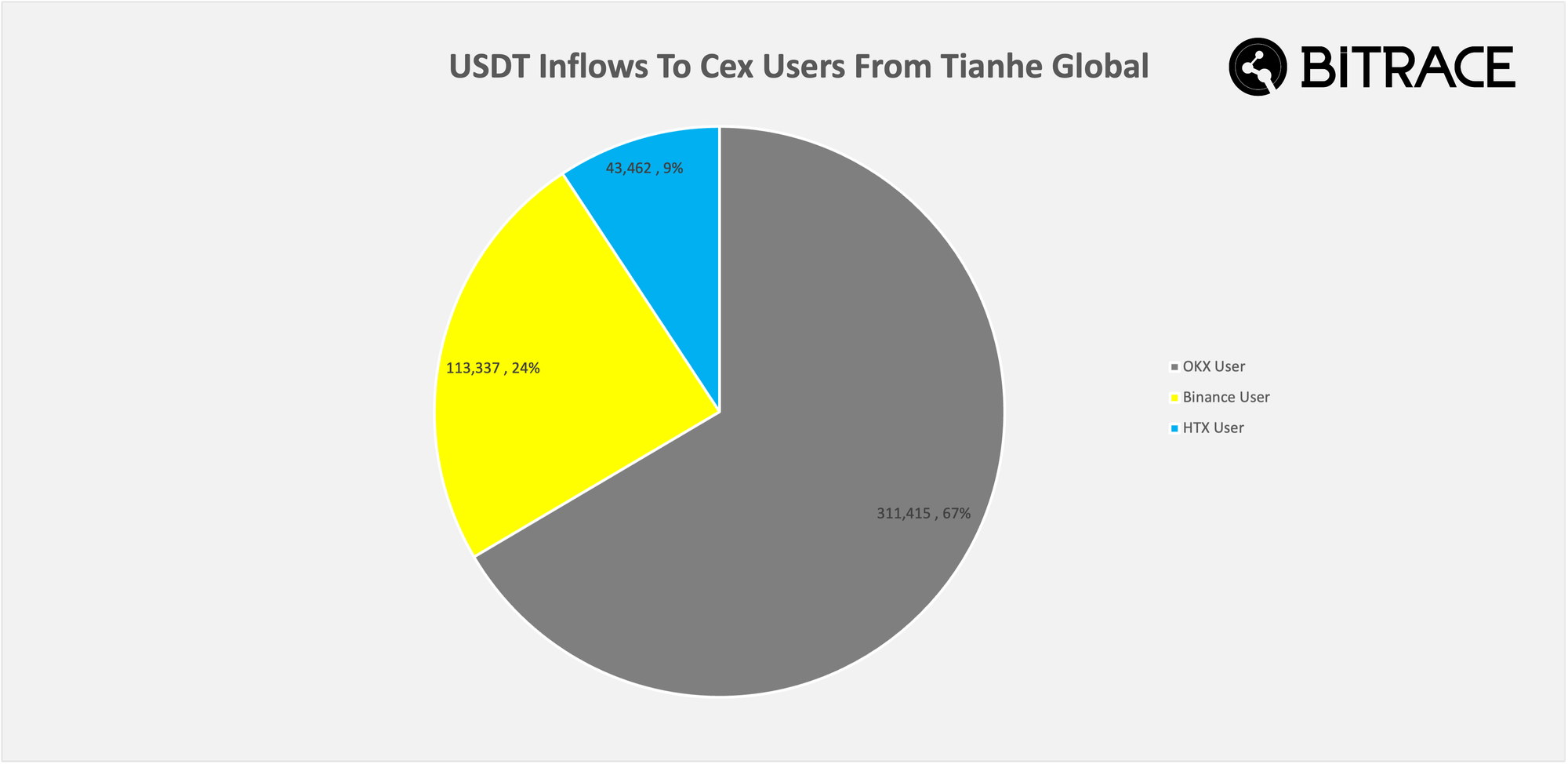

Statistics on the centralized exchange user addresses among Tianhe Global’s transaction counterparties show that OKX, Binance, and HTX respectively received 311,415 USDT, 113,337 USDT, and 43,462 USDT, accounting for 3.5% of the total outward transfers.

This figure represents only the fund pollution under the single “naked run” transaction scenario. If the withdrawal activities conducted through transaction guarantee platforms are also included in the statistics, this proportion will be significantly higher, underscoring the severe threat that such funds pose to centralized exchanges.

Beware of the Threat from Human Trafficking Funds

Human trafficking has long been condemned by international conventions as a grave violation of human rights. The Southeast Asian illegal cross-border human trafficking based on forced labor is rapidly expanding by exploiting cryptocurrency infrastructure. For centralized cryptocurrency exchanges, OTC shops, and cryptocurrency payment platforms, establishing a robust KYT (Know Your Transaction) program represents a powerful means to address and mitigate this financial threat.

Bitrace, as a Hong Kong-based RegTech company, has long collaborated with law enforcement and regulatory authorities in major countries and regions worldwide to investigate cryptocurrency-related cases and incidents. We continuously monitor the use of crypto infrastructure by illegal industries such as online gambling, money laundering, black and gray market transactions, and fraud. With a comprehensive threat intelligence database and rapid response mechanisms, we are well-equipped to help clients effectively detect, anticipate, identify, and counter illicit funds, thereby avoiding potential legal risks.

If you are interested in cooperation, please feel free to contact us:

Website: www.bitrace.io

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech