UNODC Southeast Asia Crime Report Released, with Bitrace Providing Key Data and Case Studies

On October 7, 2024, the United Nations Office on Drugs and Crime (UNODC) released a report titled “Transnational Organized Crime and the Convergence of Cyber-Enabled Fraud, Underground Banking and Technological Innovation in Southeast Asia: A Shifting Threat Landscape”. The report cited Bitrace’s involvement in past investigations and its cryptocurrency analysis.

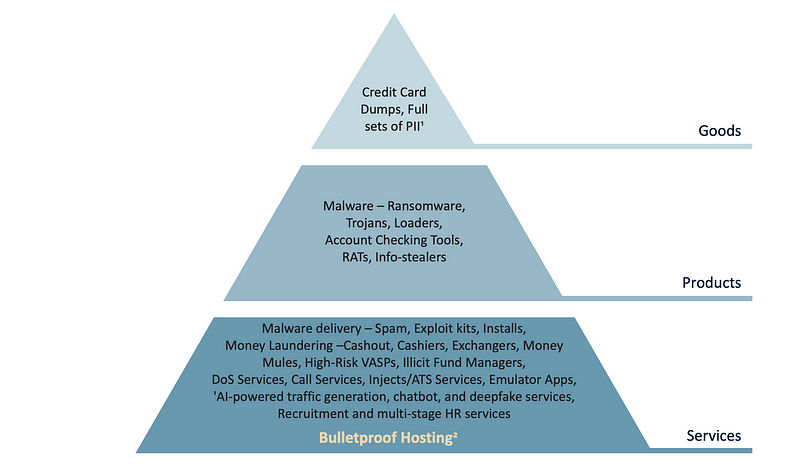

The report outlines the mechanisms, complexities, and drivers behind transnational organized crime in Southeast Asia, highlighting how criminal groups are increasingly exploiting various vulnerabilities. The rapid evolution of these threats has outpaced governments’ ability to contain them. With advances in technology, criminal groups are conducting larger-scale, harder-to-detect fraud, money laundering, underground banking, and cyber scams, leading to the emergence of a criminal service economy. Southeast Asia has now become a key testing ground for transnational crime networks seeking to expand their influence and develop new business lines.

The emerging economic paradigm, particularly the cryptocurrency industry based on blockchain technology, was prominently mentioned in the report.

The report pointed out the use of cryptocurrencies — especially USD stablecoins — in various criminal scenarios, including extortion, fraud, theft, illegal online gambling, and other unlawful activities. It also highlighted the supporting upstream and downstream crimes that facilitate these activities. While traditional fiat currencies were previously the main medium for settling these transactions, a significant portion has been replaced by cryptocurrencies since 2020.

The report also highlighted the use of cryptocurrencies in money laundering within Southeast Asia, showcasing an example of laundering through online gambling platforms. It stated that illegal cryptocurrency-related industries in the region have achieved “overwhelming success,” with illicit cryptocurrencies, alongside other involved fiat currencies, entering personal accounts on gambling platforms. These funds are then mixed through legitimate or illegal betting activities, and finally, the cleaned funds are withdrawn from the platform.

The report also mentioned transaction escrow platforms that provide laundering services for involved cryptocurrencies, noting that such companies typically maintain a central Telegram channel and act as both guarantor and custodian for all transactions to prevent fraud within the illicit economy. While these platforms accept other payment and settlement options, Tether (USDT), which is pegged to the U.S. dollar, was listed as the preferred payment method.

Throughout the report, the authors frequently cited Bitrace’s insights and data, including:

- On July 13, 2024, a Tron address under the jurisdiction of Cambodia’s Huivang Group was blacklisted by Tether, resulting in over 29 million USDT being frozen. Following Bitrace’s investigation, it was suggested that the blacklisting was likely due to the address receiving stolen funds from DMM and Poloniex.

- The report also covered long-standing QR code scams in the cryptocurrency industry, where fraudsters impersonate famous individuals or institutions, claiming that scanning the code allows participation in “double-return” investment schemes, which are, in fact, fraudulent. Based on its extensive experience in case investigations, Bitrace has produced a series of anti-fraud educational articles.

Lastly, the illegal use of cryptocurrencies by criminal groups has caused widespread harm to individuals, Web3 institutions, crypto investors, and government agencies. To better address this threat, Bitrace is committed to leveraging AI and big data technologies to more accurately and efficiently identify and monitor on-chain risks and criminal activities. The company has collaborated with law enforcement agencies and Web3 enterprises in various countries, providing support in thousands of cases, monitoring billions in risk-associated funds, and successfully recovering billions of dollars in losses.

Beyond this report, Bitrace has also maintained intelligence and data collaboration with UNODC researchers. As a regtech company specializing in cryptocurrency risk data analysis, Bitrace has extensive experience in cryptocurrency crime investigations. Over the past few years, Bitrace has provided Web3 industry expertise and insights to researchers and organizations, including UNODC, based on our deep understanding of criminal ecosystems.

Report Link:

Billion-dollar cyberfraud industry expands in Southeast Asia as criminals adopt new technologies

Contact us:

Website: https://www.bitrace.io/

Email: bd@bitrace.io

Twitter: @Bitrace_team

LinkedIn:@bitrace tech